Free Employee Handbook Template for the State of Ohio

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Employee Handbook serves as a guide for employees regarding company policies and procedures. |

| Legal Requirement | While not legally required, having an employee handbook is strongly recommended for compliance and clarity. |

| State Laws | Ohio law does not mandate specific content for employee handbooks, but it must comply with federal laws. |

| At-Will Employment | The handbook should clarify the at-will employment status of employees, indicating that either party can terminate employment at any time. |

| Non-Discrimination Policy | It is essential to include a non-discrimination policy that complies with both state and federal anti-discrimination laws. |

| Employee Rights | The handbook should outline employee rights under Ohio law, including rights related to wage and hour laws. |

| Health and Safety | Employers are encouraged to include health and safety policies to promote a safe workplace environment. |

| Updates and Revisions | Regular updates to the handbook are necessary to reflect changes in laws or company policies. |

| Acknowledgment | Employees should sign an acknowledgment form confirming they have received and understood the handbook. |

| Confidentiality | Include a confidentiality policy to protect sensitive company information and employee privacy. |

Sample - Ohio Employee Handbook Form

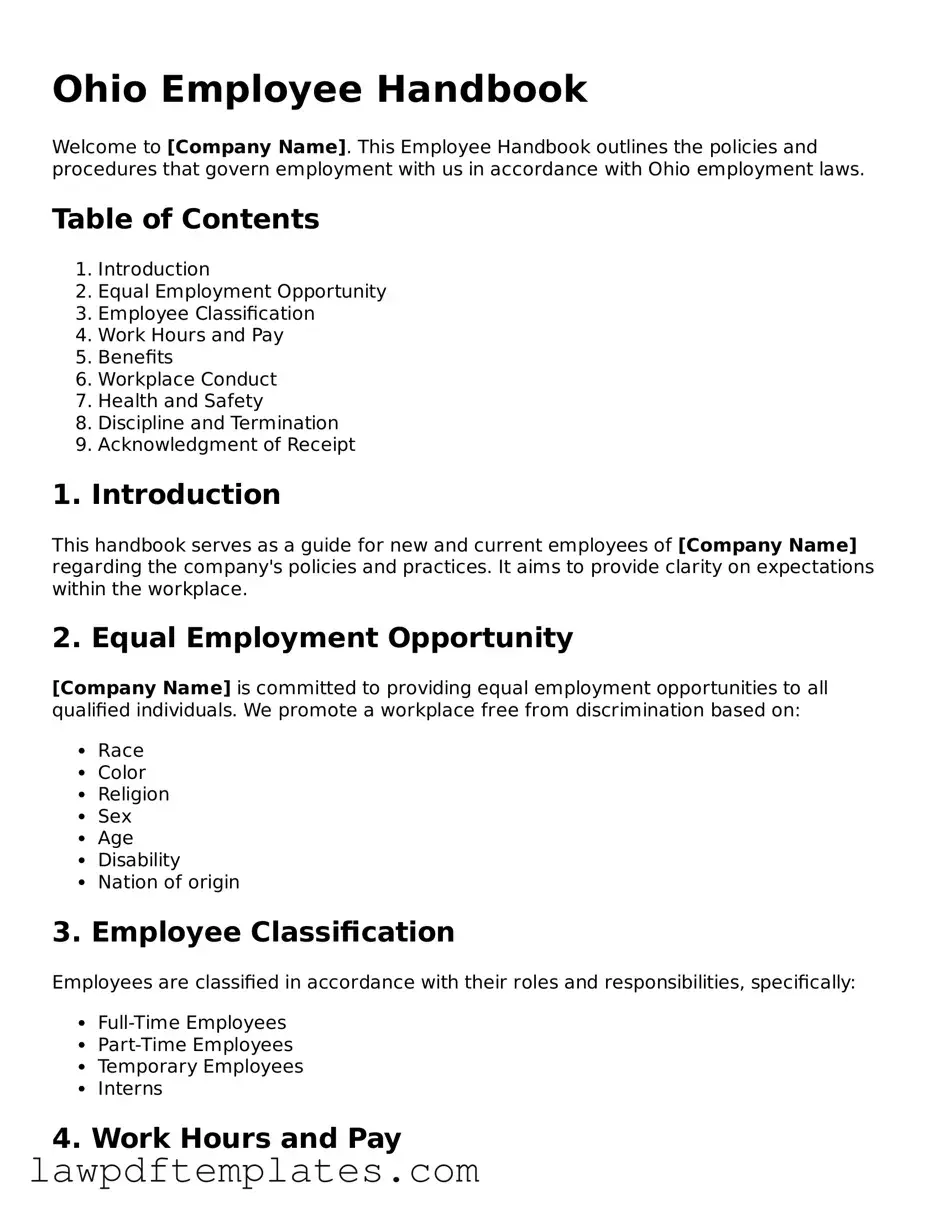

Ohio Employee Handbook

Welcome to [Company Name]. This Employee Handbook outlines the policies and procedures that govern employment with us in accordance with Ohio employment laws.

Table of Contents

- Introduction

- Equal Employment Opportunity

- Employee Classification

- Work Hours and Pay

- Benefits

- Workplace Conduct

- Health and Safety

- Discipline and Termination

- Acknowledgment of Receipt

1. Introduction

This handbook serves as a guide for new and current employees of [Company Name] regarding the company's policies and practices. It aims to provide clarity on expectations within the workplace.

2. Equal Employment Opportunity

[Company Name] is committed to providing equal employment opportunities to all qualified individuals. We promote a workplace free from discrimination based on:

- Race

- Color

- Religion

- Sex

- Age

- Disability

- Nation of origin

3. Employee Classification

Employees are classified in accordance with their roles and responsibilities, specifically:

- Full-Time Employees

- Part-Time Employees

- Temporary Employees

- Interns

4. Work Hours and Pay

Standard work hours are from [Start Time] to [End Time], [Days of the Week]. Pay periods occur on a [Biweekly/Monthly] basis. Employees are encouraged to review their pay stubs for accuracy.

5. Benefits

Eligibility for benefits begins after [Waiting Period]. Available benefits may include:

- Health Insurance

- Retirement Plans

- Paid Time Off

- Flexible Work Arrangements

6. Workplace Conduct

All employees are expected to conduct themselves in a professional manner. Key points include:

- Respectful communication

- Adherence to dress code

- Compliance with safety regulations

7. Health and Safety

[Company Name] prioritizes the health and safety of all employees. In case of an emergency, employees should follow the established evacuation procedures. Regular safety training sessions will be held.

8. Discipline and Termination

Disciplinary actions may be taken for violations of company policy. Possible actions include:

- Verbal Warning

- Written Warning

- Suspension

- Termination of Employment

9. Acknowledgment of Receipt

Employees should sign the acknowledgment form to confirm receipt and understanding of this handbook.

For additional questions or clarifications, employees may contact [HR Contact Information].

Common mistakes

Filling out the Ohio Employee Handbook form can be a straightforward process, but many people make common mistakes that can lead to confusion or issues later on. One frequent error is not reading the instructions carefully. Each section of the form has specific requirements, and overlooking these can result in incomplete or incorrect submissions. Taking the time to understand what is required can save a lot of trouble down the line.

Another common mistake is providing inaccurate personal information. This can include misspellings of names, incorrect addresses, or wrong Social Security numbers. Such errors may seem minor, but they can create significant problems, especially when it comes to payroll and benefits. Double-checking all entries before submitting the form is essential to avoid these pitfalls.

Many individuals also forget to sign and date the form. A signature is often a legal requirement that confirms the accuracy of the information provided. Without it, the form may be considered invalid. It's a simple step, but one that can easily be overlooked, especially in a rush.

Finally, failing to keep a copy of the completed form is a mistake that can lead to complications later. Having a personal record ensures that you can refer back to your submission if questions arise. It’s always a good idea to keep a copy for your files, just in case you need to verify the information in the future.

Discover More Employee Handbook Templates for Specific States

Oshr - This document details the company’s commitment to environmental practices.

Creating an Employee Handbook - The document addresses guidelines for employee terminations and resignations.

Obtaining a comprehensive Power of Attorney for a Child form ensures that you are prepared for any situation where your child may need care from another adult in your absence. This legal document is vital for establishing clear authority and can help facilitate smooth decision-making processes on behalf of your child.

Are Employers Required to Provide Employee Handbook - This section provides details on retirement plans and contributions.

Florida Employee Handbook Template - Find an overview of the company’s mission, vision, and values.