Free Promissory Note Template for the State of North Carolina

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a defined time. |

| Governing Law | The North Carolina Promissory Note is governed by Chapter 25 of the North Carolina General Statutes, which covers the Uniform Commercial Code. |

| Form Requirements | The note must include essential elements such as the principal amount, interest rate, payment schedule, and signatures of the parties involved. |

| Interest Rate | North Carolina law allows for a maximum interest rate of 8% per annum unless otherwise agreed upon by the parties. |

| Default Clause | Most promissory notes include a default clause, outlining the consequences if the borrower fails to make payments as agreed. |

| Transferability | Promissory notes in North Carolina are generally transferable, allowing the lender to assign the note to another party. |

| Enforceability | A properly executed promissory note is legally enforceable in court, provided it meets all legal requirements. |

| Notarization | While notarization is not always required, having the note notarized can provide additional legal protection and credibility. |

| Statute of Limitations | In North Carolina, the statute of limitations for enforcing a promissory note is typically three years from the date of default. |

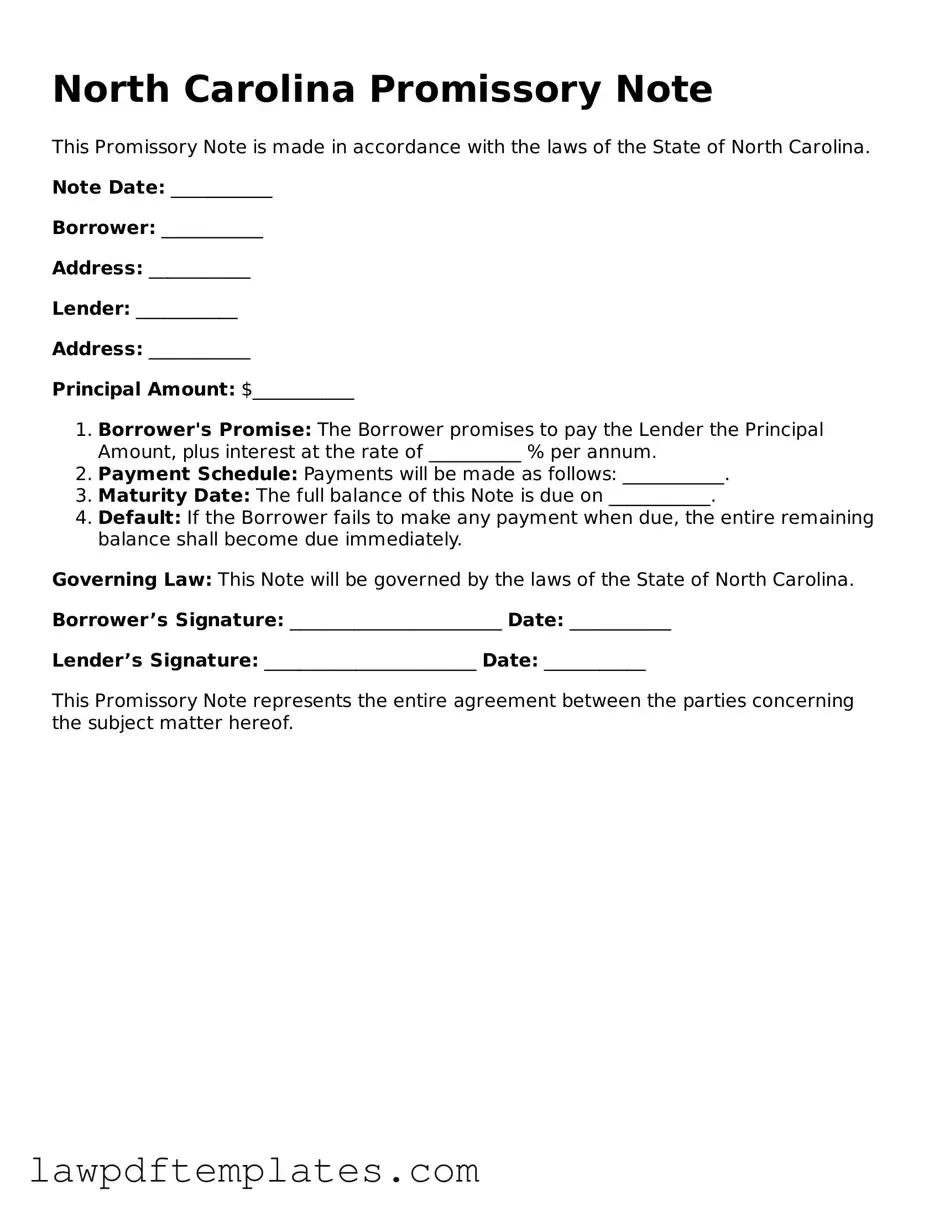

Sample - North Carolina Promissory Note Form

North Carolina Promissory Note

This Promissory Note is made in accordance with the laws of the State of North Carolina.

Note Date: ___________

Borrower: ___________

Address: ___________

Lender: ___________

Address: ___________

Principal Amount: $___________

- Borrower's Promise: The Borrower promises to pay the Lender the Principal Amount, plus interest at the rate of __________ % per annum.

- Payment Schedule: Payments will be made as follows: ___________.

- Maturity Date: The full balance of this Note is due on ___________.

- Default: If the Borrower fails to make any payment when due, the entire remaining balance shall become due immediately.

Governing Law: This Note will be governed by the laws of the State of North Carolina.

Borrower’s Signature: _______________________ Date: ___________

Lender’s Signature: _______________________ Date: ___________

This Promissory Note represents the entire agreement between the parties concerning the subject matter hereof.

Common mistakes

Filling out a North Carolina Promissory Note can seem straightforward, but many individuals make common mistakes that can lead to complications later on. One frequent error is failing to include all necessary parties involved in the agreement. If the borrower or lender is not clearly identified, it may create confusion about who is responsible for repayment.

Another mistake involves incorrect or missing dates. The date of the note is crucial, as it establishes when the agreement takes effect. Omitting this information can lead to disputes over the timeline of payments. Additionally, forgetting to specify the payment schedule can complicate matters. It's essential to outline when payments are due and how they should be made.

Many people also overlook the importance of detailing the interest rate. If the interest rate is left blank or not clearly stated, it may lead to misunderstandings about the total amount owed over time. Similarly, not including the total loan amount can create confusion. Both the lender and borrower need to know exactly how much money is being borrowed.

Another common error is neglecting to sign the document. A Promissory Note without signatures is not legally binding. Both parties must sign the document to acknowledge their agreement. Furthermore, witnesses or notarization can add an extra layer of security, but many forget this step, which can affect the enforceability of the note.

Using vague language is also a mistake that can lead to issues. Clear and specific terms help ensure that both parties understand their obligations. Ambiguous wording can result in differing interpretations, which may lead to disputes down the line. It's best to be as precise as possible.

People sometimes fail to keep copies of the signed Promissory Note. Without a copy, it can be challenging to prove the terms of the agreement if a dispute arises. Both parties should retain a signed version for their records. Lastly, individuals may not consult legal advice before finalizing the document. While it may seem unnecessary, a professional can help identify potential issues and ensure that the note complies with state laws.

Discover More Promissory Note Templates for Specific States

Promissory Note Arizona - In some cases, additional signatories may be required to guarantee the repayment of the loan.

Promissory Note Ohio - The note details consequences if the borrower defaults on the loan.

When navigating the complexities of real estate transactions in Texas, utilizing the Texas TREC Residential Contract form is essential for both buyers and sellers. This document, created by the Texas Real Estate Commission (TREC), ensures that all terms and conditions related to the sale are clearly defined and legally enforceable. It effectively addresses important components such as property specifics, financing options, inspection protocols, and the closure process. For those seeking to better understand how to properly complete this contract, further information can be found at https://texasformspdf.com/fillable-texas-trec-residential-contract-online.

Promissory Note Template Massachusetts - Promissory notes can vary in length and detail, depending on the agreement.

Blank Promissory Note - The duration of the loan is usually clearly stated in the note.