Fillable Mortgage Statement Template

File Details

| Fact Name | Description |

|---|---|

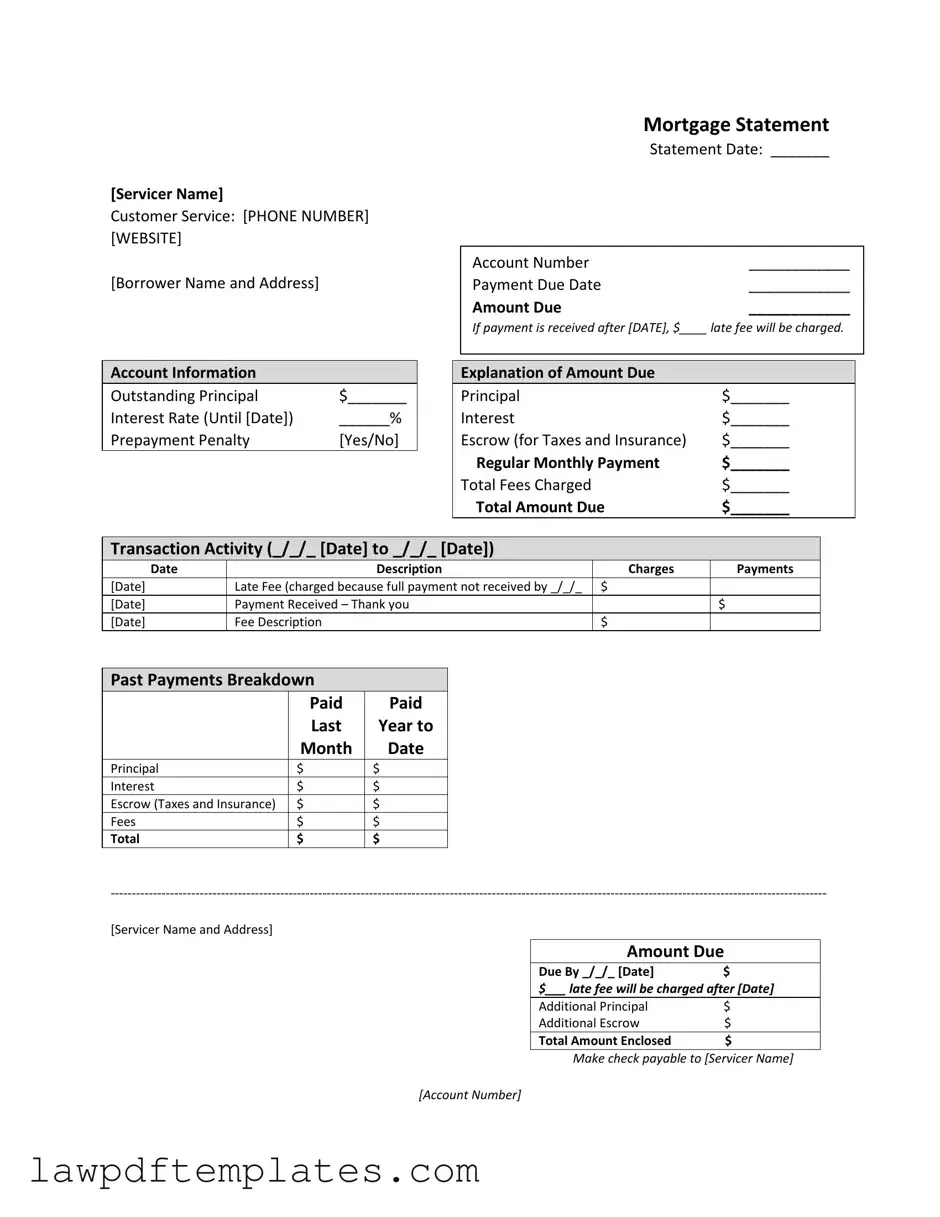

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website. This information is crucial for borrowers needing assistance or having questions about their account. |

| Payment Details | It specifies the payment due date and the amount due. If the payment is late, a late fee will be charged, emphasizing the importance of timely payments to avoid additional costs. |

| Account Information | Outstanding principal and interest rates are clearly outlined. Borrowers should pay close attention to these figures, as they affect the total amount owed and future payments. |

| Transaction Activity | This section details all transactions, including charges and payments made over a specified period. Keeping track of this information can help borrowers understand their payment history and any outstanding balances. |

| Delinquency Notice | A warning is provided if payments are overdue. It states the number of days delinquent and the potential consequences, such as fees or foreclosure, stressing the urgency of addressing missed payments. |

Sample - Mortgage Statement Form

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Common mistakes

When filling out the Mortgage Statement form, individuals often make several common mistakes that can lead to confusion or delays in processing. One frequent error is failing to provide accurate personal information. Borrowers should ensure that their name and address are spelled correctly and match the information on file with the mortgage servicer. Inaccuracies can lead to miscommunication and may hinder the processing of payments or inquiries.

Another mistake is neglecting to review the payment due date and the amount due. Borrowers sometimes overlook these critical details, which can result in late payments and additional fees. It is essential to double-check the statement date and ensure that the payment is made on or before the due date to avoid any penalties.

Additionally, many people do not pay close attention to the transaction activity section. This part of the form outlines recent payments and any late fees incurred. By failing to review this section, borrowers may miss important information about their payment history, which can affect their understanding of their current balance and any outstanding fees.

Lastly, individuals often overlook the importance of understanding the implications of partial payments. The form clearly states that partial payments are held in a suspense account and do not apply to the mortgage balance until the full amount is paid. Ignoring this information can lead to further complications, including continued delinquency and potential foreclosure. It is crucial for borrowers to fully comprehend how their payments are applied to avoid unexpected issues down the line.

Common PDF Documents

Lyft Inspection Form Pass - Confirm the inspection date is accurately noted.

For those in need of a reliable document, the Illinois bill of sale form is essential for legally transferring ownership. You can find more information and access the required form by visiting this detailed Illinois Bill of Sale form guide.

Roof Warranty - MCS Roofing remains available for support regarding warranty issues.