Fillable Stock Transfer Ledger Template

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger form is used to record the issuance and transfer of shares in a corporation, ensuring accurate tracking of stock ownership. |

| Required Information | This form requires details such as the corporation's name, stockholder information, certificate numbers, dates of transfer, and the number of shares involved. |

| Legal Governing Law | The Stock Transfer Ledger is governed by state corporation laws, which vary by state. For example, in Delaware, it falls under Title 8, Chapter 224 of the Delaware Code. |

| Importance of Accuracy | Accurate completion of the form is crucial as it helps maintain the integrity of the corporation's stock records and can impact shareholder rights. |

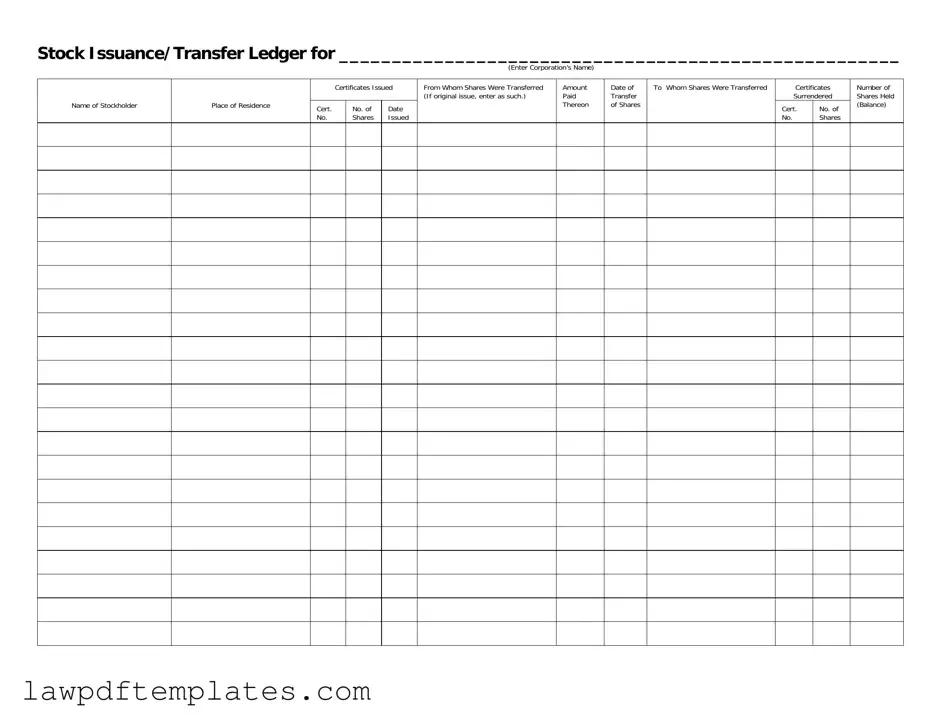

Sample - Stock Transfer Ledger Form

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Common mistakes

Filling out the Stock Transfer Ledger form can seem straightforward, but there are common mistakes that individuals often make. One prevalent error is failing to provide the complete name of the corporation at the top of the form. This is crucial because the ledger needs to clearly identify the entity involved in the stock transfer. If the corporation's name is missing or incorrect, it can lead to confusion and complications in the future.

Another mistake frequently encountered is neglecting to accurately record the details of the stockholder. The place of residence must be filled out completely. Incomplete addresses can create issues with communication and record-keeping. It’s essential to ensure that all information is up-to-date and reflects the stockholder's current residence to avoid any potential disputes.

Additionally, many individuals overlook the importance of documenting the certificates surrendered and the corresponding certificate numbers. This section is vital for tracking the transfer of shares accurately. If this information is missing, it may lead to discrepancies in the ownership records, complicating future transactions or audits.

Lastly, a common oversight is failing to indicate the amount paid for the shares being transferred. This detail is significant as it reflects the value of the transaction and ensures compliance with financial regulations. Omitting this information can result in legal issues down the line, as it may be necessary to provide proof of the transaction's legitimacy.

Common PDF Documents

Notice of Motion Child Support California - Local healthcare providers can assist with any questions regarding the completion of the form.

1098 Form - Making your check payable to the servicer ensures proper processing of payments.

For those looking to simplify the process of transferring ownership, utilizing resources like PDF Documents Hub can be incredibly helpful, providing access to the necessary Trailer Bill of Sale form that ensures all required details are accurately documented.

Gf Application Form - Express your ideals and preferences for better matches.