Free Operating Agreement Template for the State of Ohio

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Operating Agreement outlines the management structure and operational procedures for an LLC. |

| Governing Law | This form is governed by the Ohio Revised Code, specifically Chapter 1705. |

| Flexibility | Members can customize the agreement to fit their specific needs and preferences. |

| Member Roles | The agreement can define the roles and responsibilities of each member within the LLC. |

| Profit Distribution | It specifies how profits and losses will be allocated among members, which can differ from ownership percentages. |

| Amendments | Members can include provisions for amending the agreement, ensuring it remains relevant as the business evolves. |

| Dispute Resolution | The agreement can outline methods for resolving disputes among members, potentially avoiding costly litigation. |

| Compliance | Having an Operating Agreement helps ensure compliance with state laws and can protect members' personal assets. |

Sample - Ohio Operating Agreement Form

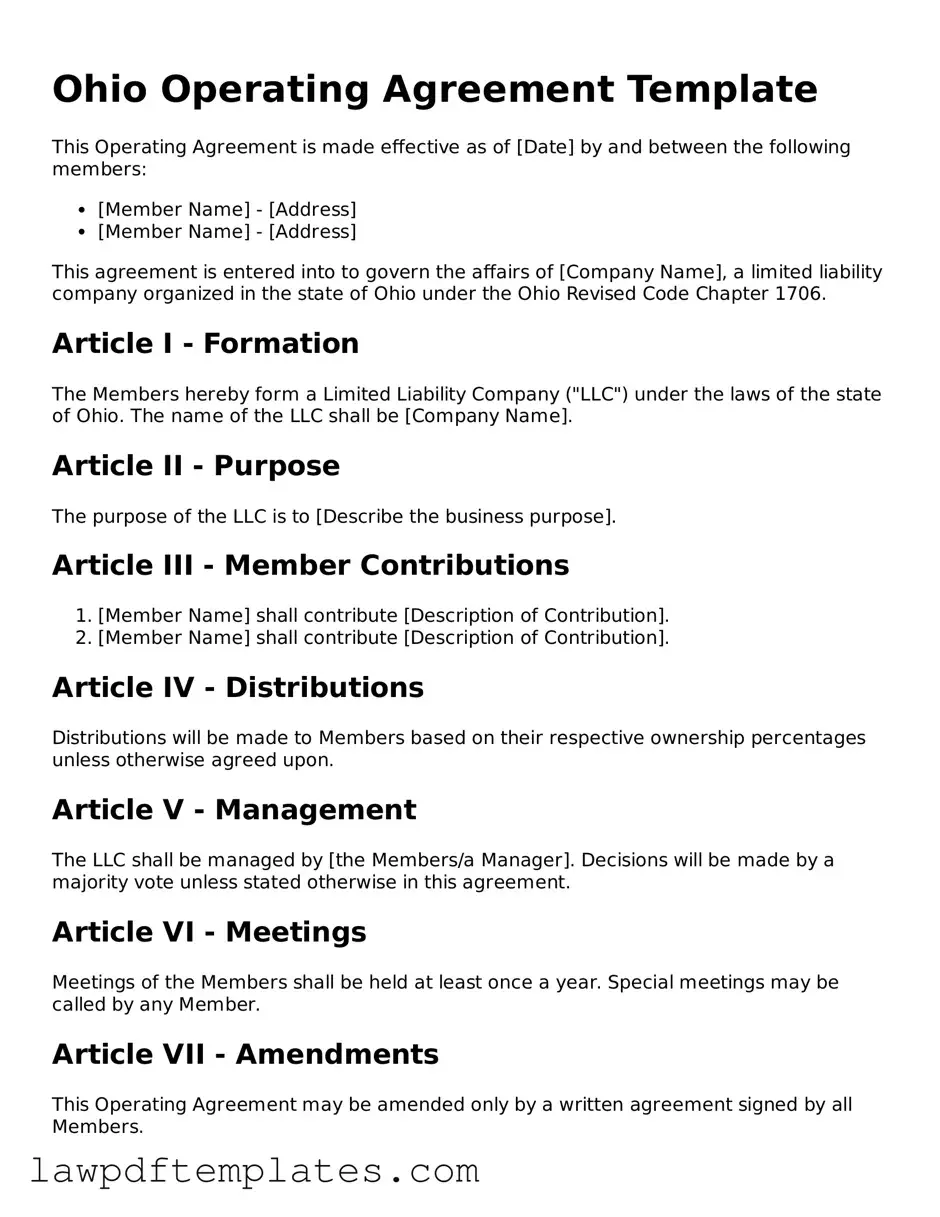

Ohio Operating Agreement Template

This Operating Agreement is made effective as of [Date] by and between the following members:

- [Member Name] - [Address]

- [Member Name] - [Address]

This agreement is entered into to govern the affairs of [Company Name], a limited liability company organized in the state of Ohio under the Ohio Revised Code Chapter 1706.

Article I - Formation

The Members hereby form a Limited Liability Company ("LLC") under the laws of the state of Ohio. The name of the LLC shall be [Company Name].

Article II - Purpose

The purpose of the LLC is to [Describe the business purpose].

Article III - Member Contributions

- [Member Name] shall contribute [Description of Contribution].

- [Member Name] shall contribute [Description of Contribution].

Article IV - Distributions

Distributions will be made to Members based on their respective ownership percentages unless otherwise agreed upon.

Article V - Management

The LLC shall be managed by [the Members/a Manager]. Decisions will be made by a majority vote unless stated otherwise in this agreement.

Article VI - Meetings

Meetings of the Members shall be held at least once a year. Special meetings may be called by any Member.

Article VII - Amendments

This Operating Agreement may be amended only by a written agreement signed by all Members.

Article VIII - Governing Law

This agreement shall be governed by and construed in accordance with the laws of the state of Ohio.

Signatures

By signing below, the Members agree to the terms outlined in this Operating Agreement.

- ______________________________ [Member Name] - Date: _______________

- ______________________________ [Member Name] - Date: _______________

Common mistakes

Filling out the Ohio Operating Agreement form is a crucial step for any business owner looking to establish a limited liability company (LLC). However, many individuals make common mistakes that can lead to complications down the road. Understanding these pitfalls can save time, money, and headaches.

One frequent mistake is failing to include all members. When drafting the agreement, it's essential to list every member involved in the LLC. Omitting a member can create legal issues later, especially when it comes to profit distribution or decision-making processes. Make sure every member is accounted for to avoid disputes.

Another common error is not specifying the management structure. Whether your LLC will be member-managed or manager-managed should be clearly stated. This distinction impacts how decisions are made and who has authority. Clarity in this area can prevent confusion and conflicts among members.

People often neglect to define the roles and responsibilities of each member. Clearly outlining what each member is responsible for helps set expectations and accountability. Without this clarity, misunderstandings can arise, leading to frustration and potential legal challenges.

Additionally, many individuals make the mistake of overlooking the importance of profit distribution. The agreement should specify how profits and losses will be shared among members. If this is not clearly defined, it can lead to disputes when it comes time to distribute earnings.

Some also forget to include provisions for member exit or addition. Life circumstances change, and members may leave or new ones may join. Having a clear process in place for these situations helps ensure a smooth transition and protects the interests of remaining members.

Another critical mistake is not updating the agreement regularly. As your business evolves, so should your Operating Agreement. Failing to make necessary updates can result in outdated provisions that no longer reflect the current state of the business.

Many people also underestimate the importance of legal review. While it may seem like a straightforward document, having a legal professional review your Operating Agreement can help identify potential issues before they become problems. This investment can save significant time and resources in the long run.

Finally, some individuals rush through the process without fully understanding the implications of their choices. Each decision made in the Operating Agreement can have lasting effects on the business and its members. Taking the time to understand each section is vital for a successful LLC.

By avoiding these mistakes, you can create a robust Operating Agreement that serves your business well. Take the time to carefully consider each aspect of the form, and don’t hesitate to seek professional guidance when needed.

Discover More Operating Agreement Templates for Specific States

How to Set Up an Operating Agreement for Llc - The agreement is a reference point for members in governing the LLC.

When engaging in a sale, having a proper legal document is vital, and that's where a Washington Bill of Sale comes into play. It not only records the transfer of ownership but also provides protection for both parties involved. For those looking to create this important document, resources such as PDF Documents Hub can be incredibly helpful in ensuring that all necessary details are included.

How to Create an Operating Agreement for an Llc - It serves as an internal document that is separate from public filings.

How to Write an Operating Agreement - This document serves as a roadmap for how the LLC will operate daily and address potential disputes.