Free Marital Separation Agreement Template for the State of Ohio

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Marital Separation Agreement outlines the terms of separation between spouses, addressing issues like property division and child custody. |

| Governing Law | This agreement is governed by Ohio Revised Code, particularly sections related to family law. |

| Voluntary Agreement | Both parties must voluntarily agree to the terms of the separation without coercion. |

| Written Document | The agreement must be in writing to be enforceable in court. |

| Child Support | Provisions for child support can be included, ensuring the best interests of the children are prioritized. |

| Property Division | Details about how marital property will be divided are a key component of the agreement. |

| Legal Advice | It is recommended that both parties seek legal advice before signing the agreement to ensure their rights are protected. |

Sample - Ohio Marital Separation Agreement Form

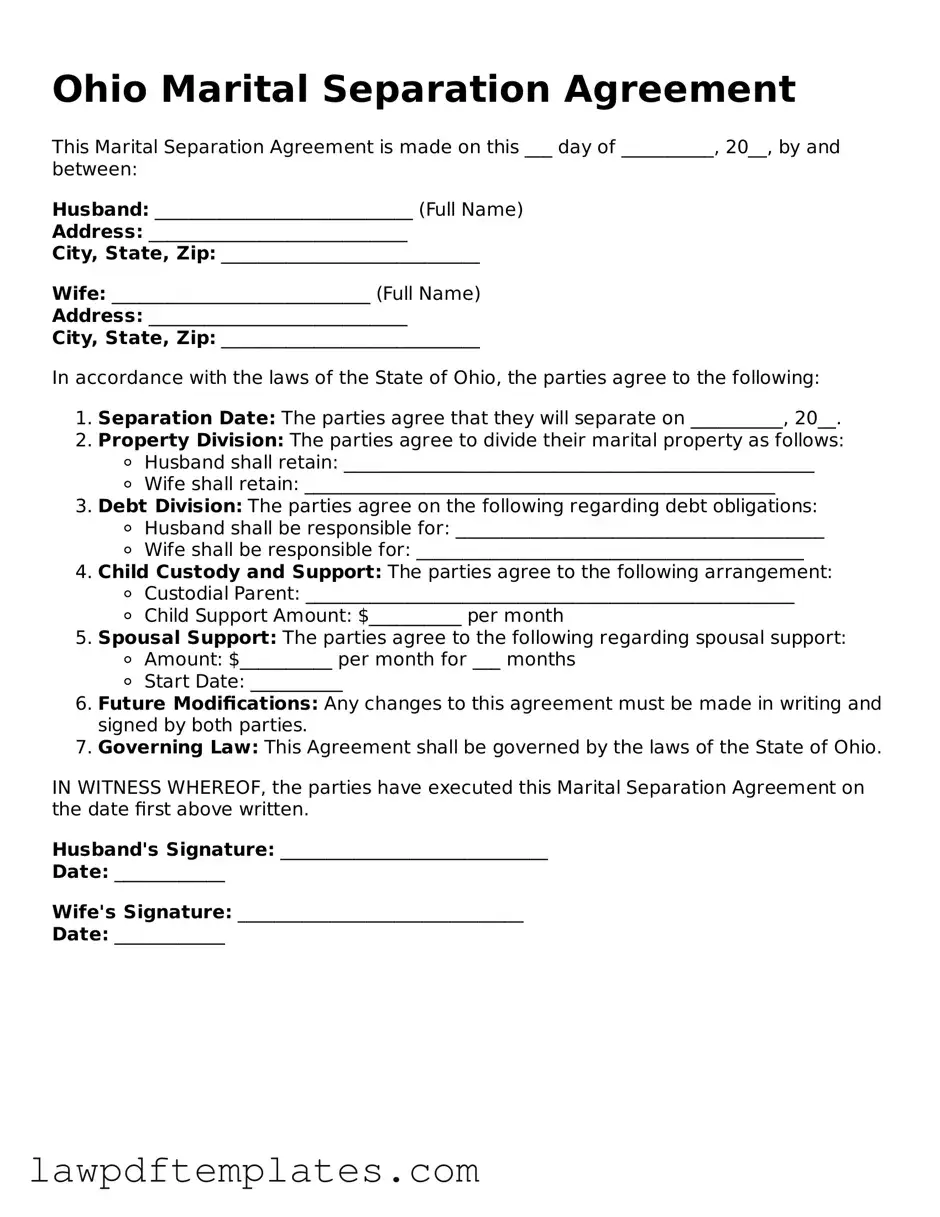

Ohio Marital Separation Agreement

This Marital Separation Agreement is made on this ___ day of __________, 20__, by and between:

Husband: ____________________________ (Full Name)

Address: ____________________________

City, State, Zip: ____________________________

Wife: ____________________________ (Full Name)

Address: ____________________________

City, State, Zip: ____________________________

In accordance with the laws of the State of Ohio, the parties agree to the following:

- Separation Date: The parties agree that they will separate on __________, 20__.

- Property Division: The parties agree to divide their marital property as follows:

- Husband shall retain: ___________________________________________________

- Wife shall retain: ___________________________________________________

- Debt Division: The parties agree on the following regarding debt obligations:

- Husband shall be responsible for: ________________________________________

- Wife shall be responsible for: __________________________________________

- Child Custody and Support: The parties agree to the following arrangement:

- Custodial Parent: _____________________________________________________

- Child Support Amount: $__________ per month

- Spousal Support: The parties agree to the following regarding spousal support:

- Amount: $__________ per month for ___ months

- Start Date: __________

- Future Modifications: Any changes to this agreement must be made in writing and signed by both parties.

- Governing Law: This Agreement shall be governed by the laws of the State of Ohio.

IN WITNESS WHEREOF, the parties have executed this Marital Separation Agreement on the date first above written.

Husband's Signature: _____________________________

Date: ____________

Wife's Signature: _______________________________

Date: ____________

Common mistakes

When filling out the Ohio Marital Separation Agreement form, individuals often make several common mistakes that can lead to complications down the road. One frequent error is failing to include all necessary information. It’s essential to provide complete details about both parties, including full names, addresses, and any other identifying information. Omitting these details can result in delays or even rejection of the agreement.

Another mistake is not clearly outlining the terms of the separation. This includes everything from asset division to child custody arrangements. Vague language can create confusion and lead to disputes later. Being specific about what each party is entitled to helps prevent misunderstandings and ensures that both individuals are on the same page.

People often overlook the importance of considering future changes. Life is unpredictable, and circumstances can shift after the agreement is signed. Failing to include provisions for potential changes in income, living arrangements, or child care can lead to issues that might require legal intervention later. It’s wise to think ahead and account for possible adjustments.

Many individuals also neglect to seek legal advice before finalizing the agreement. While it may seem straightforward, the nuances of family law can be complex. Consulting with a lawyer can provide valuable insights and help ensure that the agreement is fair and legally binding. Skipping this step can result in significant consequences that could have been avoided.

Another common mistake is not having the agreement notarized. A notarized document carries more weight in legal settings. It serves as proof that both parties willingly entered into the agreement and understood its terms. Without notarization, the agreement may face challenges in court.

Some people mistakenly believe that once the agreement is signed, it cannot be modified. In reality, changes can be made if both parties agree. However, failing to include a clause about modification can lead to confusion later. It’s important to discuss how future changes will be handled and to document that understanding within the agreement.

Additionally, individuals sometimes forget to address debts. While focusing on assets is crucial, ignoring debts can lead to significant financial complications. Clearly stating how debts will be divided can prevent one party from being unfairly burdened after the separation.

Another oversight involves not considering tax implications. Certain decisions made in the separation agreement can affect tax liabilities. Understanding these implications can save both parties from unexpected financial burdens come tax season. It’s wise to consult with a tax professional to navigate this area effectively.

Finally, many individuals fail to communicate openly with each other throughout the process. Good communication can lead to a more amicable separation and a smoother agreement process. By discussing concerns and expectations openly, both parties can work together to create a fair and comprehensive agreement.

Discover More Marital Separation Agreement Templates for Specific States

Legal Separation in Illinois - Provides a foundation for potential future divorce proceedings.

Understanding the significance of a well-prepared contract is crucial, and you can conveniently access the Texas Real Estate Purchase Agreement form through PDF Documents Hub, ensuring that your property transaction is handled with utmost clarity and professionalism.

Legal Separation in Florida - Considers changes in lifestyle and financial status during the separation period.