Free Promissory Note Template for the State of New Jersey

Form Breakdown

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a specified time or on demand. |

| Governing Law | The New Jersey Promissory Note is governed by the New Jersey Uniform Commercial Code (UCC), specifically N.J.S.A. 12A:3-101 et seq. |

| Parties Involved | Typically, a promissory note involves two parties: the maker (the person who promises to pay) and the payee (the person to whom the payment is promised). |

| Interest Rate | The note may specify an interest rate. If not stated, New Jersey law allows for a maximum rate of 6% per annum unless otherwise agreed. |

| Enforceability | For a promissory note to be enforceable, it must be in writing, signed by the maker, and include all essential terms such as amount, interest rate, and repayment schedule. |

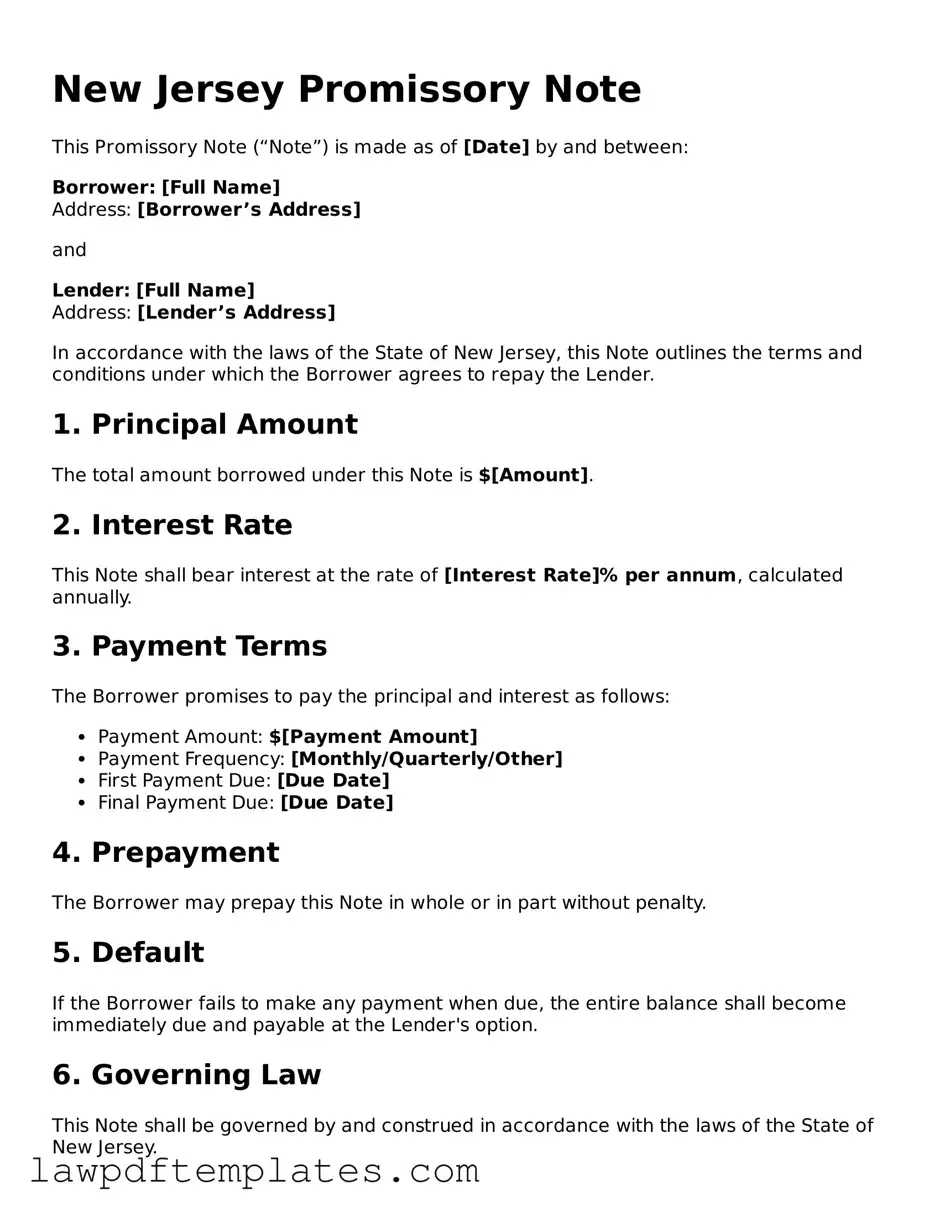

Sample - New Jersey Promissory Note Form

New Jersey Promissory Note

This Promissory Note (“Note”) is made as of [Date] by and between:

Borrower: [Full Name]

Address: [Borrower’s Address]

and

Lender: [Full Name]

Address: [Lender’s Address]

In accordance with the laws of the State of New Jersey, this Note outlines the terms and conditions under which the Borrower agrees to repay the Lender.

1. Principal Amount

The total amount borrowed under this Note is $[Amount].

2. Interest Rate

This Note shall bear interest at the rate of [Interest Rate]% per annum, calculated annually.

3. Payment Terms

The Borrower promises to pay the principal and interest as follows:

- Payment Amount: $[Payment Amount]

- Payment Frequency: [Monthly/Quarterly/Other]

- First Payment Due: [Due Date]

- Final Payment Due: [Due Date]

4. Prepayment

The Borrower may prepay this Note in whole or in part without penalty.

5. Default

If the Borrower fails to make any payment when due, the entire balance shall become immediately due and payable at the Lender's option.

6. Governing Law

This Note shall be governed by and construed in accordance with the laws of the State of New Jersey.

7. Signatures

By signing below, the parties agree to the terms set forth in this Promissory Note.

___________________________

Borrower’s Signature: [Signature]

___________________________

Lender’s Signature: [Signature]

Common mistakes

Filling out the New Jersey Promissory Note form can be straightforward, but mistakes often occur. One common error is failing to include all necessary details. Borrowers must provide specific information, such as the loan amount, interest rate, and repayment terms. Omitting any of these elements can lead to confusion and disputes later on.

Another mistake involves incorrect signatures. Both the borrower and lender must sign the document. If one party neglects to sign or uses an unofficial signature, the note may not be legally binding. This can create problems if the lender needs to enforce the note in the future.

People also frequently misinterpret the terms of the note. It’s essential to understand what each section means before signing. Misunderstanding can lead to unexpected obligations or rights. For instance, not fully grasping the implications of a late payment clause can result in unforeseen penalties.

Lastly, some individuals forget to date the document. A missing date can complicate matters, especially if there are questions about when the loan agreement began. Without a clear timeline, it may be challenging to enforce the terms of the note if disputes arise.

Discover More Promissory Note Templates for Specific States

Promissory Note Template Massachusetts - An unsecured promissory note does not involve collateral but still holds legal weight.

In order to facilitate a transparent transaction, both the seller and buyer should utilize a comprehensive document like the Florida Motor Vehicle Bill of Sale, which can be easily obtained from sources such as Fast PDF Templates, helping to clarify ownership transfer details and protect the interests of both parties involved in the sale.

Promissory Note Arizona - This document outlines the terms of a loan, including repayment schedule and interest rate.