Attorney-Approved Single-Member Operating Agreement Document

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement outlines the management structure and operational guidelines for a single-member LLC. |

| Legal Requirement | While not always legally required, having an operating agreement is highly recommended for a single-member LLC. |

| Governing Law | The operating agreement is governed by the laws of the state where the LLC is formed, such as Delaware or California. |

| Ownership Structure | This document clearly states that the single member owns 100% of the LLC. |

| Liability Protection | Having an operating agreement can help maintain the limited liability status of the LLC, protecting personal assets. |

| Management Flexibility | The agreement allows the member to define how the business will be managed and operated, providing flexibility. |

| Dispute Resolution | It can include provisions for resolving disputes, ensuring clarity and reducing potential conflicts. |

Sample - Single-Member Operating Agreement Form

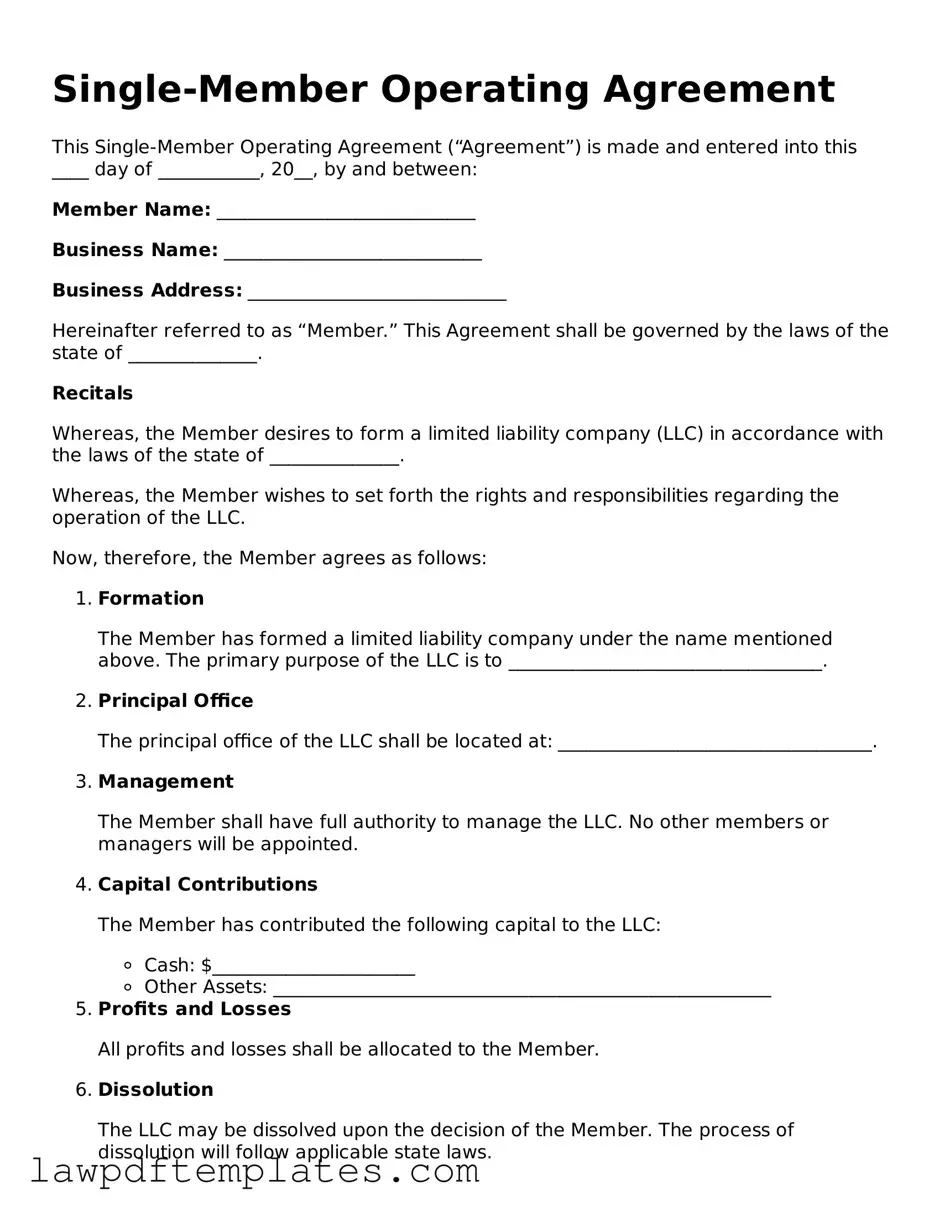

Single-Member Operating Agreement

This Single-Member Operating Agreement (“Agreement”) is made and entered into this ____ day of ___________, 20__, by and between:

Member Name: ____________________________

Business Name: ____________________________

Business Address: ____________________________

Hereinafter referred to as “Member.” This Agreement shall be governed by the laws of the state of ______________.

Recitals

Whereas, the Member desires to form a limited liability company (LLC) in accordance with the laws of the state of ______________.

Whereas, the Member wishes to set forth the rights and responsibilities regarding the operation of the LLC.

Now, therefore, the Member agrees as follows:

- Formation

- Principal Office

- Management

- Capital Contributions

- Cash: $______________________

- Other Assets: ______________________________________________________

- Profits and Losses

- Dissolution

- Amendments

- Governing Law

The Member has formed a limited liability company under the name mentioned above. The primary purpose of the LLC is to __________________________________.

The principal office of the LLC shall be located at: __________________________________.

The Member shall have full authority to manage the LLC. No other members or managers will be appointed.

The Member has contributed the following capital to the LLC:

All profits and losses shall be allocated to the Member.

The LLC may be dissolved upon the decision of the Member. The process of dissolution will follow applicable state laws.

This Agreement may only be amended in writing, signed by the Member.

This Agreement shall be governed by the laws of the state of ______________.

In witness whereof, the Member has signed this Single-Member Operating Agreement as of the date first written above.

Member Signature: ____________________________

Date: ____________________________

Common mistakes

Filling out a Single-Member Operating Agreement form can be a straightforward process, but many individuals make common mistakes that can lead to complications down the line. One prevalent error is failing to clearly define the purpose of the business. A vague description can create confusion about the business's objectives and operations. It is essential to articulate the specific activities and goals of the business to avoid misunderstandings in the future.

Another mistake often encountered is neglecting to include the member's contributions. While it may seem simple, detailing the initial capital investment and any other resources provided by the member is crucial. This information not only establishes ownership but also clarifies the financial structure of the business. Omitting this detail can lead to disputes over ownership and profit-sharing later on.

In addition, individuals frequently overlook the importance of outlining management and decision-making processes. A Single-Member Operating Agreement should specify how decisions will be made, even in a single-member context. Without this clarity, there can be confusion about authority and responsibility, especially if the business expands or involves additional stakeholders in the future.

Lastly, many people fail to consider the need for compliance with state laws. Each state has specific requirements for operating agreements, and ignoring these can result in legal complications. It is vital to research local regulations and ensure that the agreement adheres to them. This diligence helps protect the business and ensures that it operates within the legal framework established by the state.