Attorney-Approved Promissory Note Document

State-specific Promissory Note Forms

Promissory Note Form Types

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a future date or on demand. |

| Parties Involved | Typically, a promissory note involves two parties: the maker (borrower) and the payee (lender). |

| Governing Law | In the United States, the Uniform Commercial Code (UCC) governs promissory notes, though specific state laws may also apply. |

| Key Components | Essential elements include the amount owed, interest rate (if any), due date, and signatures of the parties. |

| Types of Notes | There are various types of promissory notes, including secured and unsecured notes, each with different implications for the parties involved. |

| Enforceability | For a promissory note to be enforceable, it must meet certain legal requirements, such as clarity and mutual consent. |

| Transferability | Promissory notes can often be transferred to another party, allowing for flexibility in financial transactions. |

| Default Consequences | If the maker fails to repay the note, the payee has the right to take legal action to recover the owed amount. |

| Usage | Promissory notes are commonly used in personal loans, real estate transactions, and business financing. |

Sample - Promissory Note Form

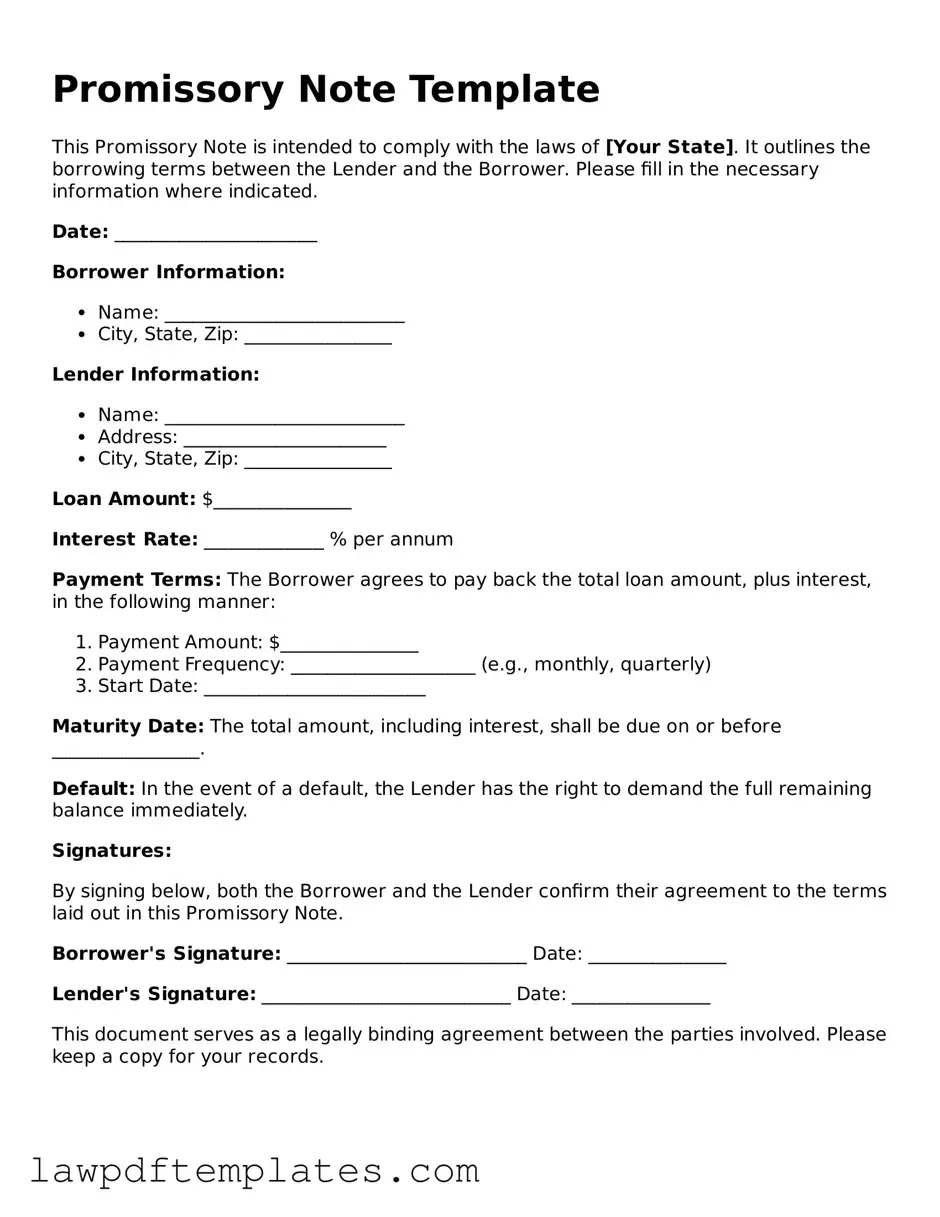

Promissory Note Template

This Promissory Note is intended to comply with the laws of [Your State]. It outlines the borrowing terms between the Lender and the Borrower. Please fill in the necessary information where indicated.

Date: ______________________

Borrower Information:

- Name: __________________________

- City, State, Zip: ________________

Lender Information:

- Name: __________________________

- Address: ______________________

- City, State, Zip: ________________

Loan Amount: $_______________

Interest Rate: _____________ % per annum

Payment Terms: The Borrower agrees to pay back the total loan amount, plus interest, in the following manner:

- Payment Amount: $_______________

- Payment Frequency: ____________________ (e.g., monthly, quarterly)

- Start Date: ________________________

Maturity Date: The total amount, including interest, shall be due on or before ________________.

Default: In the event of a default, the Lender has the right to demand the full remaining balance immediately.

Signatures:

By signing below, both the Borrower and the Lender confirm their agreement to the terms laid out in this Promissory Note.

Borrower's Signature: __________________________ Date: _______________

Lender's Signature: ___________________________ Date: _______________

This document serves as a legally binding agreement between the parties involved. Please keep a copy for your records.

Common mistakes

When filling out a Promissory Note form, many individuals make common mistakes that can lead to confusion or even legal issues down the line. One frequent error is not including all necessary details. A Promissory Note should clearly state the amount borrowed, the interest rate, and the repayment schedule. Omitting any of these critical components can create ambiguity, making it difficult to enforce the agreement later.

Another common mistake is failing to specify the terms of repayment. It's essential to outline how and when payments will be made. Some people simply write “monthly” without providing a specific date. This lack of clarity can lead to misunderstandings. Always include exact dates and methods of payment to avoid any potential disputes.

People often neglect to include the consequences of defaulting on the loan. A good Promissory Note should state what happens if the borrower fails to make payments as agreed. This might include late fees or the lender's right to take legal action. Without these stipulations, the lender may find it challenging to enforce their rights if the borrower defaults.

Lastly, signatures are crucial but sometimes overlooked. Both the borrower and lender must sign the document for it to be legally binding. Some individuals may assume that a verbal agreement is enough or forget to sign altogether. Without the necessary signatures, the Promissory Note may not hold up in court. Always double-check that all parties have signed before considering the document complete.

Popular Templates:

Dog Contract - A straightforward way to handle pet adoptions.

The Employment Verification form is a crucial document used to confirm an individual's employment status and history, and for those looking to simplify the process, resources such as Fast PDF Templates can be invaluable. This form serves a key role in various processes, including loan applications and background checks. Accurate completion is essential to ensure that the verification process proceeds smoothly and efficiently.

Da - It aids in preparing for field services through accurate reporting.