Attorney-Approved Release of Promissory Note Document

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Release of Promissory Note form is used to formally acknowledge that a debt has been paid and the note is no longer enforceable. |

| Governing Law | The laws governing the use of this form may vary by state. For example, in California, it falls under the California Civil Code. |

| Signatures Required | Both the lender and borrower must sign the form to ensure that both parties agree to the release of the debt. |

| Record Keeping | It is important to keep a copy of the signed Release of Promissory Note for personal records, as it serves as proof of the debt's settlement. |

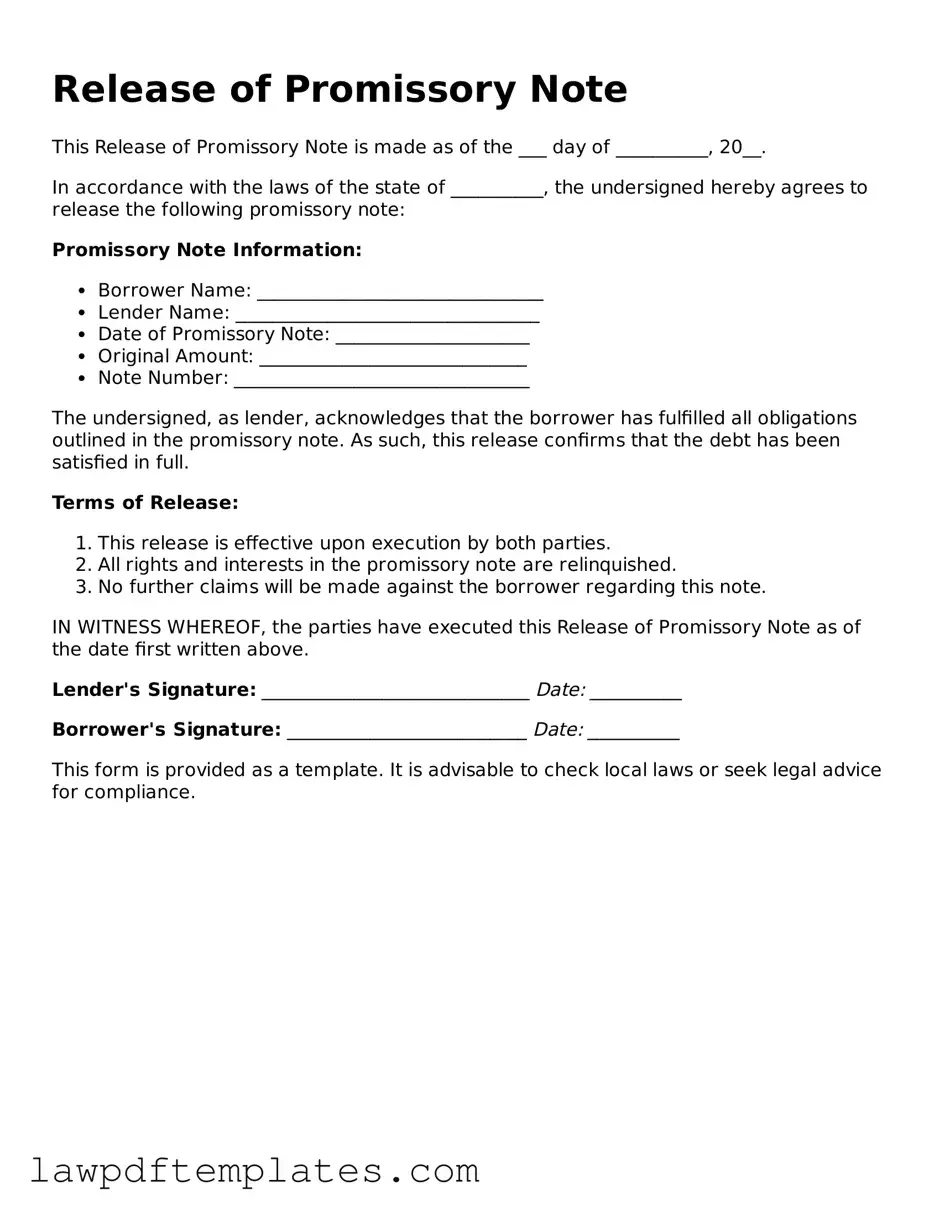

Sample - Release of Promissory Note Form

Release of Promissory Note

This Release of Promissory Note is made as of the ___ day of __________, 20__.

In accordance with the laws of the state of __________, the undersigned hereby agrees to release the following promissory note:

Promissory Note Information:

- Borrower Name: _______________________________

- Lender Name: _________________________________

- Date of Promissory Note: _____________________

- Original Amount: _____________________________

- Note Number: ________________________________

The undersigned, as lender, acknowledges that the borrower has fulfilled all obligations outlined in the promissory note. As such, this release confirms that the debt has been satisfied in full.

Terms of Release:

- This release is effective upon execution by both parties.

- All rights and interests in the promissory note are relinquished.

- No further claims will be made against the borrower regarding this note.

IN WITNESS WHEREOF, the parties have executed this Release of Promissory Note as of the date first written above.

Lender's Signature: _____________________________ Date: __________

Borrower's Signature: __________________________ Date: __________

This form is provided as a template. It is advisable to check local laws or seek legal advice for compliance.

Common mistakes

Filling out a Release of Promissory Note form can seem straightforward, but many people stumble along the way. One common mistake is not including all necessary parties. If the borrower or lender is missing, the document may not hold up in court. Always double-check that everyone involved is listed accurately.

Another frequent error is neglecting to provide the correct date. The date is crucial because it marks when the release takes effect. An incorrect date can lead to confusion and potential disputes later on. Make sure to write the date clearly and correctly.

Many individuals also forget to specify the amount being released. This detail is vital; without it, the release may be deemed incomplete. Clearly state the amount associated with the promissory note to avoid any ambiguity.

People often overlook the importance of signatures. Each party involved must sign the form. Failing to do so can invalidate the release. It’s best practice to ensure all signatures are present and that they match the names on the document.

Another mistake is not providing a clear description of the promissory note being released. This includes the original date of the note and any identifying numbers. A vague description can lead to misunderstandings, so be as specific as possible.

Additionally, many forget to keep a copy of the completed form. This oversight can be problematic if disputes arise later. Always make copies for your records to ensure you have proof of the release.

People sometimes skip the notary requirement. Depending on your state, notarization might be necessary for the document to be legally binding. Check your local regulations to see if this step is needed.

Finally, failing to review the entire form before submission is a common pitfall. Rushing through can lead to overlooked mistakes. Take your time to read through everything carefully to ensure all information is accurate and complete.

Consider Popular Types of Release of Promissory Note Documents

Online Promissory Note - When financing a car, both parties must recognize the importance of a precise and comprehensive promissory note.

When creating a financial agreement, utilizing an official document is crucial, and the New Jersey Promissory Note form serves this purpose effectively. It ensures that both the lender and borrower have a clear understanding of their responsibilities and expectations. For those looking for customizable options, resources like NJ PDF Forms can provide templates that simplify the process of drafting this important legal instrument.