Free Transfer-on-Death Deed Template for the State of Michigan

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without the need for probate. |

| Governing Law | This deed is governed by the Michigan Compiled Laws, specifically MCL 565.25a. |

| Requirements | The deed must be signed by the property owner and recorded with the county register of deeds to be valid. |

| Revocation | The transfer-on-death deed can be revoked at any time before the owner’s death by filing a revocation form or executing a new deed. |

Sample - Michigan Transfer-on-Death Deed Form

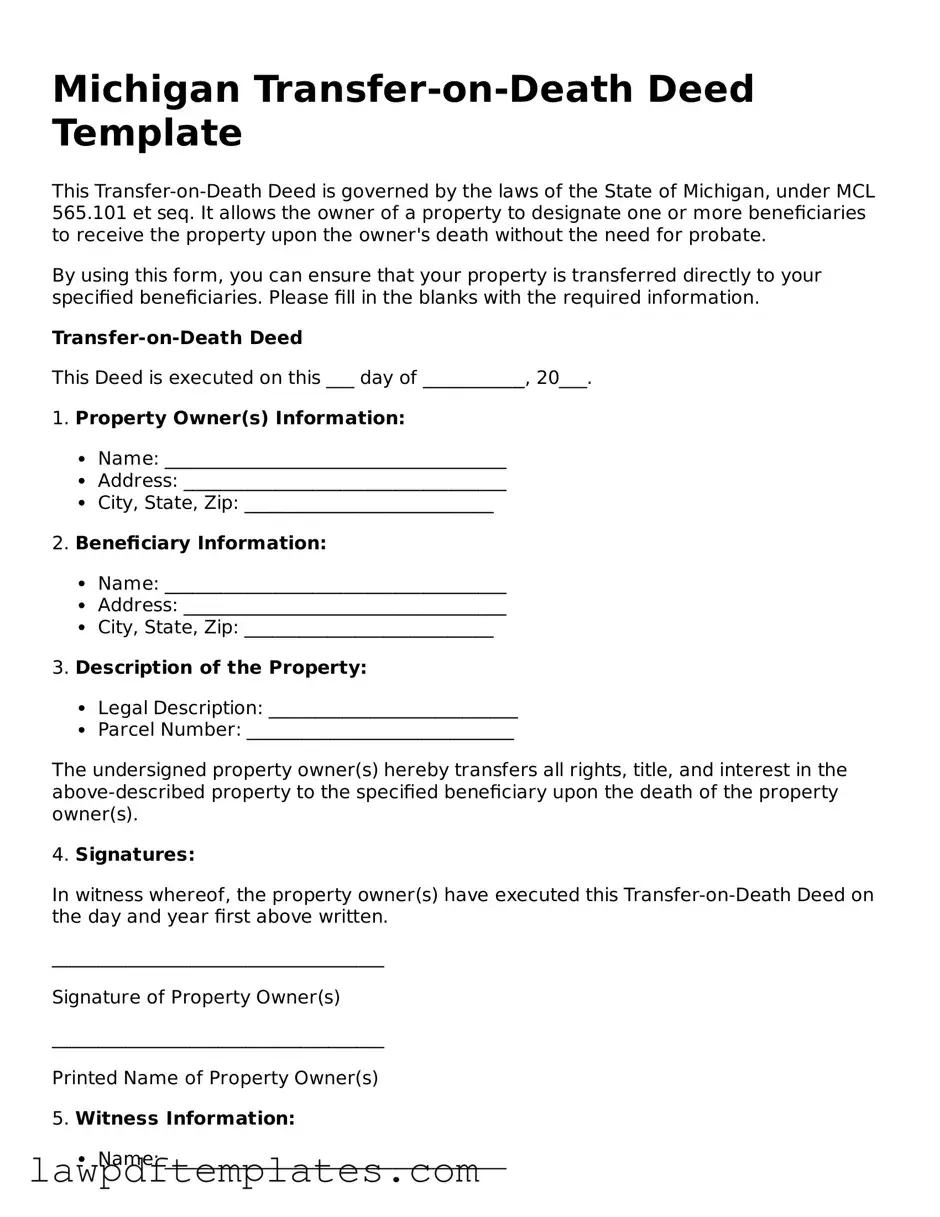

Michigan Transfer-on-Death Deed Template

This Transfer-on-Death Deed is governed by the laws of the State of Michigan, under MCL 565.101 et seq. It allows the owner of a property to designate one or more beneficiaries to receive the property upon the owner's death without the need for probate.

By using this form, you can ensure that your property is transferred directly to your specified beneficiaries. Please fill in the blanks with the required information.

Transfer-on-Death Deed

This Deed is executed on this ___ day of ___________, 20___.

1. Property Owner(s) Information:

- Name: _____________________________________

- Address: ___________________________________

- City, State, Zip: ___________________________

2. Beneficiary Information:

- Name: _____________________________________

- Address: ___________________________________

- City, State, Zip: ___________________________

3. Description of the Property:

- Legal Description: ___________________________

- Parcel Number: _____________________________

The undersigned property owner(s) hereby transfers all rights, title, and interest in the above-described property to the specified beneficiary upon the death of the property owner(s).

4. Signatures:

In witness whereof, the property owner(s) have executed this Transfer-on-Death Deed on the day and year first above written.

____________________________________

Signature of Property Owner(s)

____________________________________

Printed Name of Property Owner(s)

5. Witness Information:

- Name: _____________________________________

- Address: ___________________________________

This deed must be recorded with the County Register of Deeds in the county where the property is located to be effective.

Common mistakes

Filling out the Michigan Transfer-on-Death Deed form can be straightforward, but many people make common mistakes that can lead to complications. One frequent error is failing to include the legal description of the property. This description is essential for identifying the property in question. Without it, the deed may be deemed invalid.

Another common mistake involves not signing the deed in the presence of a notary public. Michigan law requires that the deed be notarized to ensure its authenticity. Neglecting this step can result in the deed not being recognized by the court.

People often overlook the need to provide the names and addresses of the beneficiaries. Missing this information can create confusion about who is entitled to the property upon the owner’s death. It is crucial to clearly identify all beneficiaries to avoid disputes later on.

Some individuals mistakenly believe that the Transfer-on-Death Deed can be revoked informally. In reality, any changes or revocations must be executed through a formal process. Failing to follow the correct procedure can lead to unintended consequences.

Inaccurate information about the property owner can also lead to issues. If the owner’s name is misspelled or incorrect, it can complicate the transfer process. Double-checking all personal information is vital to ensure clarity and accuracy.

Many people forget to file the deed with the appropriate county register of deeds office. Without this filing, the deed has no legal effect. It is important to complete this step to ensure the deed is enforceable.

Additionally, some individuals may not understand the implications of a Transfer-on-Death Deed. It is important to recognize that this deed does not transfer ownership while the owner is alive. Misunderstanding this can lead to confusion about property rights.

Lastly, failing to keep a copy of the filed deed can be problematic. If the original is lost, it may create difficulties in proving the transfer. Keeping a secure copy ensures that the information is readily available when needed.

Discover More Transfer-on-Death Deed Templates for Specific States

New Jersey Transfer on Death Deed - Not all states recognize Transfer-on-Death Deeds, so legal advice may be necessary.

The FedEx Bill of Lading form is a crucial document used in freight transport. It serves as a receipt for the goods being shipped and outlines the terms under which the carrier will transport these goods. To simplify the process of creating this essential document, you can utilize resources like Fast PDF Templates, which provide easy-to-use templates that help ensure that shipments are handled smoothly and that all parties are clear on their responsibilities.

Problems With Transfer on Death Deeds in Virginia - A Transfer-on-Death Deed can provide a simple, clear way to transfer family homes or investment properties.

Problems With Transfer on Death Deeds in Indiana - Enables owners to designate beneficiaries for real estate assets.