Free Deed Template for the State of Michigan

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | The Michigan Deed form is a legal document used to transfer ownership of real property in Michigan. |

| Types of Deeds | Common types include Warranty Deed, Quit Claim Deed, and Special Warranty Deed. |

| Governing Laws | The Michigan Compiled Laws, specifically Act 200 of 1963, governs property transfers. |

| Signature Requirement | The grantor must sign the deed in the presence of a notary public. |

| Recording | To be effective against third parties, the deed must be recorded with the county register of deeds. |

| Consideration | The deed should state the consideration, or payment, for the property transfer. |

| Legal Description | A complete legal description of the property must be included in the deed. |

| Tax Implications | Property transfers may have tax consequences, including transfer taxes. |

| Use of the Form | The form can be used by individuals or entities transferring property in Michigan. |

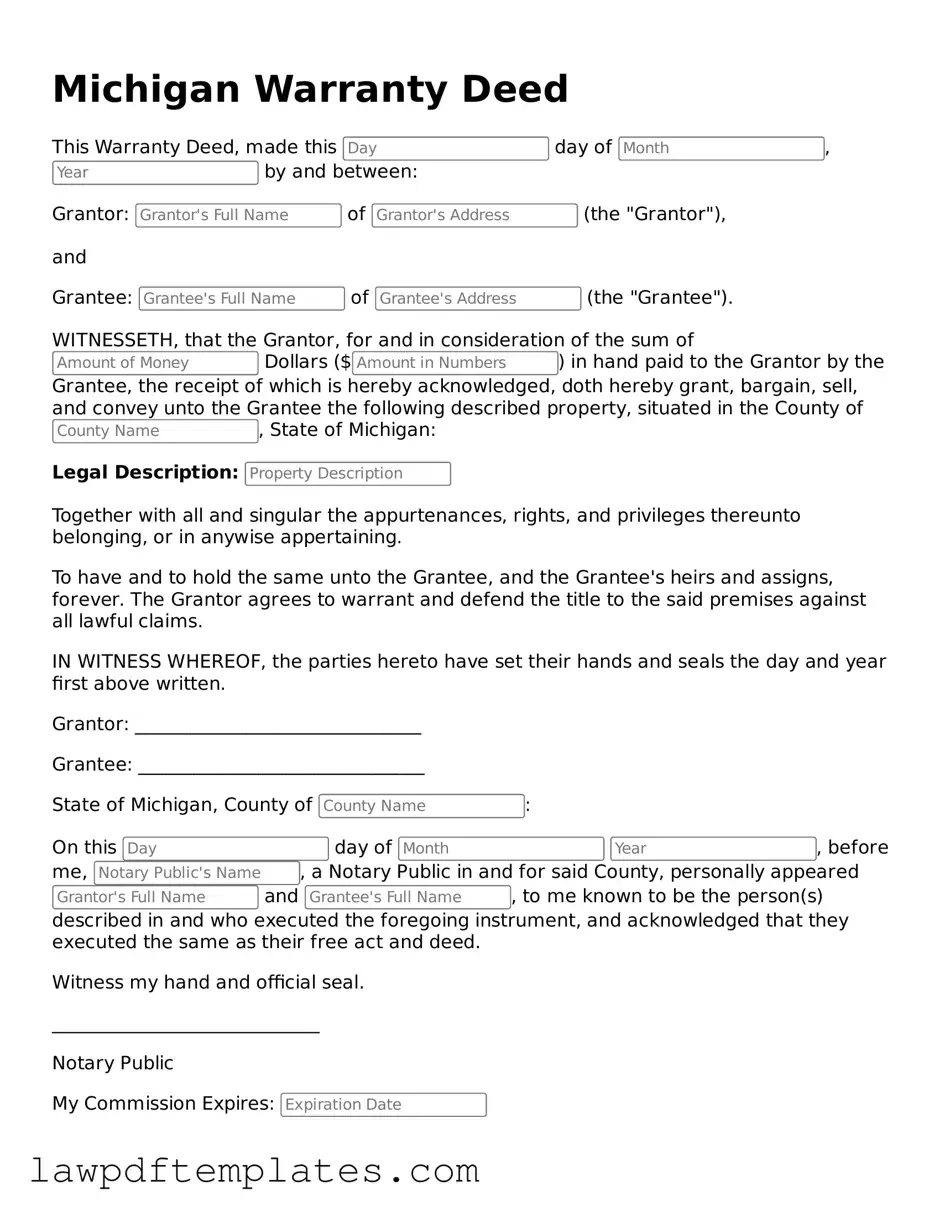

Sample - Michigan Deed Form

Michigan Warranty Deed

This Warranty Deed, made this day of , by and between:

Grantor: of (the "Grantor"),

and

Grantee: of (the "Grantee").

WITNESSETH, that the Grantor, for and in consideration of the sum of Dollars ($) in hand paid to the Grantor by the Grantee, the receipt of which is hereby acknowledged, doth hereby grant, bargain, sell, and convey unto the Grantee the following described property, situated in the County of , State of Michigan:

Legal Description:

Together with all and singular the appurtenances, rights, and privileges thereunto belonging, or in anywise appertaining.

To have and to hold the same unto the Grantee, and the Grantee's heirs and assigns, forever. The Grantor agrees to warrant and defend the title to the said premises against all lawful claims.

IN WITNESS WHEREOF, the parties hereto have set their hands and seals the day and year first above written.

Grantor: _______________________________

Grantee: _______________________________

State of Michigan, County of :

On this day of , before me, , a Notary Public in and for said County, personally appeared and , to me known to be the person(s) described in and who executed the foregoing instrument, and acknowledged that they executed the same as their free act and deed.

Witness my hand and official seal.

_____________________________

Notary Public

My Commission Expires:

Common mistakes

Filling out a Michigan Deed form can be a straightforward process, but many individuals encounter common pitfalls that can lead to complications. One prevalent mistake is failing to include the correct legal description of the property. It is essential to provide a precise and accurate description, as this information identifies the property in question. Omitting or incorrectly describing the property can result in legal disputes or issues with future transactions.

Another frequent error is neglecting to include all necessary parties. Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly identified. If any party is missing or incorrectly named, it could invalidate the deed. It is crucial to ensure that names are spelled correctly and match the names on official identification.

Many individuals also overlook the requirement for signatures. The deed must be signed by the grantor, and in some cases, the grantee may also need to sign. Additionally, the signatures should be notarized to validate the document. Failing to obtain notarization can lead to challenges in proving the authenticity of the deed.

Another common mistake involves the date of execution. The deed should clearly indicate the date it was signed. If this information is missing or incorrectly entered, it can create confusion regarding the effective date of the property transfer. This can affect the rights of the parties involved and potentially lead to disputes.

People often forget to check the requirements for witnesses. In Michigan, certain types of deeds may require witnesses to the signing. Not including witnesses when necessary can render the deed invalid. It is important to verify the specific requirements based on the type of deed being used.

In addition, individuals may fail to provide the correct tax information. Michigan has specific requirements regarding property transfer taxes, and neglecting to include this information can result in penalties. Ensuring that all tax-related details are accurate and complete is vital for compliance with state regulations.

Another mistake is using outdated forms. Laws and regulations can change, and using an old version of the deed form may lead to errors or omissions. Always ensure that the most current form is being utilized to avoid complications.

Some individuals may also misinterpret the purpose of the deed. A deed is not a contract for sale; it is a legal document that transfers ownership. Confusing the two can lead to misunderstandings about rights and responsibilities associated with the property.

Lastly, individuals sometimes neglect to keep copies of the completed deed. After the deed has been filled out and submitted, it is essential to retain a copy for personal records. This documentation can be crucial for future reference or in the event of disputes regarding property ownership.

By being aware of these common mistakes, individuals can approach the Michigan Deed form with greater confidence and accuracy. Taking the time to ensure that all details are correct can help facilitate a smoother property transfer process.

Discover More Deed Templates for Specific States

Grant Deed California - The Deed can also outline any easements or rights of way pertaining to the property.

How Do I Get My Deed to My House - Transferring a property via a deed can affect property tax assessments and exemptions.

The Texas RV Bill of Sale is an important legal document that ensures a smooth transaction when buying or selling a recreational vehicle in Texas. It captures vital details about the vehicle along with the identities of the seller and the buyer, serving as essential proof of purchase. For those looking to access this document conveniently, you can find it through PDF Documents Hub, which simplifies the process further.

Arizona Warranty Deed Form - It protects both the buyer and seller during the property transaction process.

Broward County Recorder of Deeds - The seller's signature must match their name on the title for the deed to be valid.