Free Real Estate Purchase Agreement Template for the State of Ohio

Form Breakdown

| Fact Name | Description |

|---|---|

| Governing Law | The Ohio Real Estate Purchase Agreement is governed by Ohio state law. |

| Parties Involved | The agreement typically includes the buyer and seller, each identified by their legal names. |

| Property Description | A detailed description of the property being sold is required, including address and parcel number. |

| Purchase Price | The total purchase price must be clearly stated, along with any earnest money deposit details. |

| Contingencies | The agreement may include contingencies, such as financing or home inspection, which must be satisfied for the sale to proceed. |

| Closing Date | The expected closing date should be specified, allowing both parties to prepare for the transaction. |

| Disclosures | Sellers are required to provide certain disclosures about the property, including any known defects or issues. |

| Signatures | Both parties must sign the agreement to make it legally binding, indicating their acceptance of the terms. |

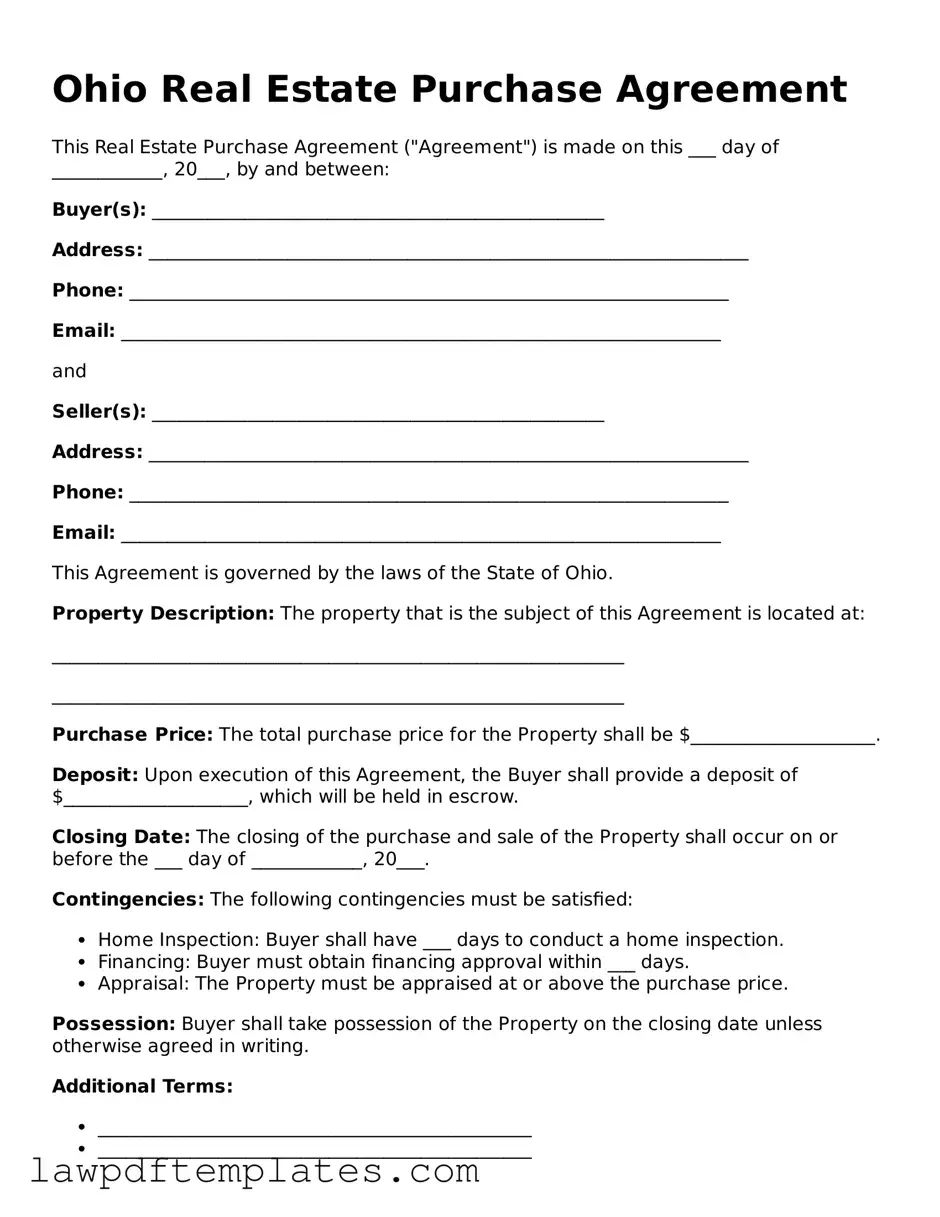

Sample - Ohio Real Estate Purchase Agreement Form

Ohio Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made on this ___ day of ____________, 20___, by and between:

Buyer(s): _________________________________________________

Address: _________________________________________________________________

Phone: _________________________________________________________________

Email: _________________________________________________________________

and

Seller(s): _________________________________________________

Address: _________________________________________________________________

Phone: _________________________________________________________________

Email: _________________________________________________________________

This Agreement is governed by the laws of the State of Ohio.

Property Description: The property that is the subject of this Agreement is located at:

______________________________________________________________

______________________________________________________________

Purchase Price: The total purchase price for the Property shall be $____________________.

Deposit: Upon execution of this Agreement, the Buyer shall provide a deposit of $____________________, which will be held in escrow.

Closing Date: The closing of the purchase and sale of the Property shall occur on or before the ___ day of ____________, 20___.

Contingencies: The following contingencies must be satisfied:

- Home Inspection: Buyer shall have ___ days to conduct a home inspection.

- Financing: Buyer must obtain financing approval within ___ days.

- Appraisal: The Property must be appraised at or above the purchase price.

Possession: Buyer shall take possession of the Property on the closing date unless otherwise agreed in writing.

Additional Terms:

- _______________________________________________

- _______________________________________________

- _______________________________________________

Signatures:

Seller Signature: ________________________________________ Date: ____________

Buyer Signature: ________________________________________ Date: ____________

This Agreement constitutes the entire understanding between the parties and may only be modified by a written agreement signed by both parties.

Common mistakes

Filling out the Ohio Real Estate Purchase Agreement form can be a daunting task for many buyers and sellers. One common mistake is failing to provide accurate property details. Buyers should ensure that the property address, legal description, and any relevant parcel numbers are correctly listed. An error in these details can lead to confusion and potential legal issues down the line.

Another frequent error involves neglecting to specify the purchase price. This figure should be clearly stated to avoid misunderstandings between the parties. Without a clear price, negotiations can become complicated, and the agreement may lack enforceability.

Buyers often forget to include contingencies. These are essential clauses that protect the buyer's interests, such as financing or inspection contingencies. Without them, buyers may find themselves locked into a purchase without the ability to back out if issues arise.

Misunderstanding deadlines is another pitfall. Each section of the agreement has specific timelines for actions like inspections, financing, and closing. Missing these deadlines can lead to automatic forfeiture of the agreement or loss of earnest money.

Providing incomplete or incorrect personal information is also a mistake. Buyers and sellers should ensure that names, addresses, and contact information are accurate. This information is crucial for communication and legal purposes throughout the transaction.

Another area where mistakes frequently occur is in the allocation of closing costs. Buyers and sellers should clearly outline who is responsible for which costs. Failing to do so can lead to disputes and dissatisfaction at closing.

Buyers sometimes overlook the importance of including earnest money details. The amount of earnest money, along with the terms of its return, should be clearly stated in the agreement. This protects both parties and ensures that there is a clear understanding of the financial commitment involved.

Some individuals make the mistake of not reviewing the entire agreement before signing. Each section of the document carries legal weight, and overlooking any part can result in unintended consequences. A thorough review is essential to ensure all terms are agreeable.

Lastly, many people forget to consult with a real estate professional or attorney. While it may seem like a straightforward process, having expert guidance can help avoid common pitfalls and ensure that the agreement is legally sound and in the best interest of all parties involved.

Discover More Real Estate Purchase Agreement Templates for Specific States

Nj Real Estate Contract Pdf - This agreement clarifies how escrow funds will be handled during the transaction.

For those looking to understand the legal aspects of property transfer, a useful resource is the important Quitclaim Deed form, which simplifies the process of transferring ownership in Georgia.

Home Purchase and Sale Agreement - The agreement reflects the actual negotiations conducted between the buyer and seller.

Georgia Purchase and Sale Agreement 2023 - It is often used in both residential and commercial property transactions.