Free Last Will and Testament Template for the State of Ohio

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed after their death. |

| Governing Law | The Ohio Revised Code, specifically Section 2107.01, governs the creation and execution of wills in Ohio. |

| Age Requirement | To create a valid will in Ohio, the individual must be at least 18 years old. |

| Signature Requirement | The testator must sign the will, or someone else can sign it in their presence and at their direction. |

| Witnesses | Ohio law requires at least two witnesses to sign the will, affirming they witnessed the testator's signature. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the existing will. |

| Self-Proving Wills | Ohio allows for self-proving wills, which streamline the probate process by including a notarized affidavit from the witnesses. |

| Holographic Wills | Ohio recognizes holographic wills, which are handwritten and signed by the testator, but they must meet specific criteria to be valid. |

Sample - Ohio Last Will and Testament Form

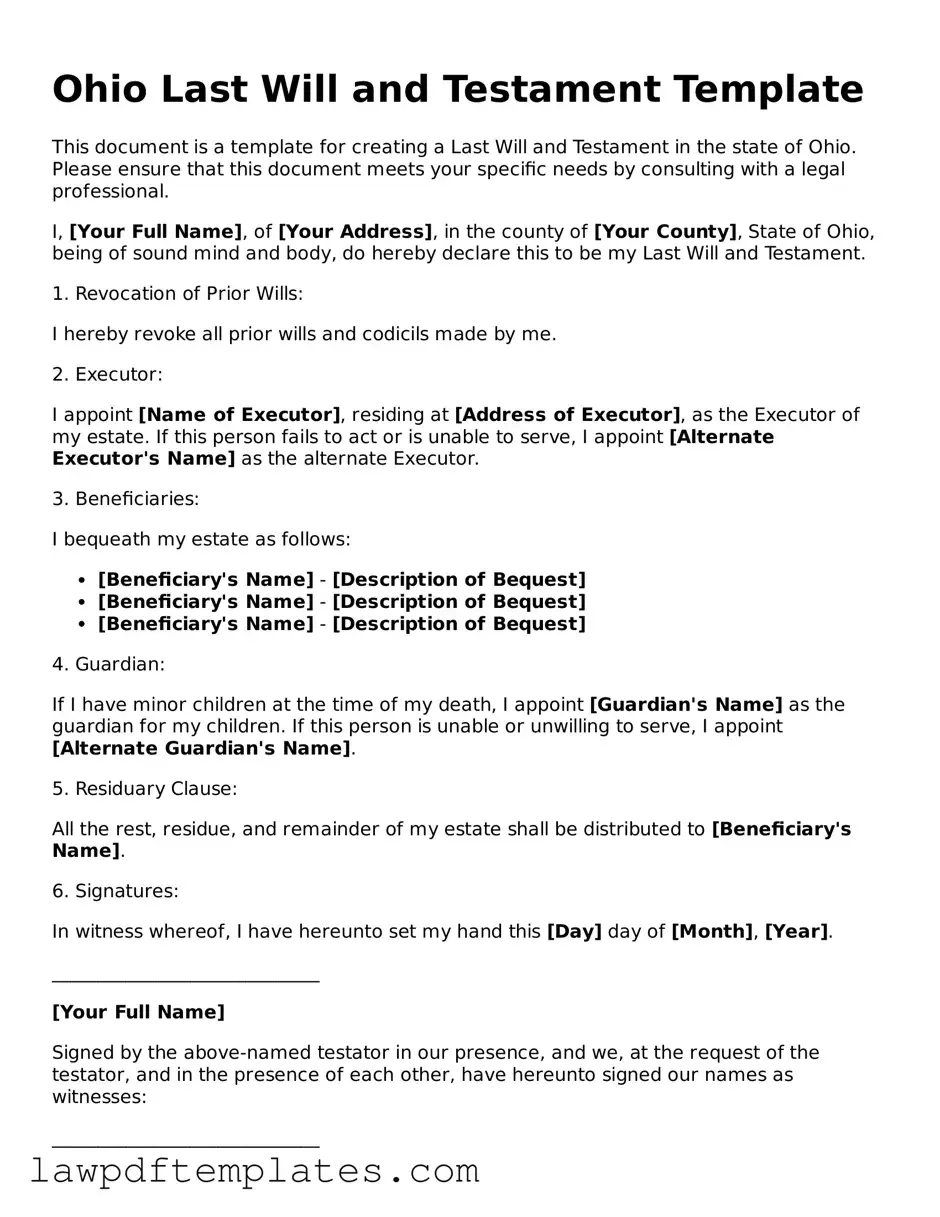

Ohio Last Will and Testament Template

This document is a template for creating a Last Will and Testament in the state of Ohio. Please ensure that this document meets your specific needs by consulting with a legal professional.

I, [Your Full Name], of [Your Address], in the county of [Your County], State of Ohio, being of sound mind and body, do hereby declare this to be my Last Will and Testament.

1. Revocation of Prior Wills:

I hereby revoke all prior wills and codicils made by me.

2. Executor:

I appoint [Name of Executor], residing at [Address of Executor], as the Executor of my estate. If this person fails to act or is unable to serve, I appoint [Alternate Executor's Name] as the alternate Executor.

3. Beneficiaries:

I bequeath my estate as follows:

- [Beneficiary's Name] - [Description of Bequest]

- [Beneficiary's Name] - [Description of Bequest]

- [Beneficiary's Name] - [Description of Bequest]

4. Guardian:

If I have minor children at the time of my death, I appoint [Guardian's Name] as the guardian for my children. If this person is unable or unwilling to serve, I appoint [Alternate Guardian's Name].

5. Residuary Clause:

All the rest, residue, and remainder of my estate shall be distributed to [Beneficiary's Name].

6. Signatures:

In witness whereof, I have hereunto set my hand this [Day] day of [Month], [Year].

_____________________________

[Your Full Name]

Signed by the above-named testator in our presence, and we, at the request of the testator, and in the presence of each other, have hereunto signed our names as witnesses:

_____________________________

[Witness 1's Full Name]

_____________________________

[Witness 2's Full Name]

Common mistakes

Creating a Last Will and Testament is an important step in ensuring that your wishes are honored after you pass away. However, many people make mistakes when filling out the Ohio Last Will and Testament form that can lead to complications later. Understanding these common pitfalls can help you avoid them and ensure your will is valid.

One frequent mistake is failing to properly identify beneficiaries. It’s crucial to clearly state who will inherit your assets. Vague descriptions, such as “my children,” can lead to confusion, especially if there are multiple children. Instead, use full names and consider including their relationship to you to eliminate any ambiguity.

Another common error involves not signing the will correctly. In Ohio, a will must be signed by the testator, which is the person creating the will. Additionally, it should be witnessed by at least two individuals who are not beneficiaries. Omitting a signature or witnesses can render the will invalid.

People often overlook the importance of updating their wills. Life changes, such as marriage, divorce, or the birth of a child, can affect your wishes. Failing to update your will after significant life events can lead to unintended distributions of your assets.

Some individuals neglect to include a residuary clause. This clause addresses any assets not specifically mentioned in the will. Without it, any remaining assets may be distributed according to Ohio's intestacy laws, which may not align with your wishes.

Another mistake is not considering tax implications. While a will itself doesn’t incur taxes, the distribution of assets can have tax consequences for your beneficiaries. It’s wise to consult with a financial advisor or tax professional to understand how your will may affect your loved ones financially.

People sometimes forget to keep their wills in a safe but accessible place. Storing your will in a safe deposit box may seem secure, but it can create challenges for your loved ones when they need to access it. Instead, consider keeping it in a location known to your executor or family members.

Finally, failing to communicate your wishes to your loved ones can lead to confusion and conflict. Discussing your will with family members can help set expectations and reduce the likelihood of disputes after your passing. Open communication fosters understanding and can help ensure your wishes are respected.

Discover More Last Will and Testament Templates for Specific States

Living Will Form New Jersey - A chance to express personal values or beliefs for future generations.

Will Template Arizona - Can clarify the handling of unique assets like art collections or antique items.

For individuals looking to navigate the legalities of trailer sales, the process can be simplified by utilizing the convenient trailer bill of sale form. This document is critical in ensuring all necessary information is accurately recorded during the transaction.

Can You Write Your Own Will in Nc - Acts as a safeguard for the individual's final wishes against fraud or coercion.