Attorney-Approved Promissory Note for a Car Document

Form Breakdown

| Fact Name | Details |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount of money for the purchase of a vehicle. |

| Parties Involved | The parties typically include the borrower (buyer) and the lender (seller or financial institution). |

| Governing Law | The laws governing promissory notes vary by state, with the Uniform Commercial Code (UCC) serving as a common framework. |

| Interest Rate | The note may specify an interest rate, which can be fixed or variable, impacting the total repayment amount. |

| Payment Terms | It outlines the payment schedule, including the frequency of payments and the duration of the loan. |

| Default Consequences | Should the borrower default, the lender may have the right to repossess the vehicle and seek additional remedies. |

| Signature Requirement | The borrower must sign the note for it to be legally binding, indicating their agreement to the terms. |

| State-Specific Forms | Some states may require specific language or disclosures in the promissory note, reflecting local regulations. |

Sample - Promissory Note for a Car Form

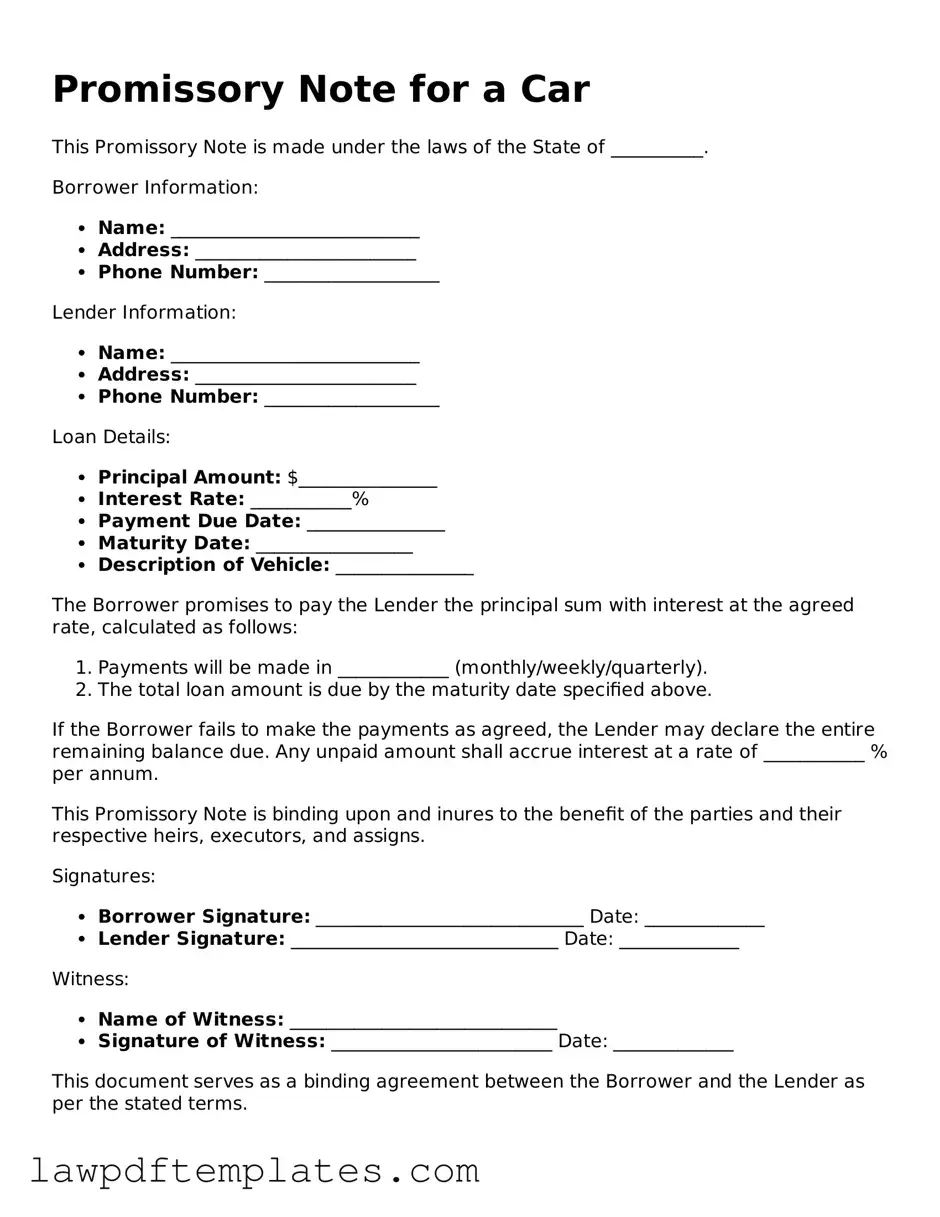

Promissory Note for a Car

This Promissory Note is made under the laws of the State of __________.

Borrower Information:

- Name: ___________________________

- Address: ________________________

- Phone Number: ___________________

Lender Information:

- Name: ___________________________

- Address: ________________________

- Phone Number: ___________________

Loan Details:

- Principal Amount: $_______________

- Interest Rate: ___________%

- Payment Due Date: _______________

- Maturity Date: _________________

- Description of Vehicle: _______________

The Borrower promises to pay the Lender the principal sum with interest at the agreed rate, calculated as follows:

- Payments will be made in ____________ (monthly/weekly/quarterly).

- The total loan amount is due by the maturity date specified above.

If the Borrower fails to make the payments as agreed, the Lender may declare the entire remaining balance due. Any unpaid amount shall accrue interest at a rate of ___________ % per annum.

This Promissory Note is binding upon and inures to the benefit of the parties and their respective heirs, executors, and assigns.

Signatures:

- Borrower Signature: _____________________________ Date: _____________

- Lender Signature: _____________________________ Date: _____________

Witness:

- Name of Witness: _____________________________

- Signature of Witness: ________________________ Date: _____________

This document serves as a binding agreement between the Borrower and the Lender as per the stated terms.

Common mistakes

Filling out a Promissory Note for a Car can be straightforward, but several common mistakes can lead to complications. One frequent error is failing to include the correct names of the parties involved. It is essential to clearly identify both the borrower and the lender. Omitting or misspelling names can create confusion and may lead to disputes later.

Another common mistake is neglecting to specify the loan amount. This figure must be accurate and clearly stated. If the amount is left blank or incorrectly filled out, it can result in misunderstandings about the financial obligations involved.

People often forget to include the interest rate. This detail is crucial, as it determines how much the borrower will pay over time. Without a stated interest rate, the terms of the loan may be unclear, leading to potential legal issues.

Additionally, some individuals overlook the importance of outlining the repayment schedule. Clearly defining when payments are due and the amount of each payment can prevent confusion. A vague repayment schedule can lead to missed payments and strained relationships.

Another mistake occurs when individuals fail to sign and date the document. A Promissory Note is not legally binding unless it is signed by both parties. Without signatures, the agreement lacks enforceability.

Inaccurate or vague descriptions of the collateral can also be problematic. When a vehicle is used as collateral, it should be described in detail, including the make, model, year, and VIN. A lack of specificity can lead to difficulties in enforcing the agreement if the borrower defaults.

Some people mistakenly assume that a verbal agreement is sufficient. A written Promissory Note is essential for clarity and legal protection. Relying on verbal promises can lead to misunderstandings and disputes.

Another common oversight is not reviewing the document before submission. Errors can easily slip through, and taking the time to double-check the information can save significant trouble later on. A careful review ensures that all terms are clear and agreed upon.

Lastly, individuals may not seek advice when needed. Consulting with a legal or financial expert can provide valuable insights and help avoid common pitfalls. Taking this step can enhance understanding and ensure that the Promissory Note is completed correctly.

Consider Popular Types of Promissory Note for a Car Documents

Release of Promissory Note Template - Documents the cancellation of a promissory note between parties.

A New York Promissory Note is a written promise to pay a specified amount of money to a designated party at a predetermined time. This legal document serves as a critical tool in various financial transactions, providing clarity and security for both lenders and borrowers. For those looking to draft or understand this important document, additional resources, such as the one found at https://nytemplates.com/blank-promissory-note-template/, can be invaluable in navigating their financial obligations effectively.