Free Transfer-on-Death Deed Template for the State of New Jersey

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The TOD deed in New Jersey is governed by the New Jersey Statutes Annotated (N.J.S.A.) 46:3B-1 et seq. |

| Eligibility | Any individual who owns real estate in New Jersey can create a TOD deed, provided they are of sound mind. |

| Beneficiaries | Property owners can name one or more beneficiaries in the TOD deed, and they can be individuals or entities. |

| Revocation | The property owner can revoke or change the TOD deed at any time before their death, as long as they follow the proper legal procedures. |

| Recording Requirement | To be effective, the TOD deed must be recorded with the county clerk’s office where the property is located before the owner's death. |

| Tax Implications | Transfer-on-Death deeds do not trigger gift taxes during the owner's lifetime, as the transfer occurs only upon death. |

| Limitations | Some types of property, such as certain business interests or properties held in trust, may not be eligible for a TOD deed. |

Sample - New Jersey Transfer-on-Death Deed Form

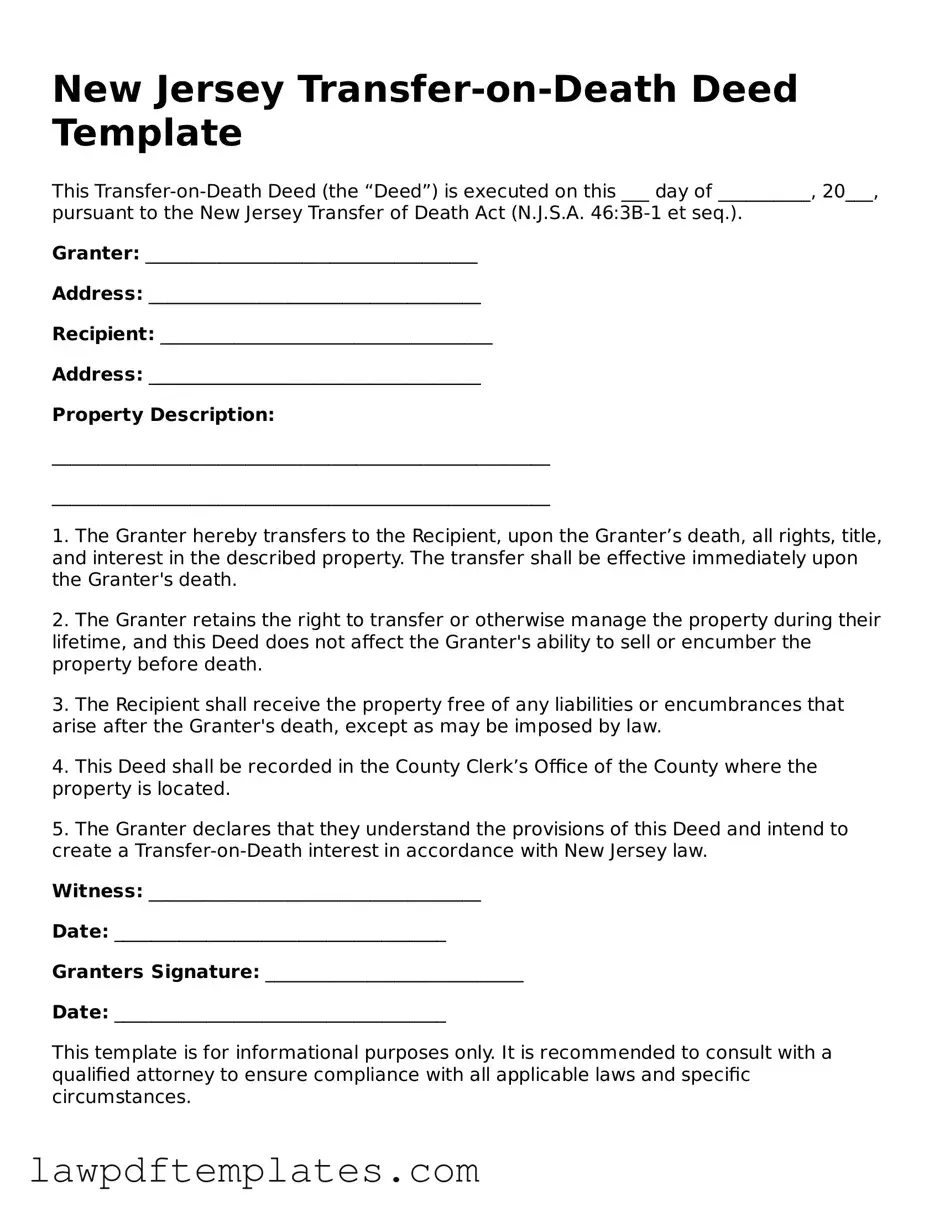

New Jersey Transfer-on-Death Deed Template

This Transfer-on-Death Deed (the “Deed”) is executed on this ___ day of __________, 20___, pursuant to the New Jersey Transfer of Death Act (N.J.S.A. 46:3B-1 et seq.).

Granter: ____________________________________

Address: ____________________________________

Recipient: ____________________________________

Address: ____________________________________

Property Description:

______________________________________________________

______________________________________________________

1. The Granter hereby transfers to the Recipient, upon the Granter’s death, all rights, title, and interest in the described property. The transfer shall be effective immediately upon the Granter's death.

2. The Granter retains the right to transfer or otherwise manage the property during their lifetime, and this Deed does not affect the Granter's ability to sell or encumber the property before death.

3. The Recipient shall receive the property free of any liabilities or encumbrances that arise after the Granter's death, except as may be imposed by law.

4. This Deed shall be recorded in the County Clerk’s Office of the County where the property is located.

5. The Granter declares that they understand the provisions of this Deed and intend to create a Transfer-on-Death interest in accordance with New Jersey law.

Witness: ____________________________________

Date: ____________________________________

Granters Signature: ____________________________

Date: ____________________________________

This template is for informational purposes only. It is recommended to consult with a qualified attorney to ensure compliance with all applicable laws and specific circumstances.

Common mistakes

Filling out the New Jersey Transfer-on-Death Deed form can be a straightforward process, but mistakes are common. One frequent error is failing to include all required information. The form requires specific details about the property and the beneficiaries. Omitting any of this information can lead to delays or complications in the transfer process.

Another mistake is not properly identifying the property. It is essential to include the correct legal description of the property. Relying on a simple address may not suffice, as legal descriptions often contain specific details that clarify the property’s boundaries.

People often neglect to ensure that the beneficiaries are clearly named. If a beneficiary is not specified or is referred to by a nickname rather than their legal name, this can create confusion. It is crucial to use full legal names to avoid potential disputes among heirs.

Not signing the deed correctly is another common error. The Transfer-on-Death Deed must be signed by the property owner in the presence of a notary public. Failing to have the deed notarized can render it invalid, which would prevent the intended transfer from occurring.

Additionally, individuals sometimes forget to record the deed with the county clerk. While completing the form is an important step, recording it is equally vital. This step ensures that the transfer is legally recognized and protects the interests of the beneficiaries.

People may also overlook the importance of reviewing the deed for accuracy before submitting it. Mistakes in spelling, dates, or other critical information can lead to legal challenges later on. A thorough review can help catch errors that might otherwise go unnoticed.

Another mistake involves not considering the implications of the transfer. Some individuals may not fully understand how transferring property upon death impacts their estate or potential tax liabilities. Consulting with a knowledgeable advisor can clarify these issues.

Sometimes, individuals fail to communicate their intentions with the beneficiaries. It is beneficial to inform those involved about the transfer and the specifics of the deed. This communication can help prevent misunderstandings and disputes after the property owner’s passing.

People may also neglect to update the deed if circumstances change. Life events such as marriage, divorce, or the death of a beneficiary can necessitate changes to the deed. Keeping the document current is essential to ensure it reflects the property owner’s wishes.

Finally, individuals might not seek legal advice when needed. While the form can be filled out independently, professional guidance can provide clarity and ensure compliance with all legal requirements. Engaging a legal advisor can help avoid costly mistakes and ensure a smoother transfer process.

Discover More Transfer-on-Death Deed Templates for Specific States

Todi Illinois - Professional legal advice can ensure that the deed complies with all necessary requirements and effectively meets the owner's goals.

Transfer on Death Affidavit - The deed remains a private agreement until the owner's death, keeping intentions confidential.

Transfer on Death Deed Georgia - Carefully identify the beneficiaries to avoid confusion and ensure the intended individuals receive the property.

By utilizing the FedEx Bill of Lading form, shippers can streamline their freight transport processes while ensuring clarity and accountability. For those looking to simplify this paperwork, Fast PDF Templates provides useful resources that can make filling out these forms easier and more efficient.

California Transfer on Death Deed - The beneficiary receives the property without any need to go through probate.