Free Deed Template for the State of Ohio

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include warranty deeds, quitclaim deeds, and special warranty deeds. |

| Governing Laws | The Ohio Revised Code, specifically Title 53, governs the use and requirements of deed forms in Ohio. |

| Signature Requirement | The grantor must sign the deed for it to be valid. Notarization is also typically required. |

| Recording | To protect the interests of the new owner, the deed should be recorded with the county recorder's office. |

| Consideration | The deed must state the consideration, or the price paid for the property, although it can be nominal. |

| Legal Description | A complete legal description of the property must be included in the deed to identify it accurately. |

| Transfer Tax | Ohio may impose a transfer tax on the conveyance of real property, which must be paid at the time of recording. |

Sample - Ohio Deed Form

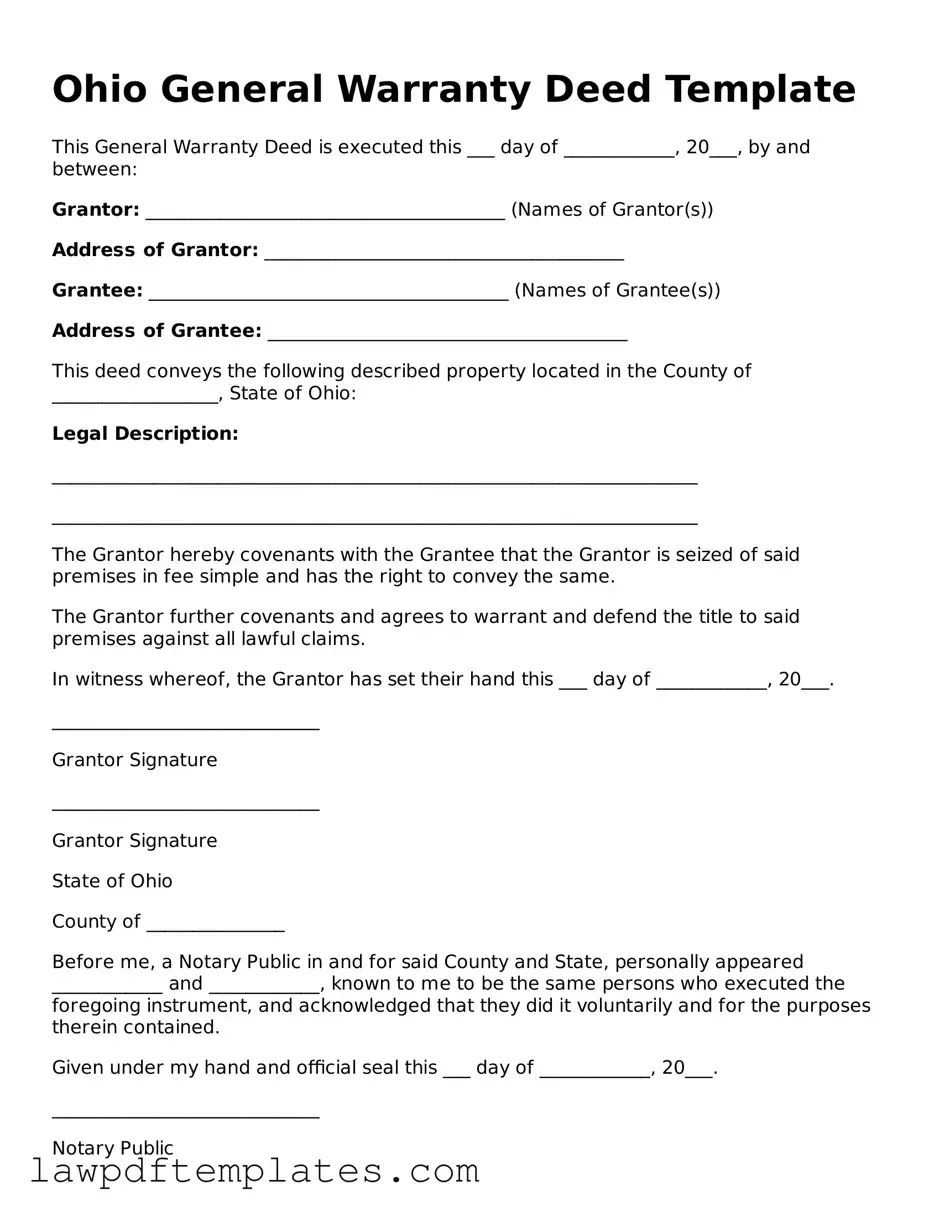

Ohio General Warranty Deed Template

This General Warranty Deed is executed this ___ day of ____________, 20___, by and between:

Grantor: _______________________________________ (Names of Grantor(s))

Address of Grantor: _______________________________________

Grantee: _______________________________________ (Names of Grantee(s))

Address of Grantee: _______________________________________

This deed conveys the following described property located in the County of __________________, State of Ohio:

Legal Description:

______________________________________________________________________

______________________________________________________________________

The Grantor hereby covenants with the Grantee that the Grantor is seized of said premises in fee simple and has the right to convey the same.

The Grantor further covenants and agrees to warrant and defend the title to said premises against all lawful claims.

In witness whereof, the Grantor has set their hand this ___ day of ____________, 20___.

_____________________________

Grantor Signature

_____________________________

Grantor Signature

State of Ohio

County of _______________

Before me, a Notary Public in and for said County and State, personally appeared ____________ and ____________, known to me to be the same persons who executed the foregoing instrument, and acknowledged that they did it voluntarily and for the purposes therein contained.

Given under my hand and official seal this ___ day of ____________, 20___.

_____________________________

Notary Public

My commission expires: ________________

Common mistakes

When filling out the Ohio Deed form, individuals often make several common mistakes that can lead to complications in property transfer. One frequent error is failing to include all necessary parties in the deed. If a spouse or co-owner is omitted, it can create legal issues down the line, especially if disputes arise regarding ownership.

Another mistake is not providing a complete and accurate legal description of the property. The description must be precise, including details like parcel numbers and boundaries. Vague or incomplete descriptions can result in confusion and may even invalidate the deed.

Many people neglect to check the requirements for notarization. In Ohio, a deed must be signed in the presence of a notary public. Failing to have the deed properly notarized can lead to rejection by the county recorder's office.

Additionally, individuals sometimes overlook the importance of including the correct date of transfer. This date is essential for establishing the timeline of ownership and can affect tax liabilities and other legal considerations.

Another common oversight involves the choice of deed type. Different types of deeds, such as warranty deeds or quitclaim deeds, serve different purposes. Choosing the wrong type can lead to misunderstandings about the level of protection being offered to the buyer.

People often forget to include the consideration, or the amount paid for the property, in the deed. This information is crucial for tax purposes and for establishing the legitimacy of the transaction.

Moreover, individuals may not realize that the deed must be filed with the county recorder after it is completed. Failing to file the deed can result in a lack of public record, which can complicate future transactions or claims on the property.

Another mistake involves using outdated forms. Laws and requirements can change, so it is vital to ensure that the most current version of the deed form is being used. Using an outdated form can lead to compliance issues.

People sometimes overlook the importance of reviewing the deed for errors before submission. Simple typos or incorrect information can lead to delays or the need for costly corrections later on.

Lastly, individuals may not seek legal advice when necessary. While it is possible to fill out a deed without assistance, consulting with a legal expert can help ensure that all requirements are met and that the deed is executed correctly, providing peace of mind for all parties involved.

Discover More Deed Templates for Specific States

Property Transfer Form - Essential in the case of multi-party property transactions.

What Does a House Deed Look Like in Nj - It's important to have clear language in a deed to avoid future disputes.

For those looking to navigate the Texas real estate market, utilizing the Texas Real Estate Sales Contract form is essential. This document not only serves to clarify important details of the transaction but also helps ensure that both buyers and sellers are on the same page throughout the process. To conveniently access and fill out the form, visit texasformspdf.com/fillable-texas-real-estate-sales-contract-online.

Broward County Recorder of Deeds - Properly executed deeds protect the interests of both buyer and seller.