Free Promissory Note Template for the State of Ohio

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a defined time. |

| Governing Law | The Ohio Promissory Note is governed by the Ohio Revised Code, specifically sections related to contracts and negotiable instruments. |

| Parties Involved | The note typically involves two parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The interest rate can be specified in the note. If not stated, Ohio law allows for a default interest rate. |

| Payment Terms | Payment terms must be clear, including the due date and method of payment. |

| Default Provisions | The note should outline what constitutes a default and the consequences of defaulting on the payment. |

| Signatures | Both the maker and the payee should sign the note to ensure it is legally binding. |

| Notarization | While notarization is not required in Ohio, it can add an extra layer of authenticity and help in legal disputes. |

| Transferability | Promissory notes in Ohio can often be transferred to another party, making them negotiable instruments. |

Sample - Ohio Promissory Note Form

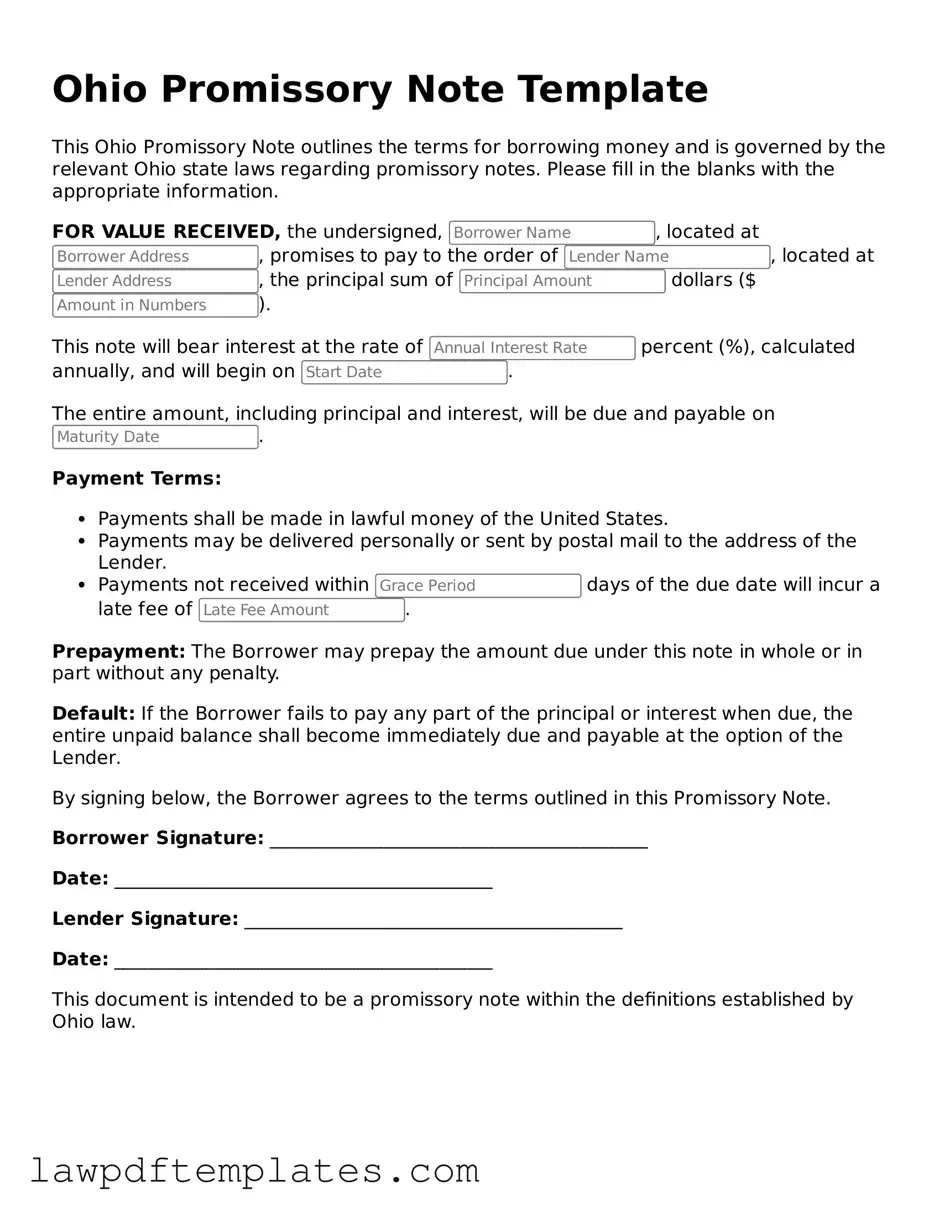

Ohio Promissory Note Template

This Ohio Promissory Note outlines the terms for borrowing money and is governed by the relevant Ohio state laws regarding promissory notes. Please fill in the blanks with the appropriate information.

FOR VALUE RECEIVED, the undersigned, , located at , promises to pay to the order of , located at , the principal sum of dollars ($).

This note will bear interest at the rate of percent (%), calculated annually, and will begin on .

The entire amount, including principal and interest, will be due and payable on .

Payment Terms:

- Payments shall be made in lawful money of the United States.

- Payments may be delivered personally or sent by postal mail to the address of the Lender.

- Payments not received within days of the due date will incur a late fee of .

Prepayment: The Borrower may prepay the amount due under this note in whole or in part without any penalty.

Default: If the Borrower fails to pay any part of the principal or interest when due, the entire unpaid balance shall become immediately due and payable at the option of the Lender.

By signing below, the Borrower agrees to the terms outlined in this Promissory Note.

Borrower Signature: _________________________________________

Date: _________________________________________

Lender Signature: _________________________________________

Date: _________________________________________

This document is intended to be a promissory note within the definitions established by Ohio law.

Common mistakes

Filling out the Ohio Promissory Note form can seem straightforward, but many people make common mistakes that can lead to complications later on. One frequent error is failing to include all necessary parties. When both the borrower and the lender are not clearly identified, it can create confusion about who is responsible for repayment.

Another mistake involves incorrect dates. The date of the agreement is crucial. If this date is missing or incorrect, it can affect the enforceability of the note. Ensure that the date reflects when both parties agreed to the terms.

Many individuals neglect to specify the loan amount clearly. Writing the amount in numbers without also spelling it out in words can lead to misunderstandings. It’s important to write the amount both ways to avoid any ambiguity.

Additionally, some people overlook the importance of interest rates. If the interest rate is not clearly stated, it can lead to disputes down the line. Be sure to specify whether the interest is fixed or variable, and include the exact percentage.

Another common error is failing to outline the repayment terms. This includes the schedule of payments and the due dates. Without this information, it may be unclear when payments are expected, leading to potential conflicts.

Some individuals also forget to include the consequences of late payments. Stipulating late fees or other penalties can help protect the lender's interests. Without this clause, the borrower may not feel the urgency to pay on time.

People sometimes make the mistake of not signing the document. A Promissory Note is not valid unless it is signed by both parties. Ensure that all necessary signatures are present before considering the note complete.

Inaccurate contact information is another issue. Providing incorrect addresses or phone numbers can hinder communication if problems arise. Always double-check that all contact details are accurate and up-to-date.

Some individuals may also fail to keep copies of the signed note. It’s vital for both parties to retain a copy for their records. This can serve as a reference in case of disputes or misunderstandings.

Lastly, people sometimes do not seek legal advice before signing. While it may seem unnecessary, consulting with a legal professional can help clarify any confusing terms and ensure that the note complies with Ohio law.

Discover More Promissory Note Templates for Specific States

Blank Promissory Note - They provide a roadmap for payment expectations and consequences.

For those seeking to navigate the employment verification landscape in Texas efficiently, utilizing the Texas Employment Verification form is crucial. It not only provides essential information to the Texas Health and Human Services Commission (HHSC) but also ensures that employers can swiftly confirm the employment status and earnings of their personnel. To access the form easily and facilitate this important process, visit https://texasformspdf.com/fillable-texas-employment-verification-online.

Promissary Note Template - A Promissory Note often serves as part of a larger financing agreement.

Illinois Promissory Note - These notes can be a crucial part of business financing and personal loans.

Promissory Note Template Massachusetts - Borrowers must ensure they can meet the repayment terms before signing.