Free Promissory Note Template for the State of Michigan

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or bearer at a specified time. |

| Governing Law | In Michigan, promissory notes are governed by the Uniform Commercial Code (UCC), specifically Article 3, which deals with negotiable instruments. |

| Parties Involved | The two main parties in a promissory note are the maker (the person who promises to pay) and the payee (the person to whom the payment is promised). |

| Essential Elements | For a promissory note to be valid, it must include an unconditional promise to pay, a specific amount, and the signature of the maker. |

| Interest Rates | Interest can be included in the terms of the note, but it must comply with Michigan's usury laws, which limit the maximum interest rate that can be charged. |

| Payment Terms | Payment terms can vary; they may specify a lump-sum payment or installment payments over time. |

| Transferability | Promissory notes are generally transferable, allowing the payee to sell or assign the note to another party. |

| Default Consequences | If the maker defaults on the note, the payee has the right to pursue legal action to recover the owed amount. |

| Record Keeping | It is advisable for both parties to keep a copy of the promissory note and any related documents for their records. |

| Use Cases | Promissory notes are commonly used in personal loans, business transactions, and real estate deals. |

Sample - Michigan Promissory Note Form

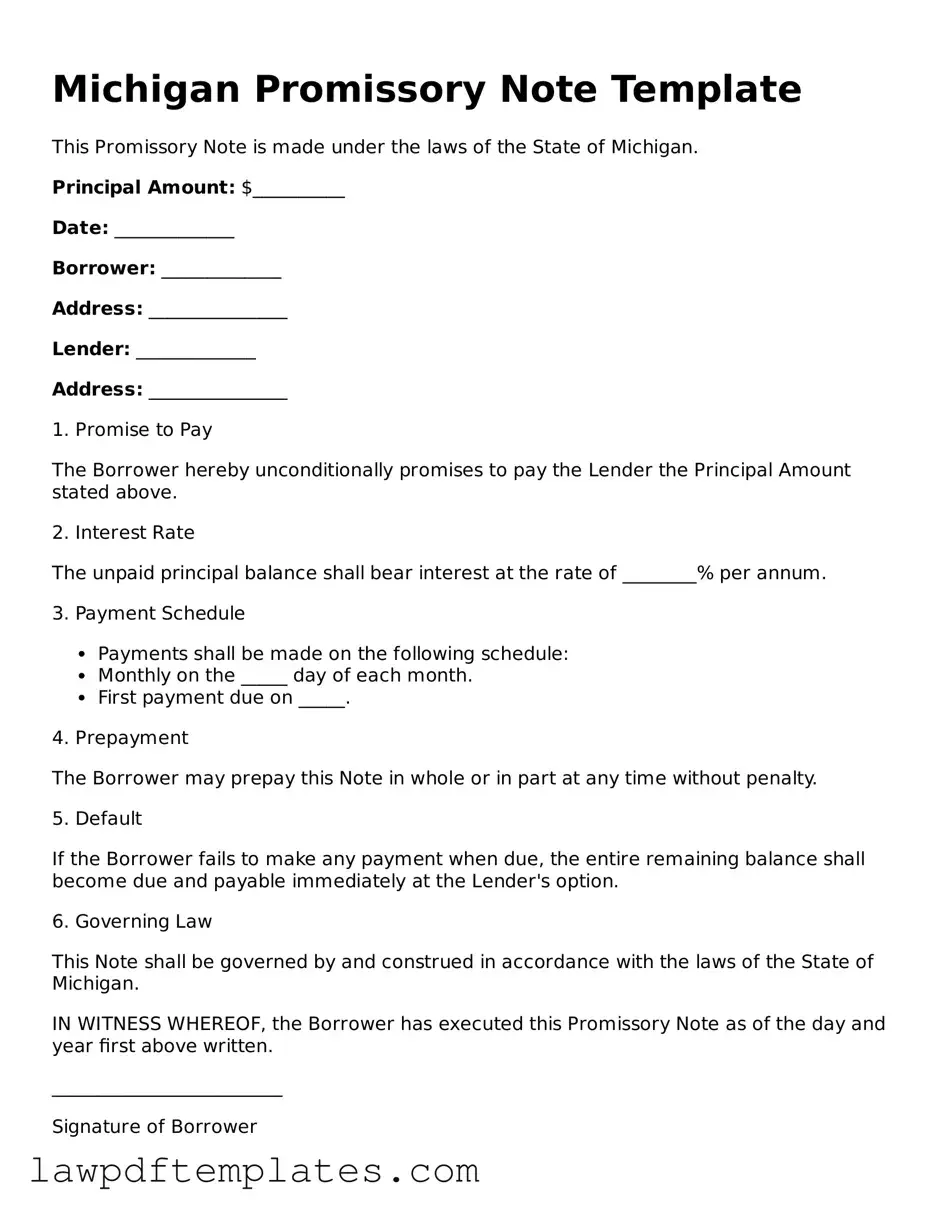

Michigan Promissory Note Template

This Promissory Note is made under the laws of the State of Michigan.

Principal Amount: $__________

Date: _____________

Borrower: _____________

Address: _______________

Lender: _____________

Address: _______________

1. Promise to Pay

The Borrower hereby unconditionally promises to pay the Lender the Principal Amount stated above.

2. Interest Rate

The unpaid principal balance shall bear interest at the rate of ________% per annum.

3. Payment Schedule

- Payments shall be made on the following schedule:

- Monthly on the _____ day of each month.

- First payment due on _____.

4. Prepayment

The Borrower may prepay this Note in whole or in part at any time without penalty.

5. Default

If the Borrower fails to make any payment when due, the entire remaining balance shall become due and payable immediately at the Lender's option.

6. Governing Law

This Note shall be governed by and construed in accordance with the laws of the State of Michigan.

IN WITNESS WHEREOF, the Borrower has executed this Promissory Note as of the day and year first above written.

_________________________

Signature of Borrower

_________________________

Signature of Lender

_________________________

Date

Common mistakes

Filling out the Michigan Promissory Note form can be straightforward, but many people still make common mistakes that can lead to complications. One frequent error is not including all necessary information. It’s crucial to provide complete details about the borrower and lender, including full names, addresses, and contact information. Omitting any of these can create confusion down the line.

Another common mistake is failing to specify the loan amount clearly. Some individuals write the amount in words but forget to include the numerical figure. This inconsistency can lead to disputes or misunderstandings regarding the exact amount owed.

People often overlook the importance of the interest rate. Whether it’s a fixed or variable rate, it must be clearly stated. Leaving this section blank or writing it ambiguously can result in disagreements later. Clarity is key.

Additionally, many forget to include the repayment terms. It’s vital to outline how and when the borrower will repay the loan. This includes specifying the payment schedule, whether it’s monthly, quarterly, or another arrangement. Without this, the borrower may not know when payments are due.

Another mistake involves signatures. Both parties must sign the document for it to be legally binding. Sometimes, people assume a verbal agreement is sufficient. A signed note is essential to enforce the agreement.

Some individuals fail to date the document. A date provides a clear timeline for the agreement and can help prevent disputes about when the loan was initiated. Always include the date when signing.

In some cases, people might not consider the need for witnesses or notarization. While not always required, having a witness or a notary can add an extra layer of security and authenticity to the document.

People also tend to ignore the importance of reviewing the entire document before submitting it. Errors can be missed if one rushes through the process. Taking the time to double-check can save a lot of trouble later.

Lastly, many individuals do not keep a copy of the signed Promissory Note. It’s essential to retain a copy for personal records. This ensures that both parties have access to the terms agreed upon and can refer back to them if needed.

By avoiding these common mistakes, individuals can ensure that their Michigan Promissory Note is filled out correctly, leading to a smoother lending process.

Discover More Promissory Note Templates for Specific States

Promissory Note Ohio - The promissory note provides a sense of security in personal and business loans.

Loan Note Template - In addition to financial terms, a promissory note may include governing law provisions for legal context.

The Free And Invoice PDF form is a document used to create and send invoices in a standardized format. This form simplifies the billing process for businesses, making it easier to communicate payment details and request funds. By using this form, businesses can maintain professionalism and efficiency in their invoicing procedures, and for those interested, a great resource for this is Fast PDF Templates.

Promissory Note Template California Word - Defaulting on a promissory note can severely affect credit ratings.