Fillable Payroll Check Template

File Details

| Fact Name | Description |

|---|---|

| Definition | A Payroll Check form is a document used by employers to pay employees for their work, detailing the amount earned and deductions made. |

| Purpose | It serves as a record of payment, providing transparency and accountability for both the employer and employee. |

| Components | The form typically includes the employee's name, pay period, gross pay, deductions, and net pay. |

| Legal Requirements | Employers must comply with federal and state laws regarding payroll documentation, including the Fair Labor Standards Act (FLSA). |

| State-Specific Forms | Some states require specific payroll forms; for example, California mandates compliance with the California Labor Code. |

| Record Keeping | Employers are generally required to keep payroll records for a minimum of three years, depending on state laws. |

| Tax Implications | Payroll checks must reflect accurate tax withholdings, including federal, state, and local taxes, as per IRS guidelines. |

| Distribution Methods | Payroll checks can be distributed via direct deposit, physical checks, or payroll cards, depending on employer policy. |

Sample - Payroll Check Form

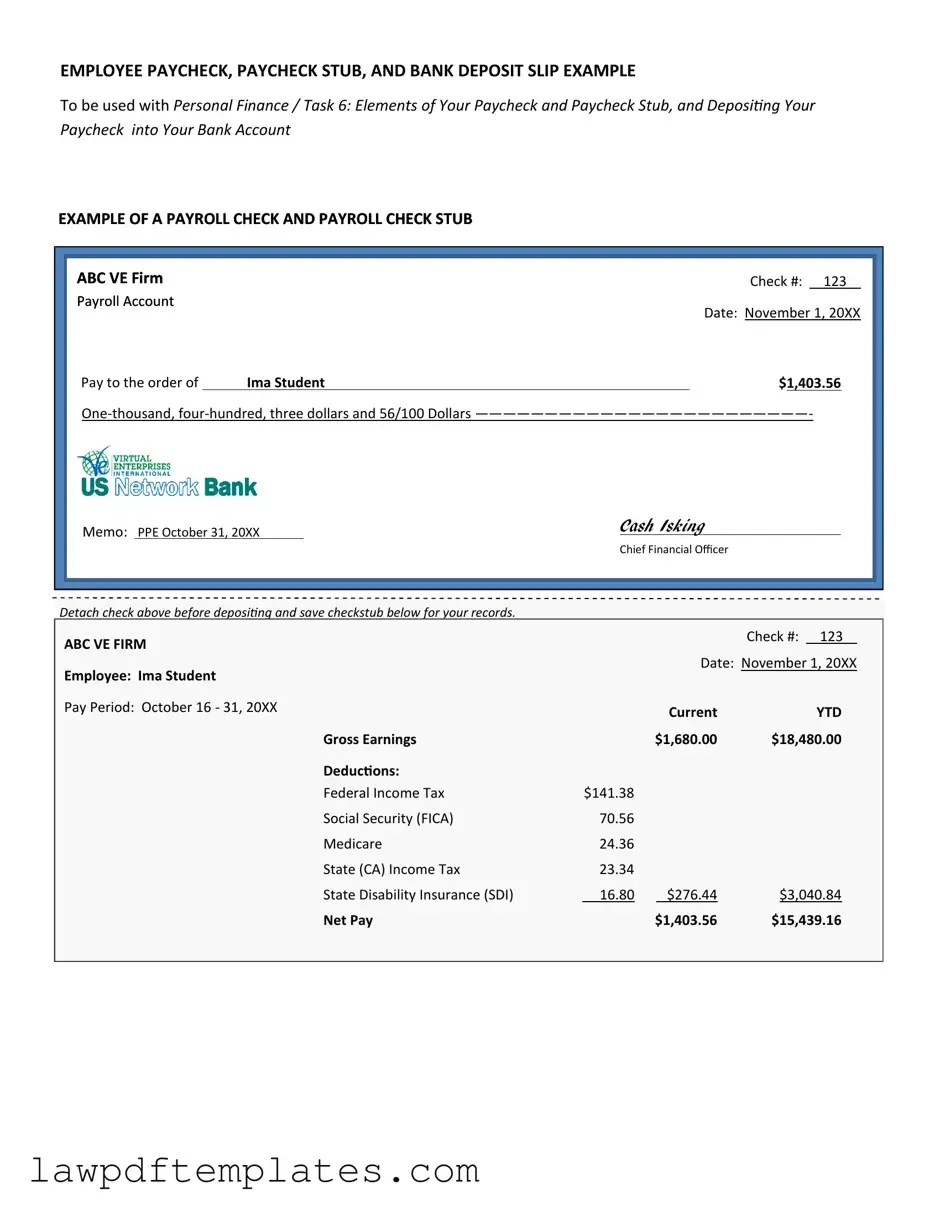

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

Common mistakes

Filling out a Payroll Check form can seem straightforward, but many people make common mistakes that can lead to complications. One frequent error is not including the correct employee identification number. This number is crucial for accurately processing payroll and ensuring that taxes are withheld appropriately. Without it, delays in payment may occur.

Another mistake is failing to specify the pay period. Each paycheck should clearly indicate the start and end dates of the period for which the employee is being paid. Omitting this information can create confusion and lead to disputes about pay amounts.

Some individuals neglect to double-check the hours worked. It is essential to record the exact number of hours an employee has worked during the pay period. Miscalculating hours can result in underpayment or overpayment, which can complicate future payroll processing.

Not accounting for deductions is another common oversight. Employees may have various deductions such as taxes, health insurance, or retirement contributions. Failing to list these deductions accurately can lead to incorrect net pay amounts.

Using the wrong pay rate can also cause issues. Whether an employee is hourly or salaried, the correct rate must be applied to ensure proper compensation. Errors in this area can affect employee morale and trust in the payroll system.

Some people forget to sign the Payroll Check form. A signature is often required to validate the document. Without it, the check may not be honored by the bank, causing unnecessary delays for the employee.

Another common mistake is not keeping a copy of the completed form. It is wise to maintain records for future reference. Without documentation, it can be challenging to resolve any discrepancies that may arise later.

Inaccurate dates can also pose a problem. Each Payroll Check form should have the correct date of issuance. Incorrect dates can lead to confusion about when payment was made and may impact tax reporting.

Lastly, failing to communicate changes can create issues. If an employee has a change in their personal information, such as a name or address, it is vital to update the Payroll Check form accordingly. Neglecting to do so can result in misdirected payments or tax complications.

Common PDF Documents

Certificate of Membership Template - Contribute to improved member relations through transparent record-keeping.

Using the FedEx Release Form can simplify the delivery process, especially for those who may not be home to receive their packages. By authorizing FedEx to leave the package at a designated spot, recipients can avoid missed deliveries and potential hassles. It’s important to carefully follow the completion guidelines for the form, and for those who need a template to assist in this process, Fast PDF Templates offers a convenient solution.

Shared Well Agreement - Clear terms in the agreement help outline expectations for both supplying and supplied parties.