Attorney-Approved Vehicle Repayment Agreement Document

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form is used to outline the terms of repayment for a vehicle loan or lease. |

| Governing Law | In the state of California, the agreement is governed by the California Civil Code, particularly sections related to contracts and secured transactions. |

| Parties Involved | The form typically involves the borrower (or lessee) and the lender (or lessor), ensuring both parties understand their obligations. |

| Key Components | Essential elements include payment amount, due dates, interest rates, and consequences of default. |

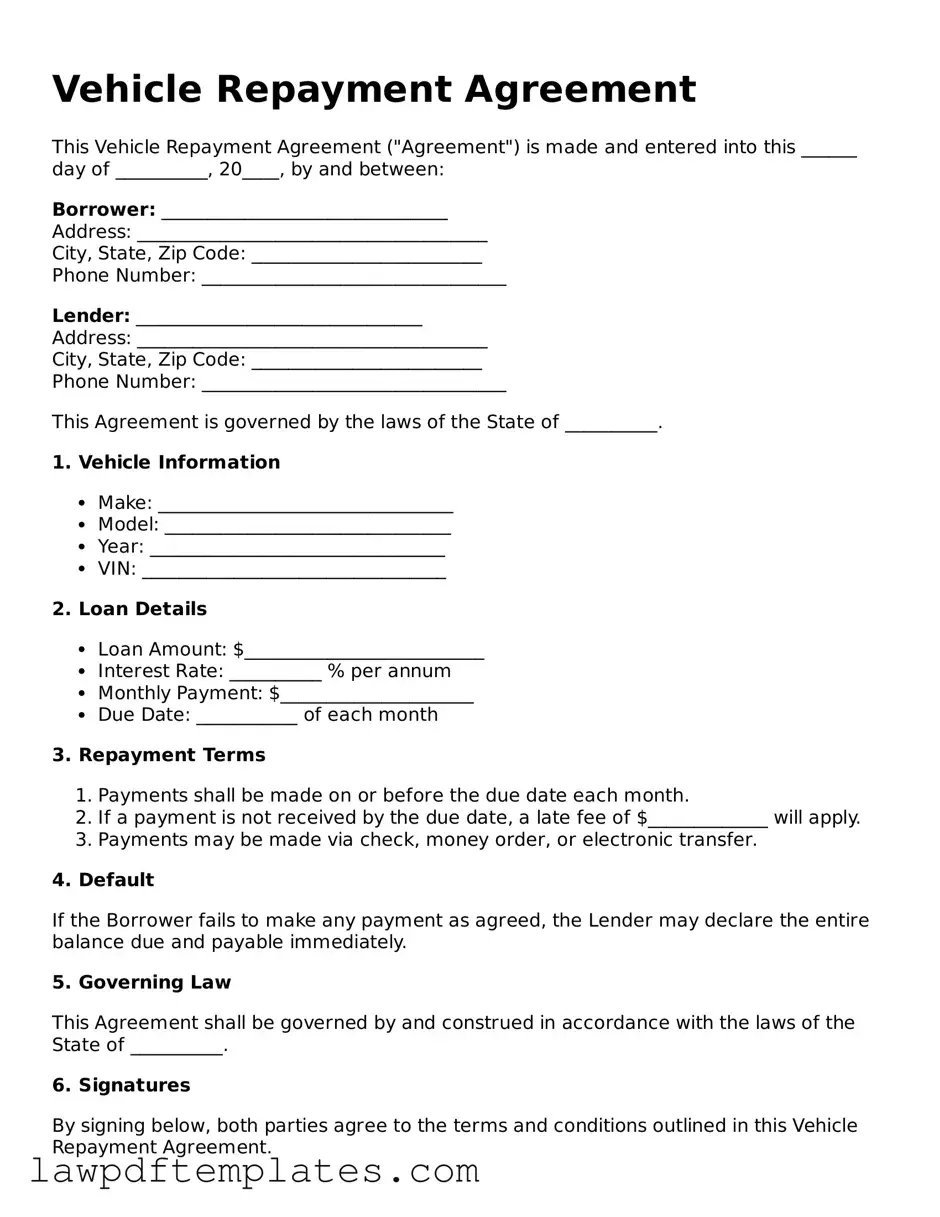

Sample - Vehicle Repayment Agreement Form

Vehicle Repayment Agreement

This Vehicle Repayment Agreement ("Agreement") is made and entered into this ______ day of __________, 20____, by and between:

Borrower: _______________________________

Address: ______________________________________

City, State, Zip Code: _________________________

Phone Number: _________________________________

Lender: _______________________________

Address: ______________________________________

City, State, Zip Code: _________________________

Phone Number: _________________________________

This Agreement is governed by the laws of the State of __________.

1. Vehicle Information

- Make: ________________________________

- Model: _______________________________

- Year: ________________________________

- VIN: _________________________________

2. Loan Details

- Loan Amount: $__________________________

- Interest Rate: __________ % per annum

- Monthly Payment: $_____________________

- Due Date: ___________ of each month

3. Repayment Terms

- Payments shall be made on or before the due date each month.

- If a payment is not received by the due date, a late fee of $_____________ will apply.

- Payments may be made via check, money order, or electronic transfer.

4. Default

If the Borrower fails to make any payment as agreed, the Lender may declare the entire balance due and payable immediately.

5. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of __________.

6. Signatures

By signing below, both parties agree to the terms and conditions outlined in this Vehicle Repayment Agreement.

_____________________________

Borrower’s Signature

Date: ______________

_____________________________

Lender’s Signature

Date: ______________

Common mistakes

Completing a Vehicle Repayment Agreement form can be a straightforward process, but many individuals make common mistakes that can lead to complications later on. One frequent error is failing to provide accurate personal information. When individuals do not double-check their names, addresses, or contact details, it can create confusion and delays. Accurate information is crucial, as it ensures that all parties involved can communicate effectively.

Another mistake often made is overlooking the specific terms of the repayment plan. Some people may not fully understand the implications of the payment schedule, interest rates, or any penalties for late payments. It is vital to read through the entire agreement carefully and ask questions if anything is unclear. Ignoring these details can result in financial strain or legal issues down the road.

Additionally, many individuals neglect to sign and date the form correctly. A missing signature or an incorrect date can render the agreement invalid. This oversight can lead to disputes about the terms and conditions of the repayment. Always ensure that the form is signed in the designated areas and that the date reflects when the agreement was finalized.

Another common error involves not keeping a copy of the completed agreement. After filling out the form, it is essential to retain a copy for personal records. Without this documentation, individuals may find it challenging to reference the terms of the agreement or prove their compliance if disputes arise. Keeping a record can provide peace of mind and serve as a useful reference.

Lastly, people often fail to read the fine print. The details in the fine print can contain crucial information about fees, conditions, or limitations that could affect the repayment process. Ignoring these details may lead to unexpected costs or obligations. Taking the time to read everything thoroughly can help avoid surprises and ensure a smoother repayment experience.

Popular Templates:

Da - The DA Form 2062 is also useful for implementing training programs.

Roof Certification Form Florida - List the email address of the owner or manager for follow-up.

For those looking to create a smooth transaction, a General Bill of Sale can easily be generated through various resources, including options for Fillable Forms, which simplify the process and ensure all necessary details are captured accurately.

Bill of Sale for a Motorcycle - A Motorcycle Bill of Sale can sometimes be used in lieu of a title if the original is lost.