Attorney-Approved Partial Release of Lien Document

Form Breakdown

| Fact Name | Details |

|---|---|

| Definition | A Partial Release of Lien form is a legal document that removes a portion of a lien from a property. |

| Purpose | This form is used when a contractor or subcontractor has received partial payment and wants to release their claim on the property for that amount. |

| Governing Law | The laws governing the Partial Release of Lien vary by state, often outlined in state-specific lien laws. |

| State-Specific Forms | Many states have their own forms and requirements, such as California's Civil Code Section 8416. |

| Signature Requirement | The form typically requires the signature of the lien claimant to be valid. |

| Filing | In some states, the Partial Release of Lien must be filed with the county recorder's office. |

| Effect on Property | Once filed, the property is no longer encumbered by the released portion of the lien. |

| Impact on Future Liens | Releasing a portion of a lien does not prevent the claimant from filing future liens for unpaid amounts. |

| Notice to Owner | Some states require that property owners receive notice of the partial release. |

| Use in Disputes | This form can be crucial in resolving disputes over payment, clarifying which amounts have been settled. |

Sample - Partial Release of Lien Form

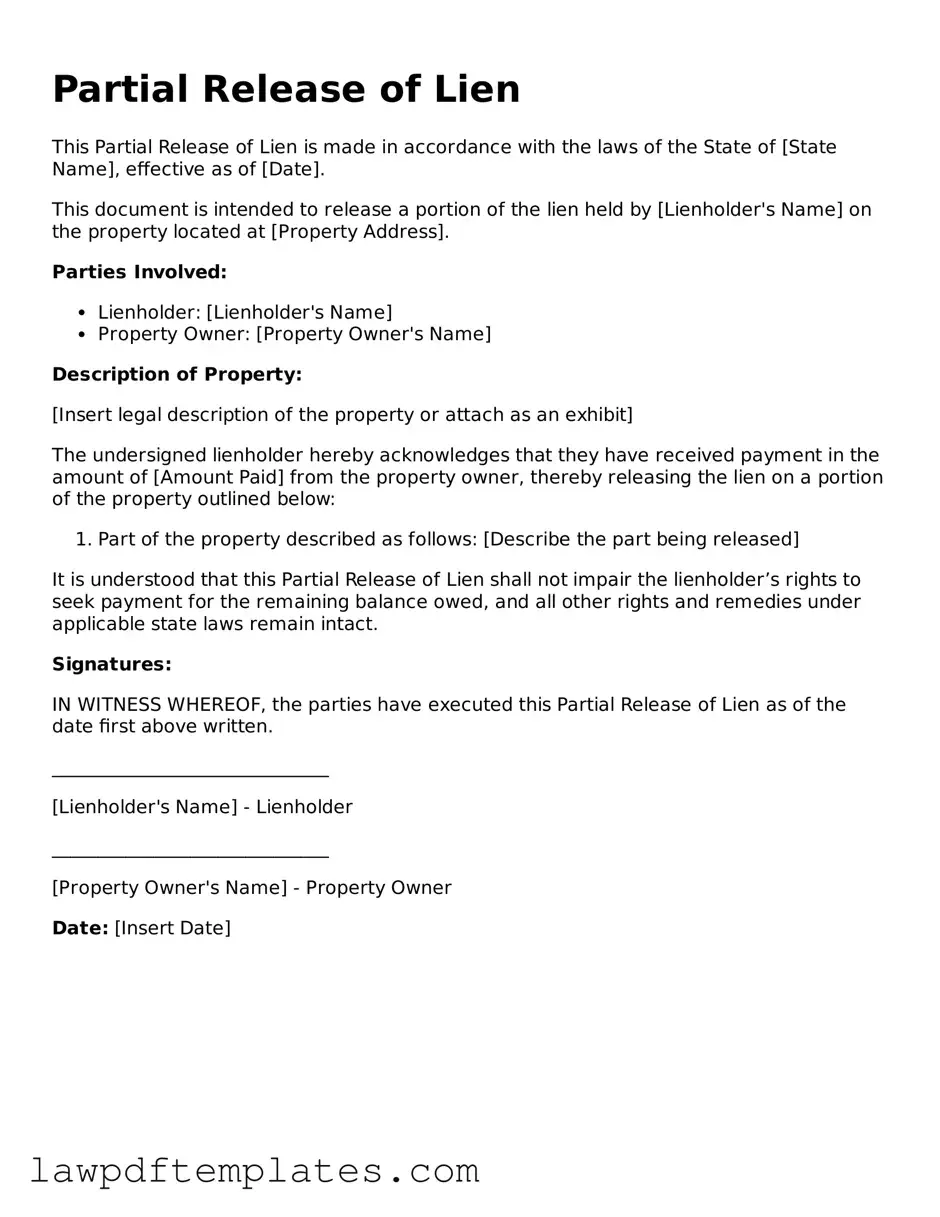

Partial Release of Lien

This Partial Release of Lien is made in accordance with the laws of the State of [State Name], effective as of [Date].

This document is intended to release a portion of the lien held by [Lienholder's Name] on the property located at [Property Address].

Parties Involved:

- Lienholder: [Lienholder's Name]

- Property Owner: [Property Owner's Name]

Description of Property:

[Insert legal description of the property or attach as an exhibit]

The undersigned lienholder hereby acknowledges that they have received payment in the amount of [Amount Paid] from the property owner, thereby releasing the lien on a portion of the property outlined below:

- Part of the property described as follows: [Describe the part being released]

It is understood that this Partial Release of Lien shall not impair the lienholder’s rights to seek payment for the remaining balance owed, and all other rights and remedies under applicable state laws remain intact.

Signatures:

IN WITNESS WHEREOF, the parties have executed this Partial Release of Lien as of the date first above written.

______________________________

[Lienholder's Name] - Lienholder

______________________________

[Property Owner's Name] - Property Owner

Date: [Insert Date]

Common mistakes

Filling out a Partial Release of Lien form is an important task that requires attention to detail. Many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to include the correct property description. This description should be precise and match the property records. If it is vague or incorrect, it can create confusion and potentially invalidate the release.

Another mistake often seen is neglecting to sign and date the form properly. Each party involved must provide their signature, and the absence of a date can raise questions about the timing of the release. It’s crucial to ensure that all required signatures are present and that they are dated appropriately to avoid disputes later.

People also sometimes overlook the necessity of notarization. In many jurisdictions, a Partial Release of Lien must be notarized to be legally effective. Skipping this step can render the document unenforceable, meaning the lien may still be considered active. Always check local requirements to confirm if notarization is needed.

Lastly, individuals may fail to provide copies of the completed form to all relevant parties. After the form is filled out and executed, it should be distributed to everyone involved, including the lender and the property owner. This ensures that all parties are aware of the lien's release, preventing any misunderstandings in the future. Proper communication is key to a smooth process.

Consider Popular Types of Partial Release of Lien Documents

Fedex Door Tag Authorizing Release - Ensure your neighbor or building manager is informed if they are signing for your package.

In the process of transferring vehicle ownership, it is vital for both the buyer and seller to understand the implications of the transaction. One key document that facilitates this understanding is the Vehicle Release of Liability form, which protects sellers from future claims after the sale. By using a Fillable Forms version of this document, vehicle owners can ensure that the responsibilities are clearly defined, thereby reducing risks associated with the transfer.

Personal Training Waiver Form - Clients can use the waiver to reflect on their readiness and willingness to engage in training.

Car Accident Settlement Agreement Form - Complete this form to settle vehicle accident damage disputes.