Free Real Estate Purchase Agreement Template for the State of New Jersey

Form Breakdown

| Fact Name | Description |

|---|---|

| Governing Law | The New Jersey Real Estate Purchase Agreement is governed by the New Jersey Real Estate Law. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Parties Involved | The agreement includes information about the buyer and seller, including their names and contact details. |

| Property Description | A detailed description of the property being sold is required, including its address and any relevant identifying information. |

| Purchase Price | The agreement specifies the total purchase price of the property and outlines payment terms. |

| Contingencies | Common contingencies, such as financing and inspection, are included to protect both parties. |

| Closing Date | The agreement sets a closing date, which is when the transaction is finalized and ownership is transferred. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

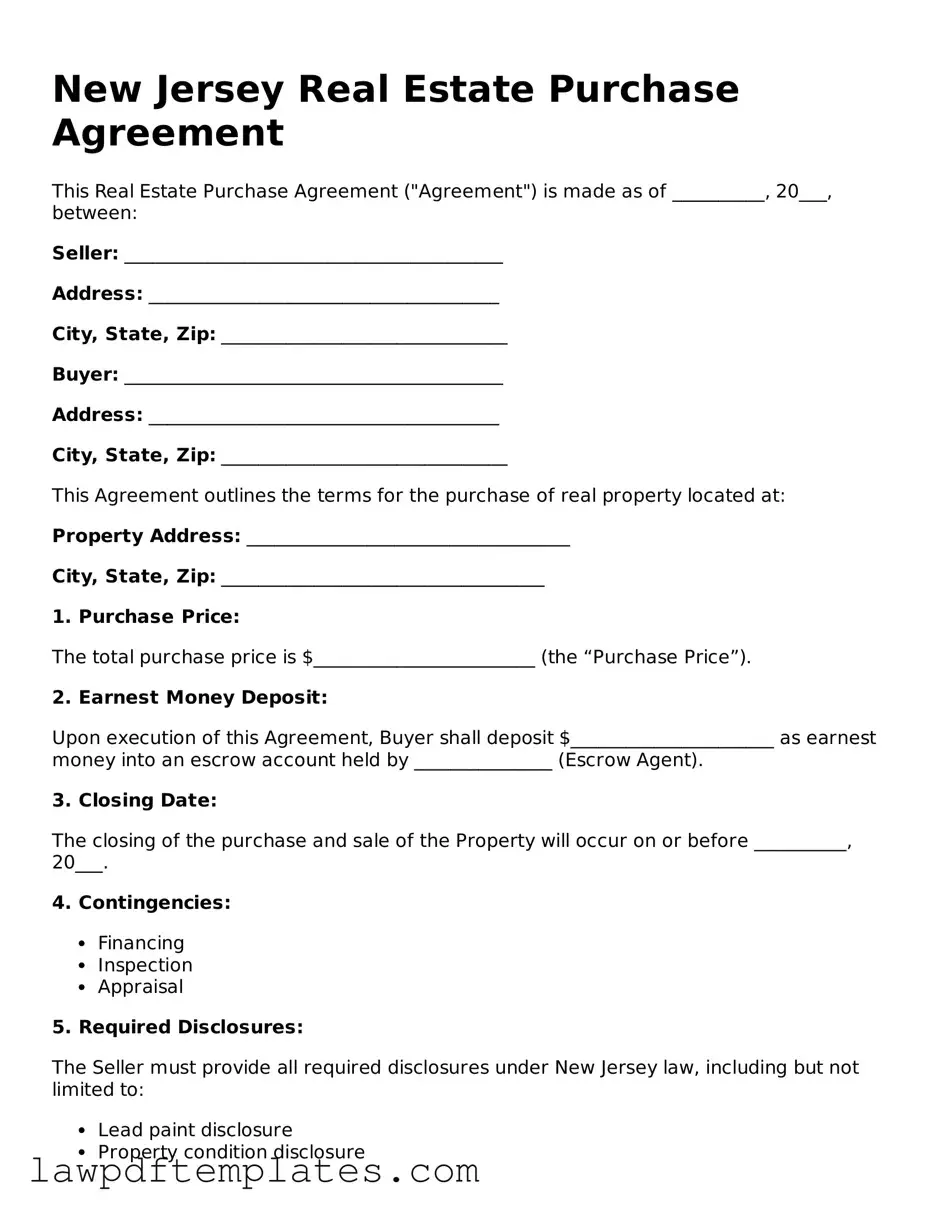

Sample - New Jersey Real Estate Purchase Agreement Form

New Jersey Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made as of __________, 20___, between:

Seller: _________________________________________

Address: ______________________________________

City, State, Zip: _______________________________

Buyer: _________________________________________

Address: ______________________________________

City, State, Zip: _______________________________

This Agreement outlines the terms for the purchase of real property located at:

Property Address: ___________________________________

City, State, Zip: ___________________________________

1. Purchase Price:

The total purchase price is $________________________ (the “Purchase Price”).

2. Earnest Money Deposit:

Upon execution of this Agreement, Buyer shall deposit $______________________ as earnest money into an escrow account held by _______________ (Escrow Agent).

3. Closing Date:

The closing of the purchase and sale of the Property will occur on or before __________, 20___.

4. Contingencies:

- Financing

- Inspection

- Appraisal

5. Required Disclosures:

The Seller must provide all required disclosures under New Jersey law, including but not limited to:

- Lead paint disclosure

- Property condition disclosure

- Any known defects

6. Title and Possession:

Buyer will receive a marketable title to the Property at closing. Possession of the Property will be delivered to Buyer upon completion of all closing procedures.

7. Governing Law:

This Agreement will be governed by the laws of the State of New Jersey.

8. Signatures:

By signing below, both parties agree to the terms outlined in this Agreement.

_____________________________

Seller’s Signature

Date: _______________

_____________________________

Buyer’s Signature

Date: _______________

Witnessed By:

_____________________________

Date: _______________

Common mistakes

Filling out the New Jersey Real Estate Purchase Agreement can be a daunting task. Many people make common mistakes that can lead to confusion or even legal issues down the line. One of the most frequent errors is failing to provide accurate property details. When the description of the property is vague or incorrect, it can create problems later on. Buyers and sellers may find themselves in disputes over what was actually included in the sale.

Another common mistake is neglecting to include contingencies. These are conditions that must be met for the sale to proceed. For instance, a buyer might want to include a contingency for obtaining financing. Without these clauses, buyers risk losing their deposit if they cannot secure a loan. Sellers, on the other hand, may find themselves in a position where they are obligated to sell despite unresolved issues.

Many individuals also overlook the importance of signatures. All parties involved must sign the agreement for it to be legally binding. It may seem obvious, but forgetting to get a signature from one party can invalidate the entire agreement. This oversight can lead to significant delays and complications, especially if one party later claims they were never in agreement.

Lastly, some people fail to understand the implications of the closing date. It’s essential to specify a realistic timeline for closing the sale. If the date is too ambitious, it can lead to unnecessary stress and complications. Both buyers and sellers should ensure that the date allows ample time for inspections, financing, and other necessary steps. By taking the time to address these common pitfalls, individuals can navigate the process more smoothly and confidently.

Discover More Real Estate Purchase Agreement Templates for Specific States

Free Nc Real Estate Purchase Agreement - Designates who will represent each party during negotiations.

For employers seeking to simplify the verification process, the Texas Employment Verification form is essential, and to get started efficiently, visit https://texasformspdf.com/fillable-texas-employment-verification-online for a fillable version that streamlines the submission of necessary employment details to the Texas Health and Human Services Commission.

Midland Title Toledo - Sets forth the closing date and conditions for completing the sale.