Free Operating Agreement Template for the State of New Jersey

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The New Jersey Operating Agreement outlines the management structure and operational guidelines for an LLC. |

| Governing Law | The agreement is governed by the New Jersey Limited Liability Company Act. |

| Members | All members of the LLC can participate in creating and signing the agreement. |

| Flexibility | The agreement allows for flexibility in defining roles, responsibilities, and profit-sharing among members. |

| Not Mandatory | While not required by law, having an operating agreement is highly recommended for clarity and protection. |

| Amendments | Members can amend the agreement as needed, following the procedures outlined within it. |

| Dispute Resolution | The agreement can include provisions for resolving disputes among members, such as mediation or arbitration. |

| Tax Treatment | It can specify how the LLC will be taxed, whether as a partnership or corporation. |

| Duration | The agreement can state the duration of the LLC, whether it is perpetual or for a specific term. |

| Confidentiality | Provisions for confidentiality can be included to protect sensitive information about the LLC. |

Sample - New Jersey Operating Agreement Form

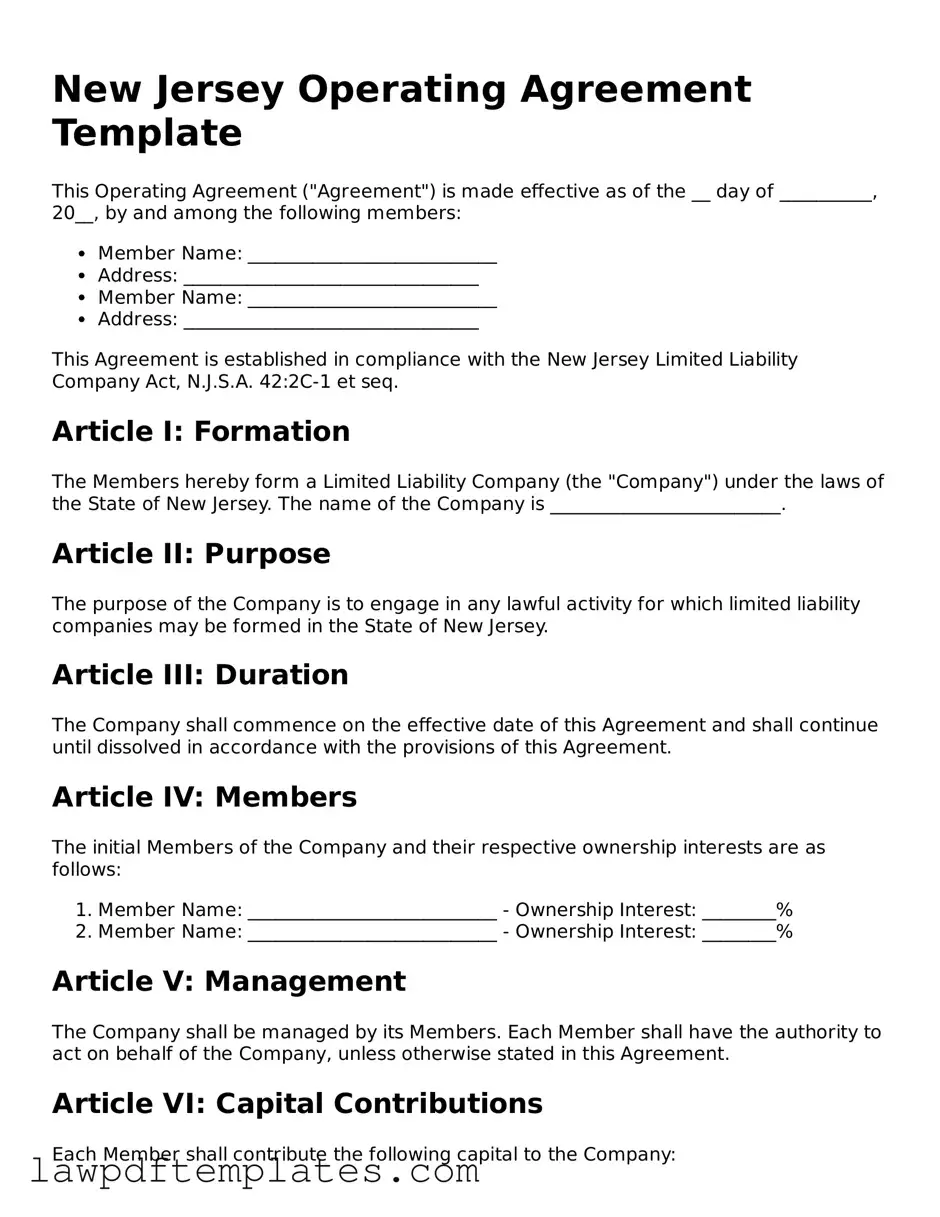

New Jersey Operating Agreement Template

This Operating Agreement ("Agreement") is made effective as of the __ day of __________, 20__, by and among the following members:

- Member Name: ___________________________

- Address: ________________________________

- Member Name: ___________________________

- Address: ________________________________

This Agreement is established in compliance with the New Jersey Limited Liability Company Act, N.J.S.A. 42:2C-1 et seq.

Article I: Formation

The Members hereby form a Limited Liability Company (the "Company") under the laws of the State of New Jersey. The name of the Company is _________________________.

Article II: Purpose

The purpose of the Company is to engage in any lawful activity for which limited liability companies may be formed in the State of New Jersey.

Article III: Duration

The Company shall commence on the effective date of this Agreement and shall continue until dissolved in accordance with the provisions of this Agreement.

Article IV: Members

The initial Members of the Company and their respective ownership interests are as follows:

- Member Name: ___________________________ - Ownership Interest: ________%

- Member Name: ___________________________ - Ownership Interest: ________%

Article V: Management

The Company shall be managed by its Members. Each Member shall have the authority to act on behalf of the Company, unless otherwise stated in this Agreement.

Article VI: Capital Contributions

Each Member shall contribute the following capital to the Company:

- Member Name: ___________________________ - Contribution Amount: $____________

- Member Name: ___________________________ - Contribution Amount: $____________

Article VII: Distributions

Distributions shall be made to the Members in proportion to their ownership interests, unless otherwise agreed in writing.

Article VIII: Amendments

This Agreement may be amended only with the written consent of all Members.

Article IX: Miscellaneous

This Agreement constitutes the entire agreement among the Members and supersedes all prior agreements or understandings. If any provision of this Agreement is held to be unenforceable, the remaining provisions shall remain in full force and effect.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

______________________________

Member Signature

______________________________

Member Signature

Common mistakes

Filling out an Operating Agreement in New Jersey is a crucial step for anyone forming a Limited Liability Company (LLC). However, many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to accurately identify the members of the LLC. It is essential to list all members clearly, as this establishes ownership and helps prevent disputes in the future.

Another mistake often seen is neglecting to specify the management structure of the LLC. Some people assume that the default management structure will suffice, but it’s vital to outline whether the LLC will be member-managed or manager-managed. This decision impacts how the business operates and how decisions are made, so clarity is key.

Additionally, individuals sometimes overlook the importance of detailing the financial contributions of each member. This section should clearly state how much each member is investing in the LLC. Without this information, misunderstandings about ownership stakes and profit distribution can arise, leading to potential conflicts among members.

Moreover, many people fail to include provisions for handling disputes. An Operating Agreement should outline how disagreements will be resolved, whether through mediation, arbitration, or another method. Ignoring this aspect can result in lengthy and costly legal battles if conflicts occur.

Lastly, a common oversight is not updating the Operating Agreement as changes occur. As the business grows or members change, the agreement should reflect these modifications. Failing to do so can render the document ineffective and may lead to legal complications. Keeping the Operating Agreement current is essential for the smooth operation of the LLC.

Discover More Operating Agreement Templates for Specific States

Llc Operating Agreement Michigan - This agreement can facilitate smoother business operations by clarifying member duties.

The simple trailer bill of sale document is crucial for ensuring that both buyers and sellers have a clear record of the transaction, including all necessary details about the trailer and terms of sale.

Operating Agreement Llc Ohio Template - It may require members to maintain confidentiality.