Free Motor Vehicle Bill of Sale Template for the State of North Carolina

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The North Carolina Motor Vehicle Bill of Sale form is used to document the sale of a vehicle between a buyer and a seller. |

| Governing Law | This form is governed by North Carolina General Statutes, specifically G.S. 20-79.1. |

| Required Information | Essential details include the vehicle's make, model, year, VIN, and sale price. |

| Signatures | Both the buyer and seller must sign the form to validate the transaction. |

| Notarization | Notarization is not required for the Bill of Sale in North Carolina, but it can add an extra layer of security. |

| Record Keeping | It is advisable for both parties to keep a copy of the completed Bill of Sale for their records. |

| Usage | The Bill of Sale is often required for vehicle registration and title transfer in North Carolina. |

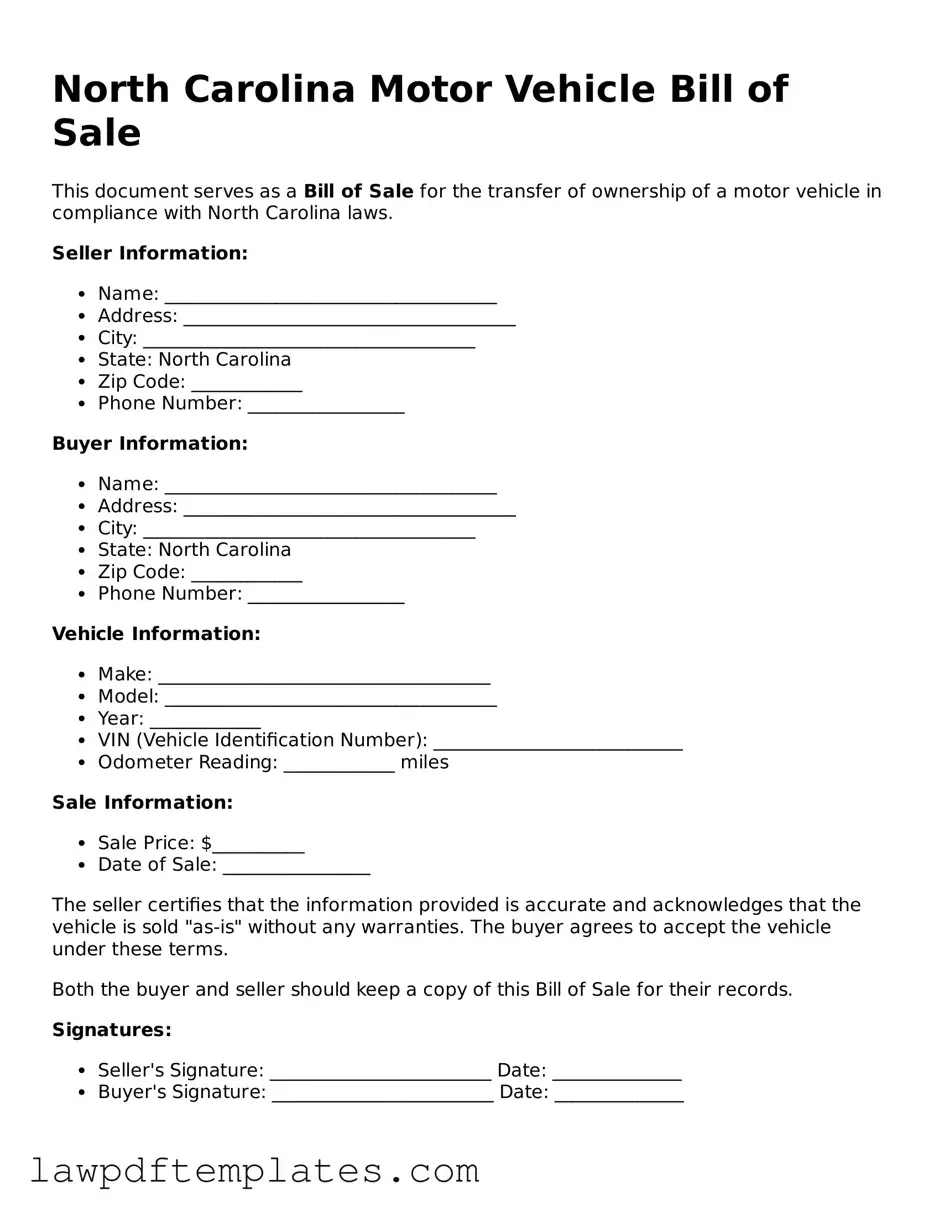

Sample - North Carolina Motor Vehicle Bill of Sale Form

North Carolina Motor Vehicle Bill of Sale

This document serves as a Bill of Sale for the transfer of ownership of a motor vehicle in compliance with North Carolina laws.

Seller Information:

- Name: ____________________________________

- Address: ____________________________________

- City: ____________________________________

- State: North Carolina

- Zip Code: ____________

- Phone Number: _________________

Buyer Information:

- Name: ____________________________________

- Address: ____________________________________

- City: ____________________________________

- State: North Carolina

- Zip Code: ____________

- Phone Number: _________________

Vehicle Information:

- Make: ____________________________________

- Model: ____________________________________

- Year: ____________

- VIN (Vehicle Identification Number): ___________________________

- Odometer Reading: ____________ miles

Sale Information:

- Sale Price: $__________

- Date of Sale: ________________

The seller certifies that the information provided is accurate and acknowledges that the vehicle is sold "as-is" without any warranties. The buyer agrees to accept the vehicle under these terms.

Both the buyer and seller should keep a copy of this Bill of Sale for their records.

Signatures:

- Seller's Signature: ________________________ Date: ______________

- Buyer's Signature: ________________________ Date: ______________

Common mistakes

Filling out the North Carolina Motor Vehicle Bill of Sale form may seem straightforward, but many people make common mistakes that can lead to complications later. One frequent error is failing to include all required information. The form needs specific details about the vehicle, such as the Vehicle Identification Number (VIN), make, model, year, and odometer reading. Omitting any of this information can create issues when registering the vehicle.

Another mistake involves incorrect spelling or typographical errors in names or addresses. These small errors can cause significant problems, especially if the bill of sale is used for legal purposes. Ensuring that all names are spelled correctly and addresses are complete is essential for a valid transaction.

Many individuals also forget to date the bill of sale. A date is crucial as it establishes the timeline of the transaction. Without a date, it may be difficult to prove when the sale occurred, which could lead to disputes in the future.

People sometimes neglect to have both the buyer and seller sign the document. A signature from both parties is necessary to validate the sale. If one party does not sign, it may raise questions about the legitimacy of the transaction.

In addition, not providing a purchase price can be problematic. The bill of sale should clearly state the amount paid for the vehicle. This detail is important for both tax purposes and for any future resale of the vehicle.

Another common oversight is failing to keep a copy of the bill of sale. After completing the form, both the buyer and seller should retain a copy for their records. This document serves as proof of the transaction and can be helpful if any issues arise later.

Some individuals do not check for any liens on the vehicle before completing the sale. If a lien exists, the seller is responsible for disclosing this information. Buyers should ensure they are not purchasing a vehicle with outstanding debts attached.

Additionally, people often overlook the importance of accurately recording the odometer reading. Misreporting this information can lead to legal complications, especially if the vehicle is sold as having lower mileage than it actually does.

Lastly, failing to understand the implications of the bill of sale can lead to misunderstandings. This document is not just a formality; it is a legal record of the transaction. Both parties should be aware of their rights and responsibilities as outlined in the bill of sale.

Discover More Motor Vehicle Bill of Sale Templates for Specific States

Dmv Bill of Sale - By completing a Motor Vehicle Bill of Sale, both parties can ensure clarity in the transaction.

To create an effective transaction, utilizing resources like Fast PDF Templates can be beneficial, ensuring that both parties have a clear understanding of the terms involved in the Illinois Bill of Sale.

What Should a Bill of Sale Look Like - The document details any existing liens on the vehicle, ensuring transparency in the sale.