Attorney-Approved Mobile Home Purchase Agreement Document

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Mobile Home Purchase Agreement is a legal document outlining the terms of the sale of a mobile home. |

| Parties Involved | The agreement typically includes the buyer and the seller, both of whom must sign the document. |

| Purchase Price | The form specifies the agreed purchase price for the mobile home. |

| Payment Terms | It outlines the payment terms, including deposit amounts and financing options, if applicable. |

| Condition of Home | The agreement may include details about the condition of the mobile home and any warranties provided by the seller. |

| Closing Date | The form specifies a closing date when the transfer of ownership will occur. |

| Governing Law | The agreement is governed by state law, which varies by location. For example, in California, it follows the California Civil Code. |

| Inspection Rights | Buyers often have the right to inspect the mobile home before finalizing the purchase. |

| Default Terms | The document outlines the consequences if either party defaults on the agreement. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

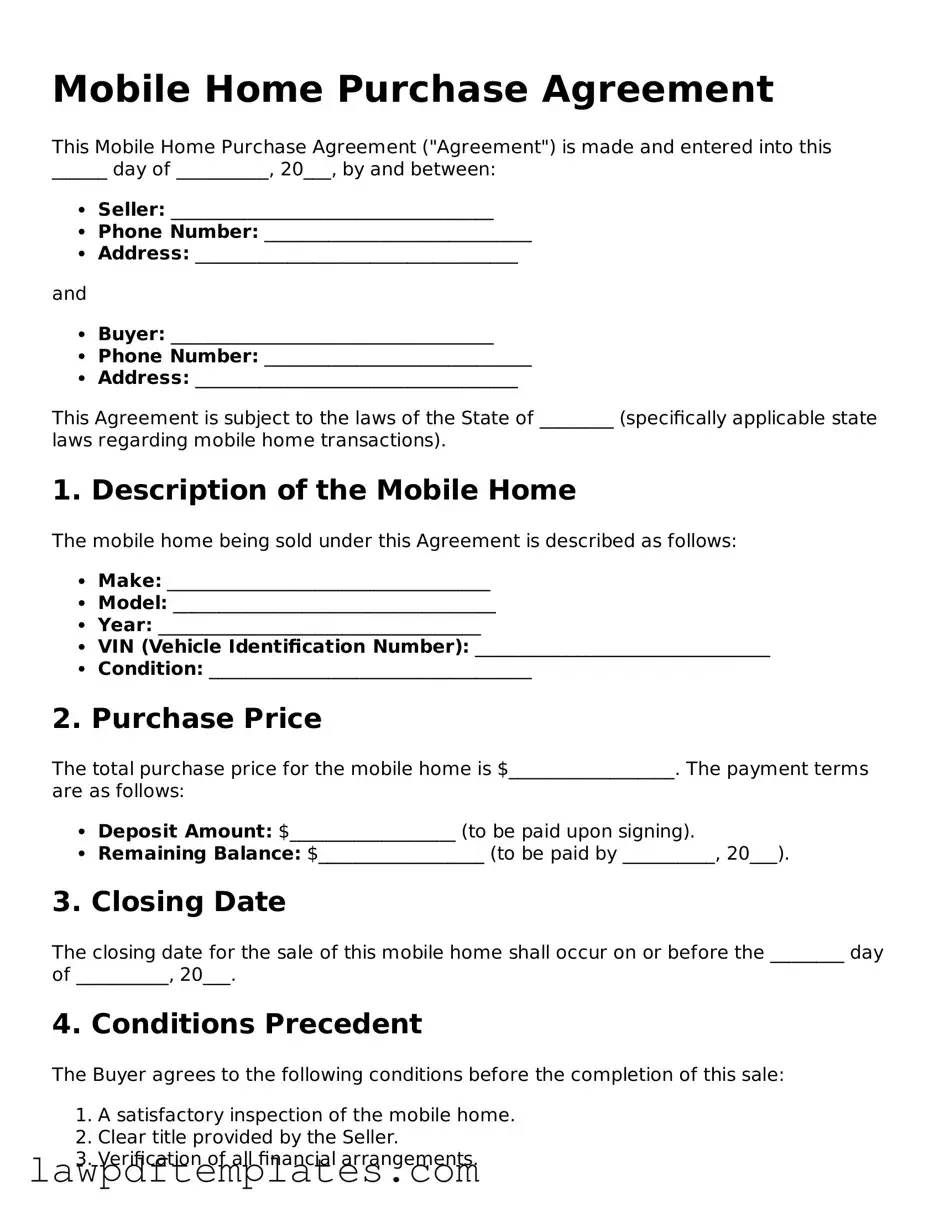

Sample - Mobile Home Purchase Agreement Form

Mobile Home Purchase Agreement

This Mobile Home Purchase Agreement ("Agreement") is made and entered into this ______ day of __________, 20___, by and between:

- Seller: ___________________________________

- Phone Number: _____________________________

- Address: ___________________________________

and

- Buyer: ___________________________________

- Phone Number: _____________________________

- Address: ___________________________________

This Agreement is subject to the laws of the State of ________ (specifically applicable state laws regarding mobile home transactions).

1. Description of the Mobile Home

The mobile home being sold under this Agreement is described as follows:

- Make: ___________________________________

- Model: ___________________________________

- Year: ___________________________________

- VIN (Vehicle Identification Number): ________________________________

- Condition: ___________________________________

2. Purchase Price

The total purchase price for the mobile home is $__________________. The payment terms are as follows:

- Deposit Amount: $__________________ (to be paid upon signing).

- Remaining Balance: $__________________ (to be paid by __________, 20___).

3. Closing Date

The closing date for the sale of this mobile home shall occur on or before the ________ day of __________, 20___.

4. Conditions Precedent

The Buyer agrees to the following conditions before the completion of this sale:

- A satisfactory inspection of the mobile home.

- Clear title provided by the Seller.

- Verification of all financial arrangements.

5. Seller’s Obligations

The Seller agrees to:

- Provide all necessary documents to transfer ownership.

- Ensure the mobile home is delivered in the condition agreed upon.

6. Buyer’s Obligations

The Buyer agrees to:

- Make all payments in accordance with this Agreement.

- Assume responsibility for the mobile home upon closing.

7. Signatures

By signing below, both parties agree to the terms outlined in this Agreement.

Seller Signature: _________________________ Date: ___________________

Buyer Signature: _________________________ Date: ___________________

Common mistakes

Filling out a Mobile Home Purchase Agreement can be a daunting task, and mistakes are common. One frequent error occurs when buyers fail to provide accurate personal information. This includes names, addresses, and contact details. Inaccuracies can lead to significant delays in the transaction process, or worse, complications in ownership transfer.

Another mistake often made is overlooking the details regarding the property itself. Buyers may neglect to specify the correct model, year, and serial number of the mobile home. This information is crucial, as it helps to clearly identify the property being purchased. Without these details, disputes may arise later, creating confusion and potential legal issues.

Additionally, many people do not pay sufficient attention to the financing terms outlined in the agreement. Buyers sometimes assume that the financing conditions are standard and do not carefully review interest rates, payment schedules, or down payment requirements. This oversight can lead to unexpected financial burdens down the line, making it essential to understand every aspect of the financing arrangement.

Buyers also frequently forget to include contingencies in their agreements. A contingency allows the buyer to back out of the deal under specific circumstances, such as failing to secure financing or discovering significant issues during an inspection. Without these clauses, buyers may find themselves locked into a purchase that is not in their best interest.

Lastly, a common mistake involves not seeking legal advice before signing the agreement. Many individuals believe they can navigate the process on their own, which can lead to misunderstandings about rights and responsibilities. Consulting with a legal professional can provide clarity and help prevent costly errors, ensuring that the agreement protects the buyer's interests.

Popular Templates:

Atv Bill of Sale Printable - Facilitates the legal transfer of vehicle title from seller to buyer.

This useful resource outlines the key aspects of an Investment Letter of Intent, providing insight into its significance in the investment landscape. By reviewing this guide, stakeholders can better understand how to draft an effective document that ensures clear communication and alignment among all parties involved. For further details, check out the comprehensive Investment Letter of Intent template.

96 Well Plate Format - Designed for user-friendly interaction and interpretation.