Free Lady Bird Deed Template for the State of Michigan

Form Breakdown

| Fact Name | Description |

|---|---|

| What is a Lady Bird Deed? | A Lady Bird Deed is a type of transfer deed that allows property owners to transfer their property to beneficiaries while retaining the right to live in and control the property during their lifetime. |

| Governing Law | The Lady Bird Deed is governed by Michigan law, specifically under the Michigan Compiled Laws, Act 368 of 1978. |

| Benefits of a Lady Bird Deed | This deed helps avoid probate, allows for easy transfer of property upon death, and can provide tax benefits. |

| Retained Rights | The property owner retains the right to use, sell, or mortgage the property without the beneficiaries' consent during their lifetime. |

| Beneficiary Designation | Property owners can name one or more beneficiaries in the deed, ensuring that the property passes directly to them after the owner's death. |

| Revocation | A Lady Bird Deed can be revoked or altered at any time by the property owner, provided they are of sound mind. |

| Tax Implications | While a Lady Bird Deed can help avoid probate, it may have implications for property taxes and capital gains taxes, which should be considered. |

| Eligibility | Any individual who owns real estate in Michigan can create a Lady Bird Deed, as long as they are competent to do so. |

| Execution Requirements | The deed must be signed by the property owner and notarized to be legally valid in Michigan. |

Sample - Michigan Lady Bird Deed Form

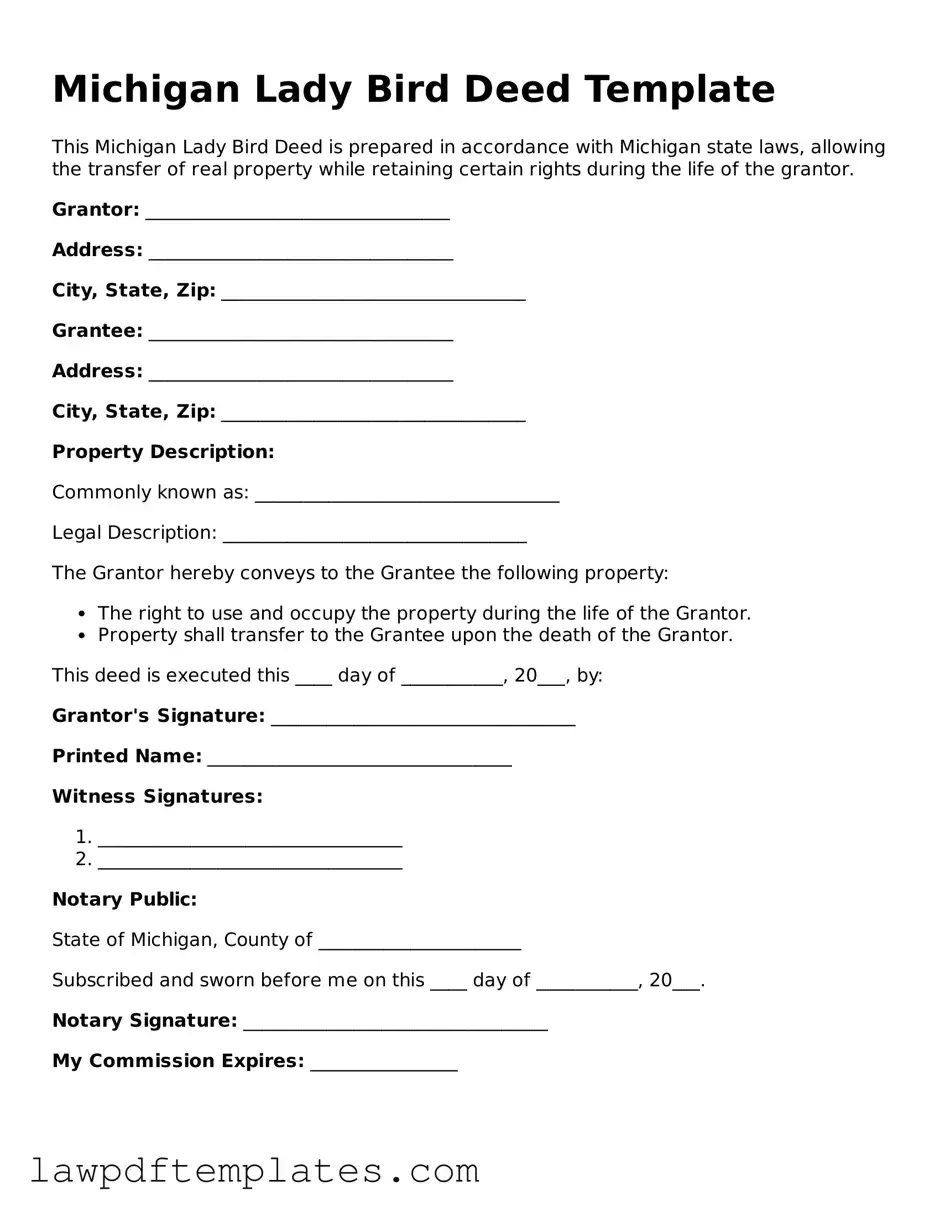

Michigan Lady Bird Deed Template

This Michigan Lady Bird Deed is prepared in accordance with Michigan state laws, allowing the transfer of real property while retaining certain rights during the life of the grantor.

Grantor: _________________________________

Address: _________________________________

City, State, Zip: _________________________________

Grantee: _________________________________

Address: _________________________________

City, State, Zip: _________________________________

Property Description:

Commonly known as: _________________________________

Legal Description: _________________________________

The Grantor hereby conveys to the Grantee the following property:

- The right to use and occupy the property during the life of the Grantor.

- Property shall transfer to the Grantee upon the death of the Grantor.

This deed is executed this ____ day of ___________, 20___, by:

Grantor's Signature: _________________________________

Printed Name: _________________________________

Witness Signatures:

- _________________________________

- _________________________________

Notary Public:

State of Michigan, County of ______________________

Subscribed and sworn before me on this ____ day of ___________, 20___.

Notary Signature: _________________________________

My Commission Expires: ________________

Common mistakes

Filling out the Michigan Lady Bird Deed form can be a straightforward process, but many people make common mistakes that can lead to complications down the line. One frequent error is failing to include all necessary parties. When transferring property, it’s essential to list all individuals who have an ownership interest. Omitting a co-owner can create legal challenges and may invalidate the deed.

Another mistake involves the description of the property. The property must be accurately described to avoid confusion. This includes providing the correct address and legal description. Inaccurate information can lead to disputes or difficulties in future transactions. Double-checking this section can save a lot of trouble later.

People often overlook the importance of signatures. The Lady Bird Deed must be signed by the grantor—this is the person transferring the property. If the grantor is married, both spouses should sign unless the property is solely owned. Missing signatures can render the deed ineffective, so it’s crucial to ensure all necessary parties have signed.

Another common issue arises with notarization. The deed must be notarized to be legally binding. Failing to have the document notarized can lead to complications in property transfer. It’s advisable to visit a notary public after completing the form to ensure this step is not skipped.

Some individuals also neglect to consider the tax implications of a Lady Bird Deed. While this type of deed can help avoid probate, it may still have tax consequences. Consulting with a tax professional before filing can provide clarity and help avoid unexpected liabilities.

Additionally, people sometimes misunderstand the implications of retaining a life estate. The Lady Bird Deed allows the grantor to retain control over the property during their lifetime. However, misunderstanding this concept can lead to unintended consequences regarding property management and inheritance. It’s vital to grasp what it means to retain a life estate fully.

Lastly, failing to record the deed is a mistake that can have lasting effects. After completing and notarizing the Lady Bird Deed, it must be recorded with the county register of deeds. Not recording the deed can lead to disputes over ownership and can complicate future property transactions. Ensuring the deed is filed properly is a critical final step.

Discover More Lady Bird Deed Templates for Specific States

How to Get a Lady Bird Deed in Florida - The document can be advantageous for tax planning, offering potential for savings in property taxes.

For those looking to secure their rental agreements, our guide to the important Residential Lease Agreement essentials provides valuable insights into the necessary documentation and potential pitfalls that landlords and tenants should avoid.

Lady Bird Deed North Carolina - The deed allows owners to retain the right to live in the property for life.