Free Transfer-on-Death Deed Template for the State of Ohio

Form Breakdown

| Fact Name | Details |

|---|---|

| Definition | The Ohio Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Ohio Revised Code Section 5302.22. |

| Eligibility | Any individual who owns real estate in Ohio can create a Transfer-on-Death Deed. |

| Revocation | The deed can be revoked at any time before the owner's death by filing a revocation document with the county recorder. |

| Filing Requirement | The deed must be recorded with the county recorder's office to be effective, and it should be done before the owner's death. |

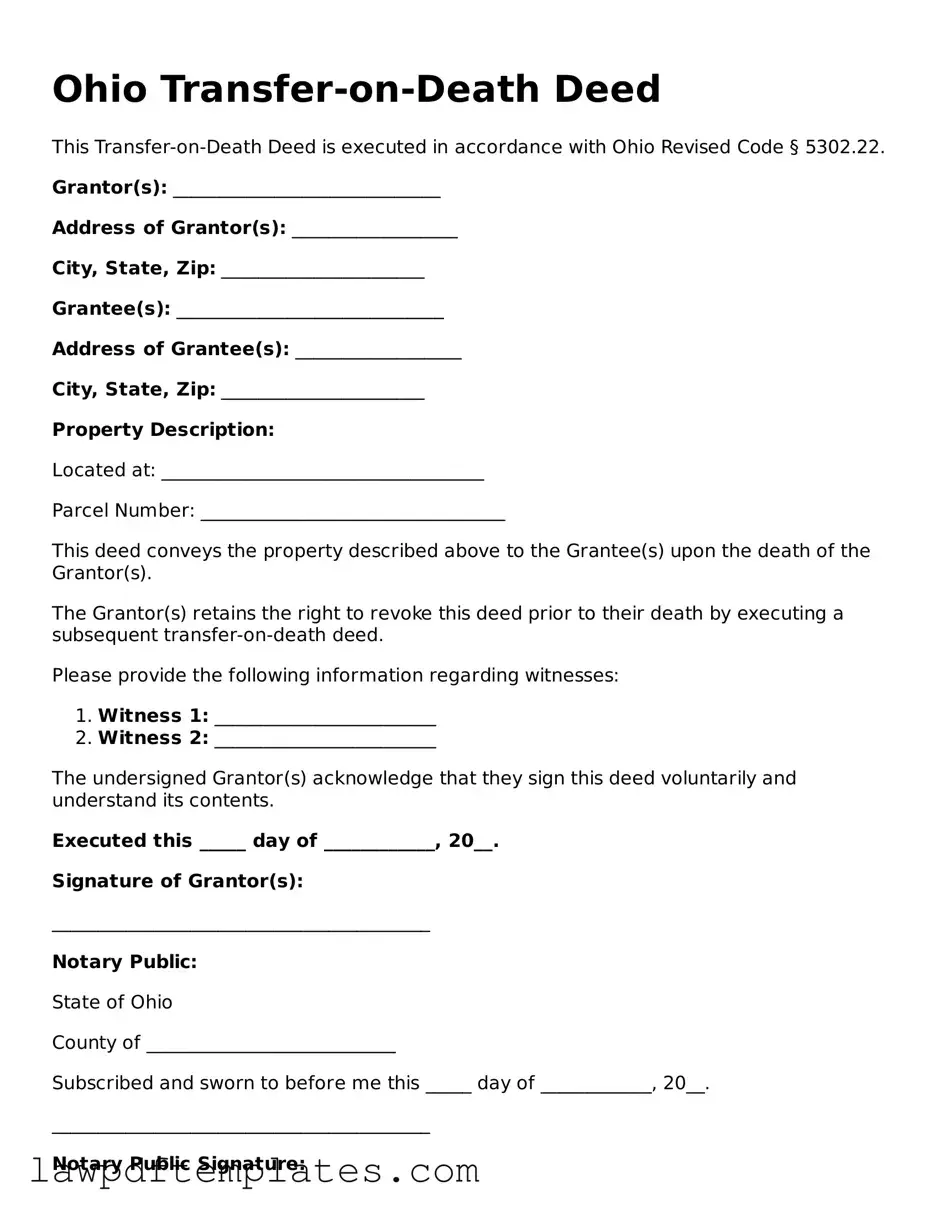

Sample - Ohio Transfer-on-Death Deed Form

Ohio Transfer-on-Death Deed

This Transfer-on-Death Deed is executed in accordance with Ohio Revised Code § 5302.22.

Grantor(s): _____________________________

Address of Grantor(s): __________________

City, State, Zip: ______________________

Grantee(s): _____________________________

Address of Grantee(s): __________________

City, State, Zip: ______________________

Property Description:

Located at: ___________________________________

Parcel Number: _________________________________

This deed conveys the property described above to the Grantee(s) upon the death of the Grantor(s).

The Grantor(s) retains the right to revoke this deed prior to their death by executing a subsequent transfer-on-death deed.

Please provide the following information regarding witnesses:

- Witness 1: ________________________

- Witness 2: ________________________

The undersigned Grantor(s) acknowledge that they sign this deed voluntarily and understand its contents.

Executed this _____ day of ____________, 20__.

Signature of Grantor(s):

_________________________________________

Notary Public:

State of Ohio

County of ___________________________

Subscribed and sworn to before me this _____ day of ____________, 20__.

_________________________________________

Notary Public Signature:

My commission expires: ___________________

Common mistakes

Filling out the Ohio Transfer-on-Death Deed form can be straightforward, but mistakes often occur. One common error is not providing the correct legal description of the property. This description must be precise and match the information on the property deed. If it’s incorrect, the transfer may not be valid.

Another frequent mistake involves the names of the beneficiaries. It’s essential to spell names correctly and include all necessary details. Omitting a middle name or using a nickname can lead to confusion and potential legal issues later on. Always double-check the names against official documents.

People also sometimes forget to sign the deed. This may seem simple, but without a signature, the document is not legally binding. Additionally, failing to have the deed notarized can invalidate the transfer. Ohio law requires notarization for the deed to be effective.

Some individuals neglect to record the deed with the county recorder's office. After completing the form, it must be filed to ensure that the transfer is recognized. If it’s not recorded, the transfer may not be enforceable, and beneficiaries could face challenges in claiming the property.

Another mistake is not considering tax implications. While the Transfer-on-Death Deed allows for a smooth transfer of property, it may have tax consequences for the beneficiaries. Understanding these implications ahead of time can help avoid unexpected financial burdens.

Lastly, people sometimes fail to update the deed after life changes, such as marriage or divorce. If the circumstances change, it’s important to revise the deed accordingly. Otherwise, the original beneficiaries may inherit the property, even if it’s no longer the owner’s intention.

Discover More Transfer-on-Death Deed Templates for Specific States

Problems With Transfer on Death Deeds in Indiana - May not be recognized in all states, so understanding state laws is crucial.

Transfer on Death Deed Georgia - This deed can serve as an essential element in a comprehensive estate plan, alongside wills and trusts.

The Trader Joe's application form serves as a key step for individuals seeking employment at this popular grocery store chain. This form collects essential information about applicants, including their work history and availability. For those looking for further resources on how to complete this process, you can refer to the PDF Documents Hub. If you're ready to start your journey with Trader Joe's, fill out the application by clicking the button below.

Todi Illinois - This deed serves as a tool for individuals who want to keep their estate private, avoiding public probate records.

Florida Transfer on Death Deed Form - Each state may have specific forms or requirements for creating a Transfer-on-Death Deed.