Free Transfer-on-Death Deed Template for the State of North Carolina

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in North Carolina to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The North Carolina Transfer-on-Death Deed is governed by N.C. Gen. Stat. § 32A-1.1. |

| Eligibility | Any individual who owns real property in North Carolina can create a Transfer-on-Death Deed. |

| Revocation | The deed can be revoked at any time before the owner's death by recording a new deed or a revocation document. |

| Beneficiary Designation | Multiple beneficiaries can be named, and the property can be divided among them in specified proportions. |

| Recording Requirement | The deed must be recorded with the county register of deeds to be effective. |

| Impact on Taxes | Transfer-on-Death Deeds do not affect property taxes during the owner's lifetime, but beneficiaries may face tax implications upon transfer. |

Sample - North Carolina Transfer-on-Death Deed Form

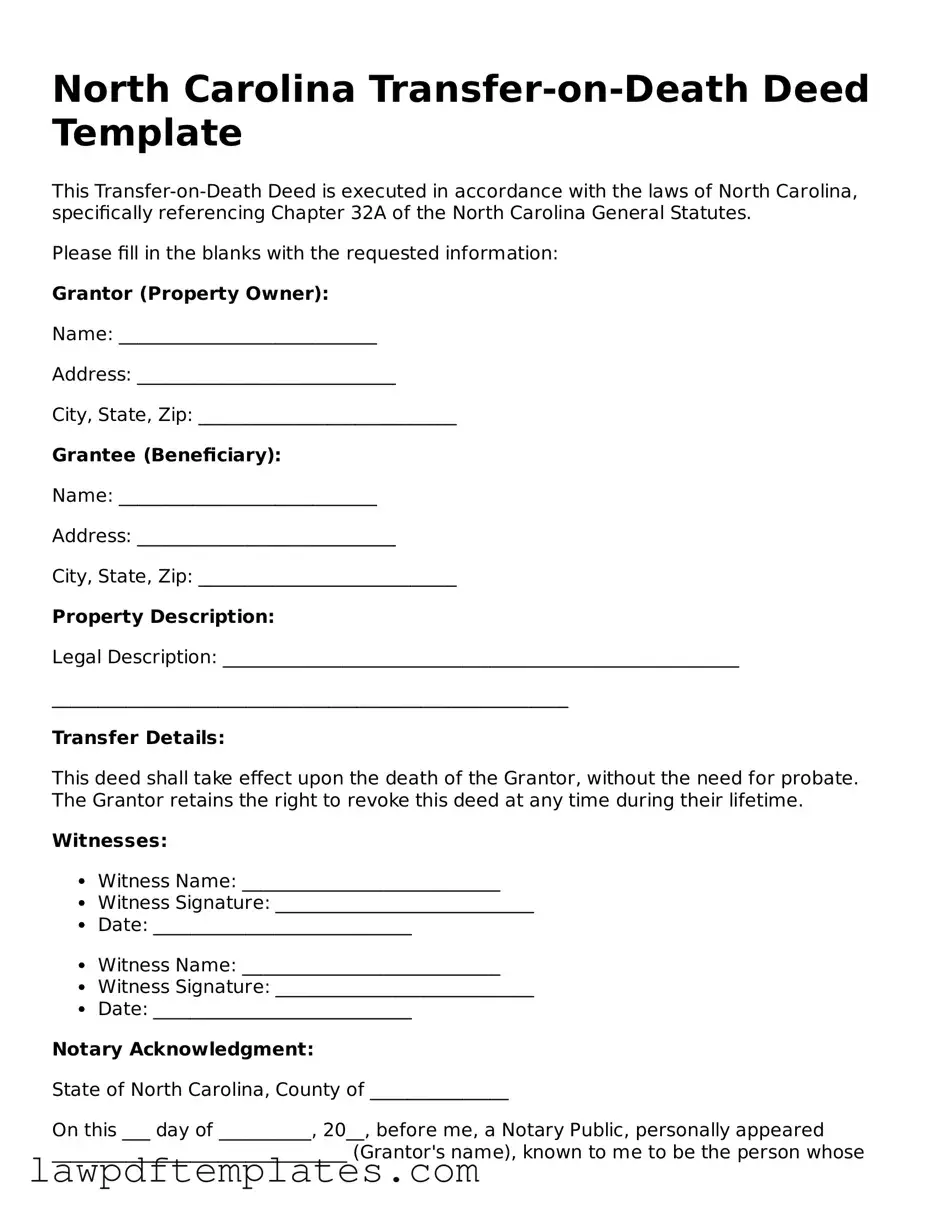

North Carolina Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the laws of North Carolina, specifically referencing Chapter 32A of the North Carolina General Statutes.

Please fill in the blanks with the requested information:

Grantor (Property Owner):

Name: ____________________________

Address: ____________________________

City, State, Zip: ____________________________

Grantee (Beneficiary):

Name: ____________________________

Address: ____________________________

City, State, Zip: ____________________________

Property Description:

Legal Description: ________________________________________________________

________________________________________________________

Transfer Details:

This deed shall take effect upon the death of the Grantor, without the need for probate. The Grantor retains the right to revoke this deed at any time during their lifetime.

Witnesses:

- Witness Name: ____________________________

- Witness Signature: ____________________________

- Date: ____________________________

- Witness Name: ____________________________

- Witness Signature: ____________________________

- Date: ____________________________

Notary Acknowledgment:

State of North Carolina, County of _______________

On this ___ day of __________, 20__, before me, a Notary Public, personally appeared ________________________________ (Grantor's name), known to me to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

Witness my hand and official seal.

____________________________________

Notary Public Signature

My Commission Expires: ____________

Common mistakes

Filling out the North Carolina Transfer-on-Death Deed form can be a straightforward process, but several common mistakes can lead to complications. One frequent error is failing to provide accurate property descriptions. The form requires a detailed description of the property being transferred. Omitting specific details or using vague language can create confusion and may result in legal disputes later.

Another mistake involves incorrect naming of beneficiaries. It is crucial to ensure that the names of all beneficiaries are spelled correctly and that their legal relationships to the grantor are clearly defined. Errors in spelling or incorrect identification can lead to challenges in the transfer process, potentially delaying the intended transfer.

People often neglect to sign the deed in the presence of a notary public. North Carolina law requires that the Transfer-on-Death Deed be notarized to be valid. Failing to do so can render the deed ineffective, and the property may not transfer as intended upon the grantor's death.

Additionally, individuals may forget to record the deed with the appropriate county register of deeds. Recording the deed is essential for it to take effect. If the deed is not recorded, it may not be recognized, and the transfer may not occur, defeating the purpose of completing the form.

Another common oversight is not updating the deed after significant life events. Changes such as marriage, divorce, or the birth of a child can impact the beneficiaries listed. Keeping the deed updated ensures that the grantor's wishes are accurately reflected and reduces the risk of disputes among heirs.

Lastly, some individuals fail to understand the implications of the Transfer-on-Death Deed. It is vital to recognize that this form does not provide immediate ownership rights to the beneficiaries. The grantor retains full control of the property during their lifetime. Misunderstanding this concept can lead to confusion about the rights of beneficiaries before the grantor's passing.

Discover More Transfer-on-Death Deed Templates for Specific States

Problems With Transfer on Death Deeds - It is a useful tool in estate planning for property owners.

In addition to the essential details, utilizing templates can greatly simplify the process of drafting a Florida Motor Vehicle Bill of Sale. For those looking for assistance, Fast PDF Templates offers a convenient solution to ensure all necessary information is accurately captured, facilitating a smooth transaction for both sellers and buyers.

Transfer on Death Deed Georgia - Recording a new Transfer-on-Death Deed can supersede any previous deeds that may have been executed.

California Transfer on Death Deed - This option can keep your property out of the court system after death.