Attorney-Approved Operating Agreement Document

State-specific Operating Agreement Forms

Operating Agreement Form Types

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement is a key document used by LLCs to outline the management structure and operating procedures. |

| Purpose | This agreement helps define the roles and responsibilities of members, ensuring clarity in operations. |

| State Requirement | Not all states require an Operating Agreement, but it is highly recommended for LLCs. |

| Customization | Operating Agreements can be customized to suit the specific needs of the LLC and its members. |

| Governing Laws | Each state has its own laws governing LLCs, which can affect the content of the Operating Agreement. |

| Dispute Resolution | The agreement often includes procedures for resolving disputes among members, which can help avoid costly litigation. |

| Amendments | Members can amend the Operating Agreement as needed, but typically this requires a majority or unanimous consent. |

| Tax Implications | The Operating Agreement can outline how profits and losses are distributed, impacting members' tax responsibilities. |

| Protection of Interests | By clearly outlining the rights and responsibilities of members, the Operating Agreement protects individual interests within the LLC. |

Sample - Operating Agreement Form

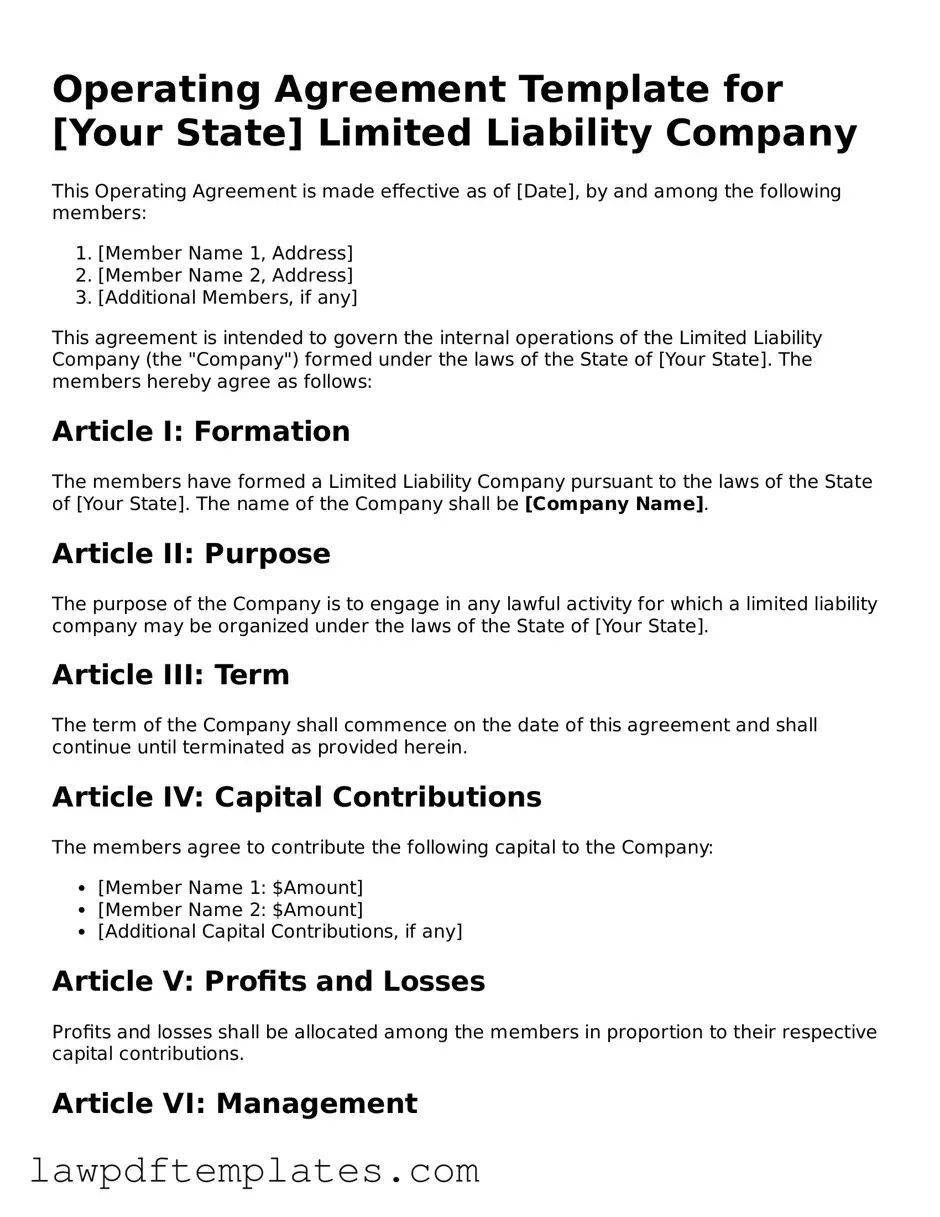

Operating Agreement Template for [Your State] Limited Liability Company

This Operating Agreement is made effective as of [Date], by and among the following members:

- [Member Name 1, Address]

- [Member Name 2, Address]

- [Additional Members, if any]

This agreement is intended to govern the internal operations of the Limited Liability Company (the "Company") formed under the laws of the State of [Your State]. The members hereby agree as follows:

Article I: Formation

The members have formed a Limited Liability Company pursuant to the laws of the State of [Your State]. The name of the Company shall be [Company Name].

Article II: Purpose

The purpose of the Company is to engage in any lawful activity for which a limited liability company may be organized under the laws of the State of [Your State].

Article III: Term

The term of the Company shall commence on the date of this agreement and shall continue until terminated as provided herein.

Article IV: Capital Contributions

The members agree to contribute the following capital to the Company:

- [Member Name 1: $Amount]

- [Member Name 2: $Amount]

- [Additional Capital Contributions, if any]

Article V: Profits and Losses

Profits and losses shall be allocated among the members in proportion to their respective capital contributions.

Article VI: Management

The management of the Company shall be vested in its members. Decisions shall be made by a majority vote of the members, unless otherwise specified.

Article VII: Distributions

Distributions of cash or other assets shall be made to the members at the discretion of the members, based on their respective ownership percentages.

Article VIII: Indemnification

The Company shall indemnify its members against any losses, liabilities, or expenses incurred in connection with the Company's business.

Article IX: Amendments

This Agreement may be amended only by a written agreement signed by all members.

Article X: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of [Your State].

IN WITNESS WHEREOF, the members have executed this Operating Agreement as of the date first above written.

__________________________

[Member Name 1]

__________________________

[Member Name 2]

__________________________

[Additional Members, if any]

Common mistakes

When completing the Operating Agreement form, individuals often overlook important details that can lead to complications down the road. One common mistake is failing to clearly define the roles and responsibilities of each member. Without this clarity, misunderstandings may arise, potentially causing disputes among members.

Another frequent error is neglecting to include the initial capital contributions of each member. This information is crucial as it establishes the financial commitment of each party. If this detail is missing, it could lead to disagreements regarding profit distribution and ownership stakes in the future.

Additionally, many people forget to outline the procedures for adding or removing members. This oversight can create confusion if a member wishes to exit the business or if new members are introduced. Having a clear process in place helps ensure a smooth transition and maintains the integrity of the agreement.

Some individuals also make the mistake of not specifying how decisions will be made. Whether decisions require a simple majority or a unanimous vote can significantly impact the business operations. Without this specification, conflicts may arise over how to proceed with important business matters.

Another area where mistakes commonly occur is in the section addressing profit and loss distribution. Many people either leave this section blank or do not provide a clear formula. This ambiguity can lead to disputes among members regarding how profits are shared, which can ultimately harm the business's relationships.

It is also crucial to remember that the Operating Agreement should be updated as the business evolves. Failing to review and revise the agreement regularly can result in outdated provisions that no longer reflect the current structure or goals of the business.

Some individuals mistakenly assume that a verbal agreement is sufficient. While discussions may occur, having a written document is essential for legal protection. A formal Operating Agreement provides a clear reference point for all members, reducing the likelihood of misunderstandings.

Lastly, many people do not seek legal advice when drafting their Operating Agreement. Consulting with a legal professional can help ensure that all necessary provisions are included and that the document complies with state laws. This step is vital for protecting the interests of all members involved.

Popular Templates:

How to Get Acord Insurance Certificate - Essential for maintaining safety and compliance records.

Free Bill of Sale for Firearm - Some states may have specific requirements for these forms, including witness signatures.

In addition to understanding the importance of the Illinois Bill of Sale, it's worthwhile to explore resources that can assist in creating this document effectively. For those seeking convenient templates, Fast PDF Templates offers a variety of options to streamline the process, ensuring that all necessary information is included for a smooth transaction.

Marriage Records Sacramento Ca - Documentation that can simplify legal processes for couples.