Free Last Will and Testament Template for the State of North Carolina

Form Breakdown

| Fact Name | Details |

|---|---|

| Governing Law | The North Carolina Last Will and Testament is governed by Chapter 31 of the North Carolina General Statutes. |

| Age Requirement | In North Carolina, individuals must be at least 18 years old to create a valid will. |

| Witness Requirement | A will must be signed by at least two witnesses who are present at the same time. |

| Revocation of Previous Wills | Creating a new will automatically revokes any prior wills unless specified otherwise. |

| Holographic Wills | North Carolina recognizes holographic wills, which are handwritten and do not require witnesses. |

| Executor Appointment | The testator can name an executor in the will to manage the estate after death. |

| Property Distribution | The will allows the testator to specify how their assets and property should be distributed after death. |

| No Formal Language Required | North Carolina does not require specific language to create a valid will, as long as the intent is clear. |

Sample - North Carolina Last Will and Testament Form

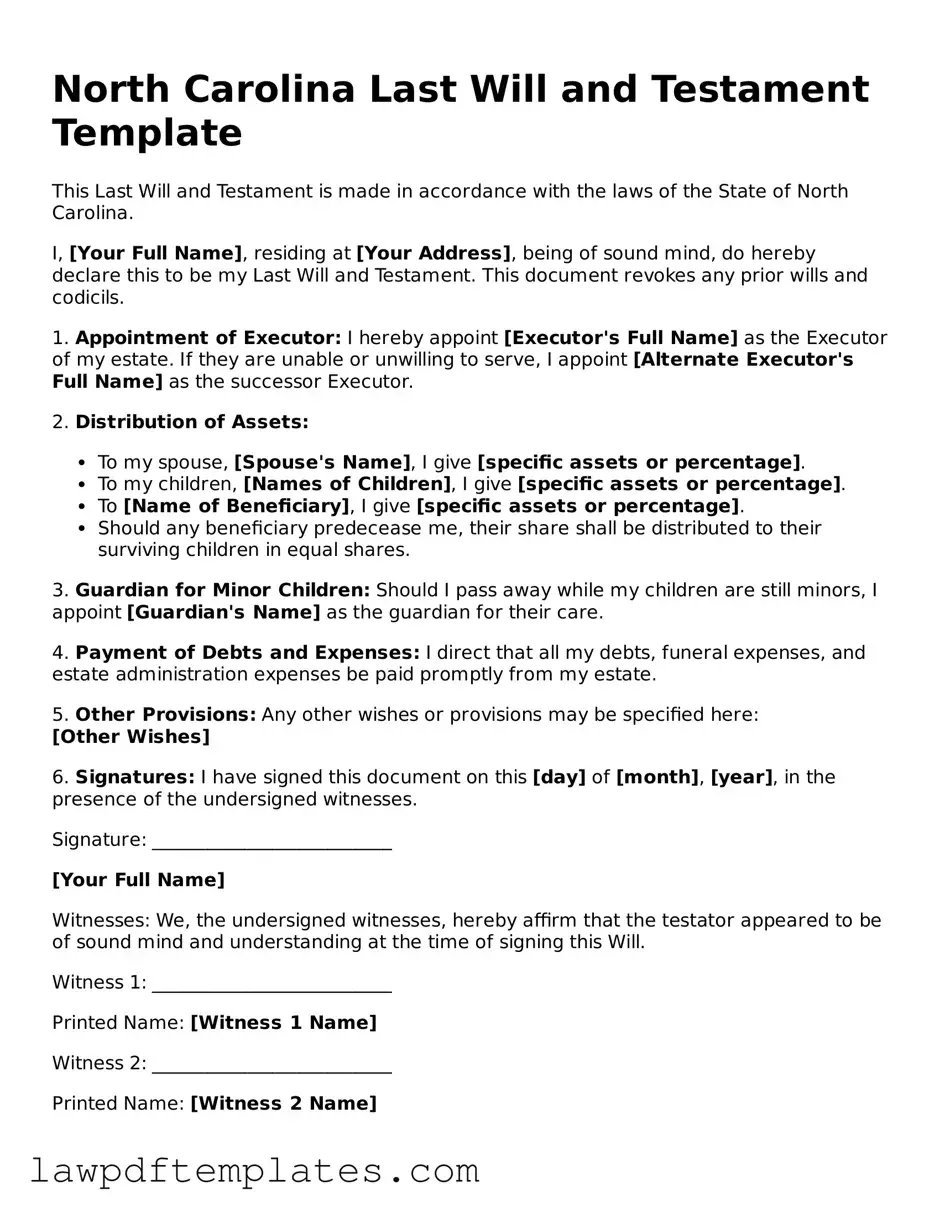

North Carolina Last Will and Testament Template

This Last Will and Testament is made in accordance with the laws of the State of North Carolina.

I, [Your Full Name], residing at [Your Address], being of sound mind, do hereby declare this to be my Last Will and Testament. This document revokes any prior wills and codicils.

1. Appointment of Executor: I hereby appoint [Executor's Full Name] as the Executor of my estate. If they are unable or unwilling to serve, I appoint [Alternate Executor's Full Name] as the successor Executor.

2. Distribution of Assets:

- To my spouse, [Spouse's Name], I give [specific assets or percentage].

- To my children, [Names of Children], I give [specific assets or percentage].

- To [Name of Beneficiary], I give [specific assets or percentage].

- Should any beneficiary predecease me, their share shall be distributed to their surviving children in equal shares.

3. Guardian for Minor Children: Should I pass away while my children are still minors, I appoint [Guardian's Name] as the guardian for their care.

4. Payment of Debts and Expenses: I direct that all my debts, funeral expenses, and estate administration expenses be paid promptly from my estate.

5. Other Provisions: Any other wishes or provisions may be specified here:

[Other Wishes]

6. Signatures: I have signed this document on this [day] of [month], [year], in the presence of the undersigned witnesses.

Signature: __________________________

[Your Full Name]

Witnesses: We, the undersigned witnesses, hereby affirm that the testator appeared to be of sound mind and understanding at the time of signing this Will.

Witness 1: __________________________

Printed Name: [Witness 1 Name]

Witness 2: __________________________

Printed Name: [Witness 2 Name]

This will is made in accordance with North Carolina General Statutes, Chapter 31 (Wills) and adjusted for individual circumstances.

Common mistakes

Creating a Last Will and Testament is an important step in ensuring that your wishes are honored after your passing. However, many individuals make mistakes when filling out this crucial document. One common error is failing to clearly identify the testator, or the person making the will. It is essential to provide your full legal name and address to avoid any confusion regarding your identity.

Another frequent mistake is not properly signing the will. In North Carolina, a will must be signed by the testator or by someone else in their presence and at their direction. If this requirement is not met, the will may be deemed invalid. Additionally, witnesses are necessary; failing to have at least two competent witnesses can lead to complications. These witnesses should not be beneficiaries of the will, as this can create conflicts of interest.

People often overlook the importance of being specific about asset distribution. Vague language can lead to misunderstandings among heirs. It is crucial to detail what each beneficiary will receive and to clarify any conditions attached to those bequests. This clarity helps to prevent disputes and ensures that your intentions are understood.

Moreover, individuals may neglect to update their wills after significant life changes, such as marriage, divorce, or the birth of a child. Failing to make these updates can result in unintended consequences, such as excluding a new spouse or child from inheritance. Regularly reviewing and revising your will is a responsible practice that reflects your current situation.

Another mistake is not considering the appointment of an executor. The executor is responsible for carrying out the terms of the will. If you do not name someone, the court will appoint an administrator, which may not align with your preferences. Choose a trustworthy individual who can handle the responsibilities involved in settling your estate.

Some individuals forget to include a residuary clause, which addresses any assets not specifically mentioned in the will. Without this clause, any unallocated assets may be distributed according to state law, which may not reflect your wishes. This oversight can lead to unintended beneficiaries receiving your property.

Additionally, failing to discuss your will with your beneficiaries can lead to confusion and resentment after your passing. Open communication about your decisions can help manage expectations and foster understanding among family members. It may also provide an opportunity to clarify your intentions.

People sometimes neglect to consider tax implications when drafting their wills. Understanding how estate taxes may affect your beneficiaries can influence your decisions regarding asset distribution. Consulting with a financial advisor can provide valuable insights into minimizing tax burdens on your heirs.

Lastly, individuals may not store their wills in a secure and accessible location. A will that cannot be found after your death is as good as nonexistent. It is advisable to inform your executor and trusted family members of the will's location, ensuring that it can be located when needed.

By being mindful of these common mistakes, you can create a Last Will and Testament that accurately reflects your wishes and provides peace of mind for you and your loved ones.

Discover More Last Will and Testament Templates for Specific States

Last Will and Testament Illinois - Facilitates the transfer of business interests after the original owner’s passing.

Living Will Form New Jersey - Can be a reflection of your personal journey and values.

A Washington Non-disclosure Agreement (NDA) is a legal document designed to protect sensitive information shared between parties. This agreement ensures that confidential details remain private and are not disclosed to unauthorized individuals. To safeguard your interests, consider filling out the Non-disclosure Agreement form by clicking the button below.

Will Template Arizona - A means to express your wishes regarding guardianship of minor children.