Free Deed in Lieu of Foreclosure Template for the State of Ohio

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal agreement where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | Ohio Revised Code Section 5301.01 governs the transfer of property through a Deed in Lieu of Foreclosure in Ohio. |

| Benefits | This process can help borrowers avoid the lengthy and costly foreclosure process, allowing for a quicker resolution. |

| Eligibility | Typically, borrowers must be in default on their mortgage and unable to make payments to qualify for a Deed in Lieu of Foreclosure. |

| Impact on Credit | A Deed in Lieu of Foreclosure will negatively affect the borrower's credit score, but it may be less damaging than a full foreclosure. |

Sample - Ohio Deed in Lieu of Foreclosure Form

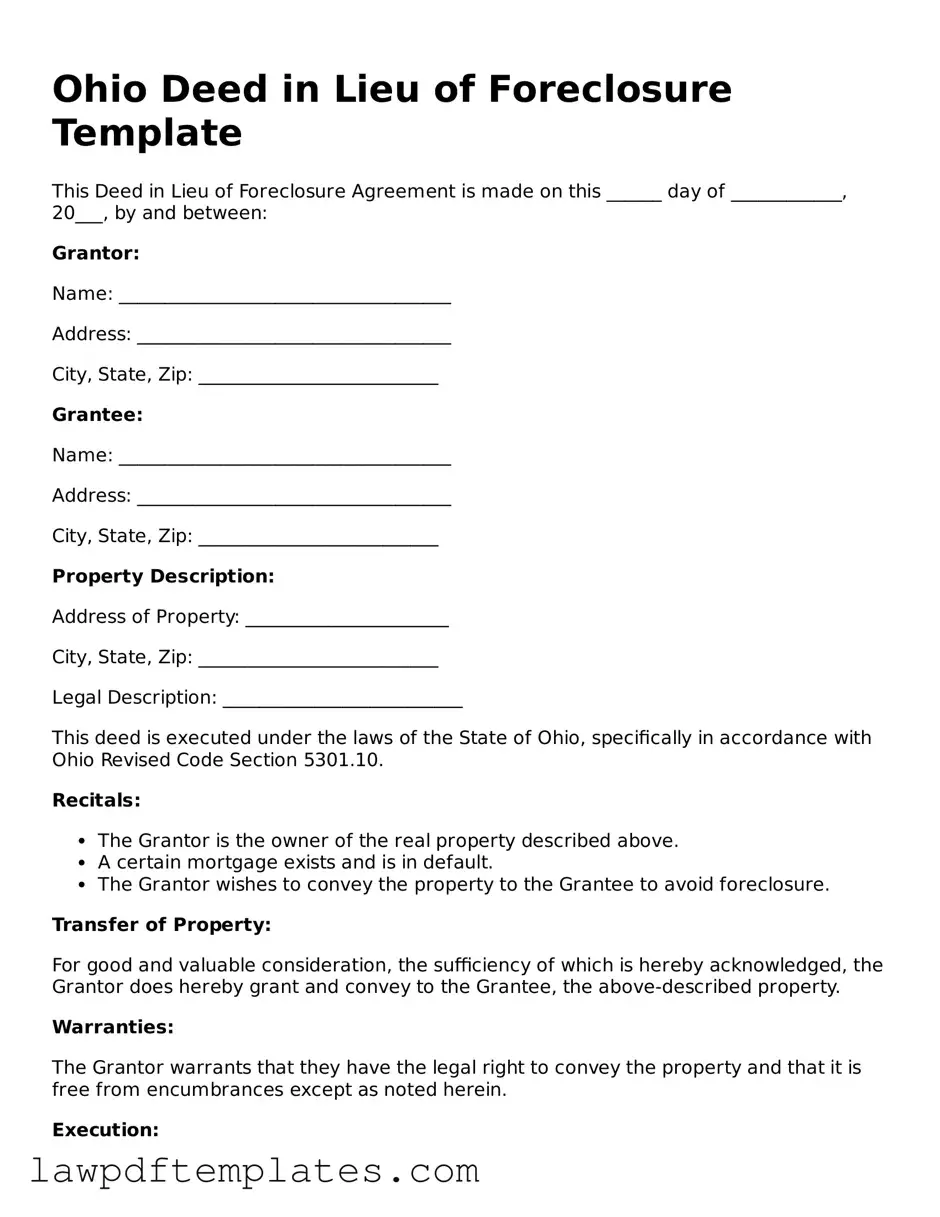

Ohio Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure Agreement is made on this ______ day of ____________, 20___, by and between:

Grantor:

Name: ____________________________________

Address: __________________________________

City, State, Zip: __________________________

Grantee:

Name: ____________________________________

Address: __________________________________

City, State, Zip: __________________________

Property Description:

Address of Property: ______________________

City, State, Zip: __________________________

Legal Description: __________________________

This deed is executed under the laws of the State of Ohio, specifically in accordance with Ohio Revised Code Section 5301.10.

Recitals:

- The Grantor is the owner of the real property described above.

- A certain mortgage exists and is in default.

- The Grantor wishes to convey the property to the Grantee to avoid foreclosure.

Transfer of Property:

For good and valuable consideration, the sufficiency of which is hereby acknowledged, the Grantor does hereby grant and convey to the Grantee, the above-described property.

Warranties:

The Grantor warrants that they have the legal right to convey the property and that it is free from encumbrances except as noted herein.

Execution:

IN WITNESS WHEREOF, the parties have executed this Deed in Lieu of Foreclosure as of the date first above written.

_____________________________

Grantor Signature: ____________________________________

Print Name: __________________________________________

_____________________________

Grantee Signature: ____________________________________

Print Name: __________________________________________

STATE OF OHIO

COUNTY OF ____________________

Subscribed and sworn before me this ______ day of _______________, 20__.

______________________________________

Notary Public

My commission expires: ____________________

______________________________________

Notary Seal

Common mistakes

Filling out the Ohio Deed in Lieu of Foreclosure form can be a complex process. Many homeowners make critical mistakes that can delay or even derail the process. Understanding these common pitfalls is essential for a smooth transition.

One frequent mistake is failing to provide accurate property information. The deed must include the correct legal description of the property. Omitting or miswriting this information can lead to significant complications. Always double-check the property address and legal description against official records.

Another common error is neglecting to sign the document properly. All parties involved in the deed must sign the form. If even one signature is missing, the deed may be considered invalid. Ensure that all necessary signatures are obtained before submission.

People often overlook the importance of including all lienholders. If there are multiple liens on the property, all lienholders must be notified and included in the deed process. Failing to do this can result in future claims against the property, complicating the transfer.

Additionally, some individuals do not understand the implications of the deed in lieu. They may mistakenly believe that it absolves them of all financial obligations. It’s crucial to recognize that while this process can relieve some burdens, it may still have repercussions on credit scores and potential tax liabilities.

Another mistake is not consulting with legal or financial advisors. The implications of a deed in lieu can be complex. Seeking professional guidance can help navigate these waters and avoid costly errors.

People also often forget to attach necessary documentation. The deed in lieu form may require additional paperwork, such as a statement of the mortgage balance or proof of hardship. Missing these documents can cause delays in processing.

Some homeowners submit the deed without understanding their lender’s requirements. Each lender may have specific criteria for accepting a deed in lieu. It is essential to communicate with the lender to ensure compliance with their guidelines.

Another oversight is not keeping copies of the submitted documents. Once the deed is filed, it’s important to retain copies for personal records. This can be useful in future disputes or for reference.

Lastly, individuals sometimes rush the process. Filling out the deed in lieu form requires careful consideration and attention to detail. Taking the time to thoroughly review the document can prevent mistakes that could have lasting consequences.

Discover More Deed in Lieu of Foreclosure Templates for Specific States

Deed in Lieu Vs Foreclosure - The lender may agree not to pursue a deficiency judgment if the property sells for less than the mortgage balance.

Georgia Foreclosure Laws - It helps to eliminate uncertainties around property ownership, giving both parties clarity about the future.

For individuals looking to streamline their decision-making process, the importance of having a solid financial Power of Attorney arrangement cannot be overstated. This form empowers your chosen agent to act in your best interests during crucial times. Understanding its implications can significantly impact the management of your affairs.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - A successful Deed in Lieu can assist in mitigating the emotional toll of losing a home to foreclosure.