Attorney-Approved Owner Financing Contract Document

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract is an agreement where the seller provides financing to the buyer for the purchase of a property, eliminating the need for traditional bank financing. |

| Benefits | This type of financing can make purchasing a home easier for buyers who may not qualify for a mortgage, while sellers can attract more potential buyers. |

| Interest Rates | Interest rates in owner financing agreements can be negotiated between the buyer and seller, often resulting in more favorable terms for both parties. |

| Down Payment | Typically, the seller may require a down payment, which can vary widely based on the agreement but is often lower than traditional financing requirements. |

| Governing Laws | Owner financing contracts are governed by state laws, which can vary. For example, in California, the California Civil Code applies, while in Texas, the Texas Property Code is relevant. |

| Default Consequences | If the buyer defaults on the payments, the seller may have the right to foreclose on the property, similar to traditional mortgage agreements. |

| Contract Terms | Terms of the contract, such as payment schedules, interest rates, and duration, should be clearly outlined to prevent misunderstandings. |

| Legal Advice | It is advisable for both parties to seek legal advice before entering into an owner financing agreement to ensure all terms are fair and legally binding. |

Sample - Owner Financing Contract Form

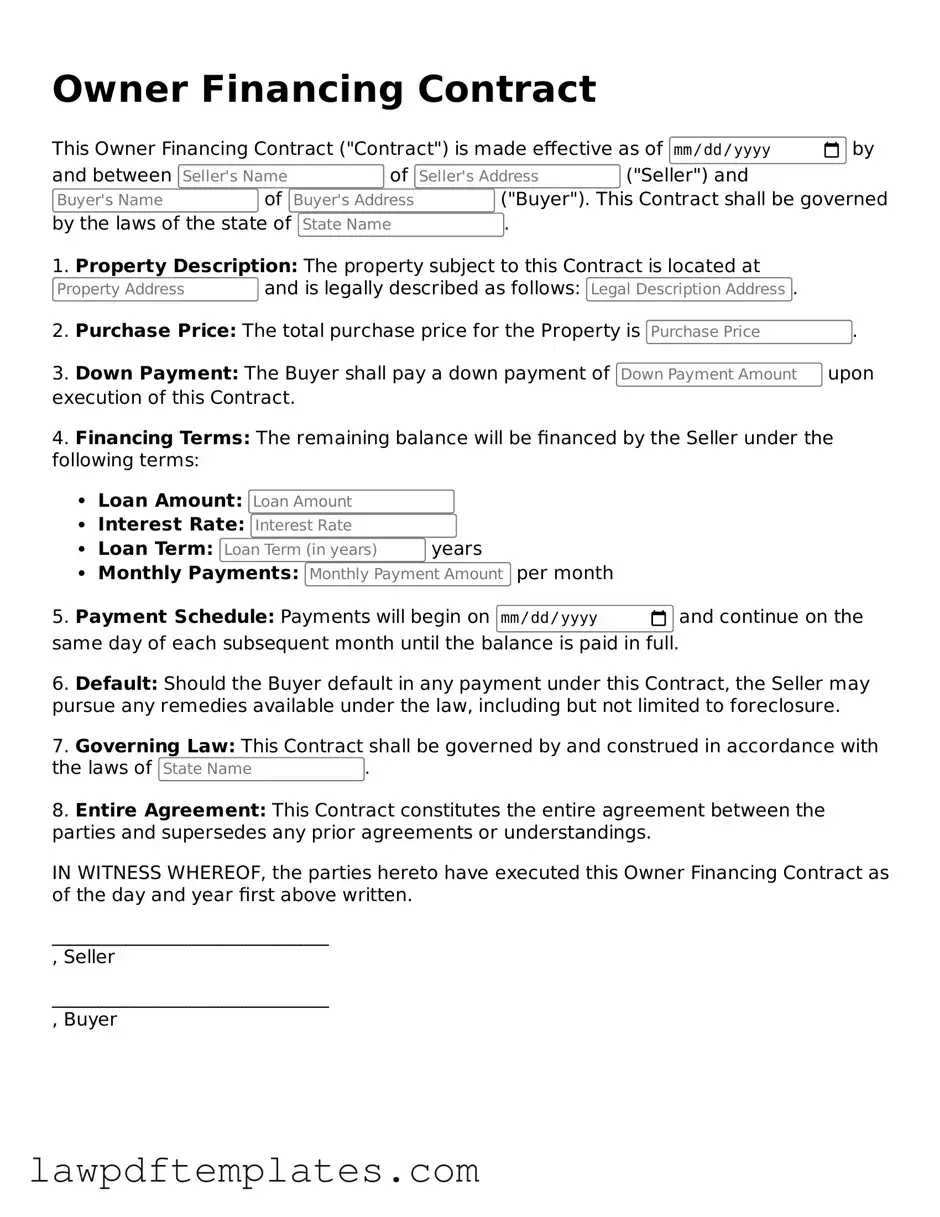

Owner Financing Contract

This Owner Financing Contract ("Contract") is made effective as of by and between of ("Seller") and of ("Buyer"). This Contract shall be governed by the laws of the state of .

1. Property Description: The property subject to this Contract is located at and is legally described as follows: .

2. Purchase Price: The total purchase price for the Property is .

3. Down Payment: The Buyer shall pay a down payment of upon execution of this Contract.

4. Financing Terms: The remaining balance will be financed by the Seller under the following terms:

- Loan Amount:

- Interest Rate:

- Loan Term: years

- Monthly Payments: per month

5. Payment Schedule: Payments will begin on and continue on the same day of each subsequent month until the balance is paid in full.

6. Default: Should the Buyer default in any payment under this Contract, the Seller may pursue any remedies available under the law, including but not limited to foreclosure.

7. Governing Law: This Contract shall be governed by and construed in accordance with the laws of .

8. Entire Agreement: This Contract constitutes the entire agreement between the parties and supersedes any prior agreements or understandings.

IN WITNESS WHEREOF, the parties hereto have executed this Owner Financing Contract as of the day and year first above written.

______________________________

______________________________

Common mistakes

When completing the Owner Financing Contract form, individuals often overlook key details that can lead to complications later. One common mistake is failing to accurately fill in the buyer's and seller's names. This information must be correct and consistent throughout the document to avoid confusion or disputes.

Another frequent error involves neglecting to specify the purchase price. This figure should be clearly stated to ensure both parties understand the financial terms of the agreement. Without this information, the contract may be deemed incomplete.

Some individuals mistakenly leave out the interest rate. This detail is crucial as it determines how much the buyer will pay over the life of the loan. Omitting this can lead to misunderstandings and potential legal issues.

Additionally, people sometimes forget to include the payment schedule. Clearly outlining when payments are due helps both parties manage their expectations and responsibilities. A vague payment schedule can result in missed payments and strained relationships.

Another mistake is not addressing the consequences of default. The contract should clearly outline what happens if the buyer fails to make payments. This information protects the seller’s interests and provides clarity for the buyer.

Some individuals do not sign and date the contract properly. Both parties must provide their signatures and the date of signing to validate the agreement. Without these, the contract may not hold up in a legal context.

People often overlook the importance of including any necessary disclosures. Depending on state laws, certain disclosures may be required to inform the buyer of specific conditions related to the property. Failing to include these can lead to legal repercussions.

Another common oversight is neglecting to consult with a legal professional. While it is possible to fill out the form independently, seeking legal advice can help ensure that all terms are fair and compliant with local laws.

Lastly, individuals may not keep copies of the completed contract. Retaining a signed copy is essential for both parties to reference in the future. Without it, there may be disputes regarding the terms of the agreement.

Consider Popular Types of Owner Financing Contract Documents

Real Estate Termination Agreement - Termination can sometimes lead to fruitful new beginnings in real estate endeavors.

For those looking to navigate the complexities of property transactions, having the right tools is vital. A well-crafted "efficient Real Estate Purchase Agreement" can guide both buyers and sellers, ensuring a clear understanding of their responsibilities. For more information on this crucial document, visit efficient Real Estate Purchase Agreement.