Attorney-Approved Transfer-on-Death Deed Document

State-specific Transfer-on-Death Deed Forms

Form Breakdown

| Fact Name | Description |

|---|---|

| What is a Transfer-on-Death Deed? | A Transfer-on-Death Deed (TODD) allows an individual to transfer real property to beneficiaries upon their death, avoiding probate. |

| Governing Law | The laws governing Transfer-on-Death Deeds vary by state. For example, in California, it is governed by California Probate Code Section 5600. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property upon their death, which can simplify the transfer process. |

| Revocation | A Transfer-on-Death Deed can be revoked or modified at any time before the owner's death, providing flexibility for changing circumstances. |

| No Immediate Transfer | Ownership does not transfer until the death of the property owner, allowing the owner to retain full control during their lifetime. |

| Tax Implications | Beneficiaries may receive a step-up in basis for tax purposes, which can reduce capital gains taxes when they sell the property. |

| State-Specific Forms | Each state may have its own specific form for the Transfer-on-Death Deed. It's crucial to use the correct form to ensure validity. |

| Not for All Properties | Not all types of property can be transferred using a TODD. For instance, some states restrict its use to residential real estate. |

| Legal Assistance Recommended | While it is possible to create a TODD without legal help, consulting an attorney can ensure that the deed is executed properly and meets all legal requirements. |

Sample - Transfer-on-Death Deed Form

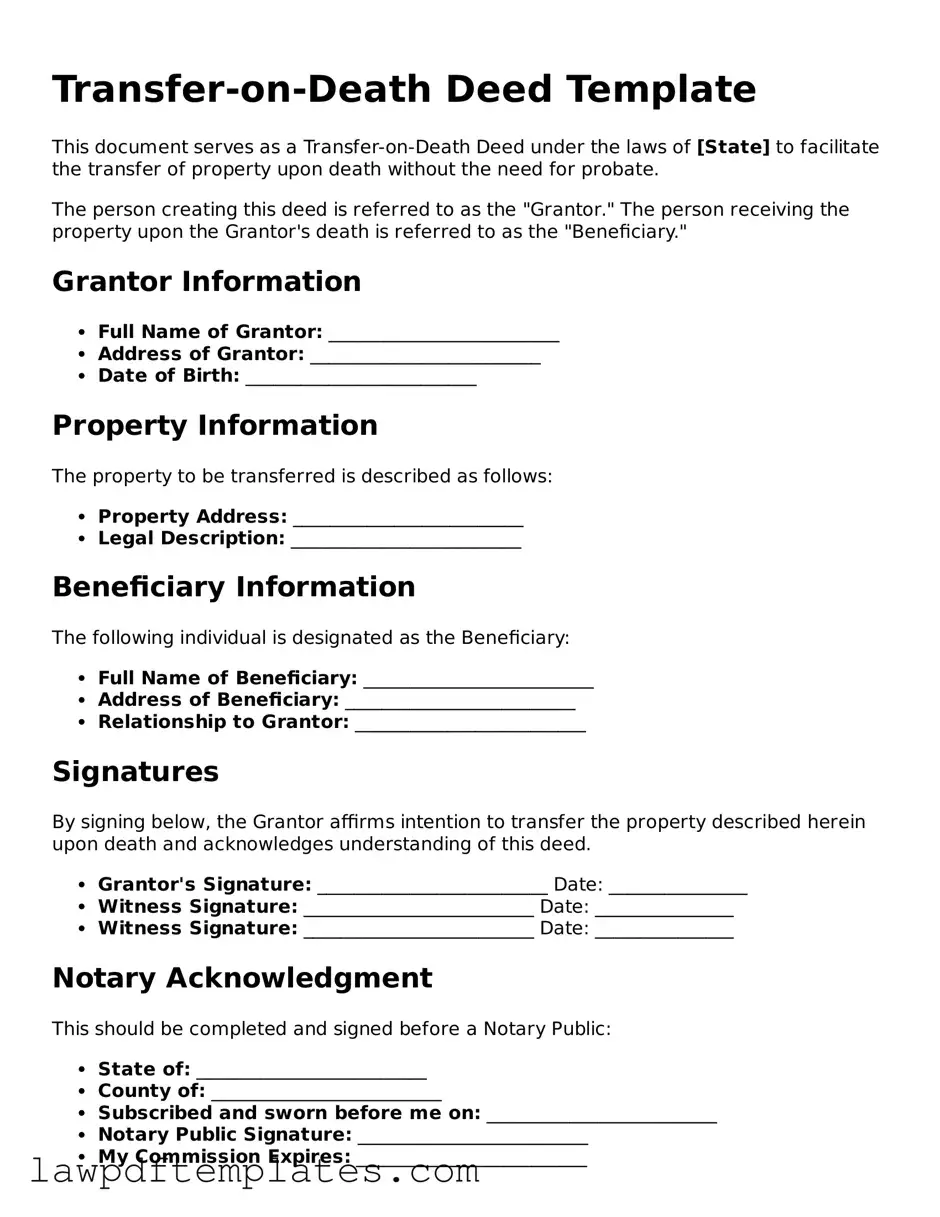

Transfer-on-Death Deed Template

This document serves as a Transfer-on-Death Deed under the laws of [State] to facilitate the transfer of property upon death without the need for probate.

The person creating this deed is referred to as the "Grantor." The person receiving the property upon the Grantor's death is referred to as the "Beneficiary."

Grantor Information

- Full Name of Grantor: _________________________

- Address of Grantor: _________________________

- Date of Birth: _________________________

Property Information

The property to be transferred is described as follows:

- Property Address: _________________________

- Legal Description: _________________________

Beneficiary Information

The following individual is designated as the Beneficiary:

- Full Name of Beneficiary: _________________________

- Address of Beneficiary: _________________________

- Relationship to Grantor: _________________________

Signatures

By signing below, the Grantor affirms intention to transfer the property described herein upon death and acknowledges understanding of this deed.

- Grantor's Signature: _________________________ Date: _______________

- Witness Signature: _________________________ Date: _______________

- Witness Signature: _________________________ Date: _______________

Notary Acknowledgment

This should be completed and signed before a Notary Public:

- State of: _________________________

- County of: _________________________

- Subscribed and sworn before me on: _________________________

- Notary Public Signature: _________________________

- My Commission Expires: _________________________

Please ensure that this document is filed according to the laws governing Transfer-on-Death Deeds in [State].

Common mistakes

Filling out a Transfer-on-Death Deed form can be a straightforward process, but there are common mistakes that individuals often make. One frequent error is failing to include all necessary information. This can lead to delays or even invalidate the deed. Ensure that you provide complete details about the property, including the legal description, address, and any relevant parcel numbers.

Another common mistake is not properly identifying the beneficiaries. It's crucial to clearly state who will inherit the property upon your passing. Ambiguous language or vague descriptions can create confusion and disputes among heirs. Use full names and consider including their relationship to you to avoid any potential issues.

People often overlook the importance of signatures. The deed must be signed by the owner(s) of the property. If there are multiple owners, all must sign the document. Additionally, some states require the signature to be notarized or witnessed. Failing to follow these requirements can render the deed ineffective.

Many individuals neglect to record the Transfer-on-Death Deed with the appropriate county office. Simply filling out the form is not enough; it must be officially recorded to be legally binding. Check with your local jurisdiction to understand the specific recording requirements and deadlines.

Another mistake is not reviewing state-specific laws. Each state has its own rules regarding Transfer-on-Death Deeds. What works in one state may not be valid in another. Be sure to familiarize yourself with your state’s regulations to ensure compliance and effectiveness.

Some people mistakenly believe that a Transfer-on-Death Deed can be revoked or changed easily. While it is possible to modify the deed, it requires following specific procedures. Failing to properly revoke or update the deed can lead to unintended consequences for your estate.

Lastly, individuals sometimes forget to communicate their intentions with family members. Discussing your plans with beneficiaries can prevent misunderstandings and conflict later on. Transparency helps ensure that everyone is on the same page and can contribute to a smoother transition of property ownership.

Consider Popular Types of Transfer-on-Death Deed Documents

Gift Deed Rules - In some cases, a Gift Deed may need to be filed with state or local property authorities for it to be enforceable.

For those navigating real estate transactions in Georgia, understanding the intricacies of the Quitclaim Deed process is crucial. This straightforward form, known as the quitclaim deed form, facilitates the transfer of ownership without title guarantees, ensuring a clear relinquishment of rights by the grantor. Access the valuable resource available at this quitclaim deed form guide to learn more about its proper usage and implications.

Quit Claim Deed Blank Form - Quitclaim Deeds can be executed without a lawyer, although legal advice may be beneficial in certain situations.