Free Transfer-on-Death Deed Template for the State of Massachusetts

Form Breakdown

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners in Massachusetts to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Massachusetts Transfer-on-Death Deed is governed by Massachusetts General Laws, Chapter 190B, Section 2-513. |

| Beneficiary Designation | Property owners can name one or more beneficiaries in the deed. This designation is revocable and can be changed at any time before the owner's death. |

| Execution Requirements | The deed must be signed by the property owner and notarized. It also needs to be recorded in the registry of deeds in the county where the property is located. |

| Advantages | This deed avoids the lengthy probate process, allowing beneficiaries to gain immediate access to the property after the owner's death. |

Sample - Massachusetts Transfer-on-Death Deed Form

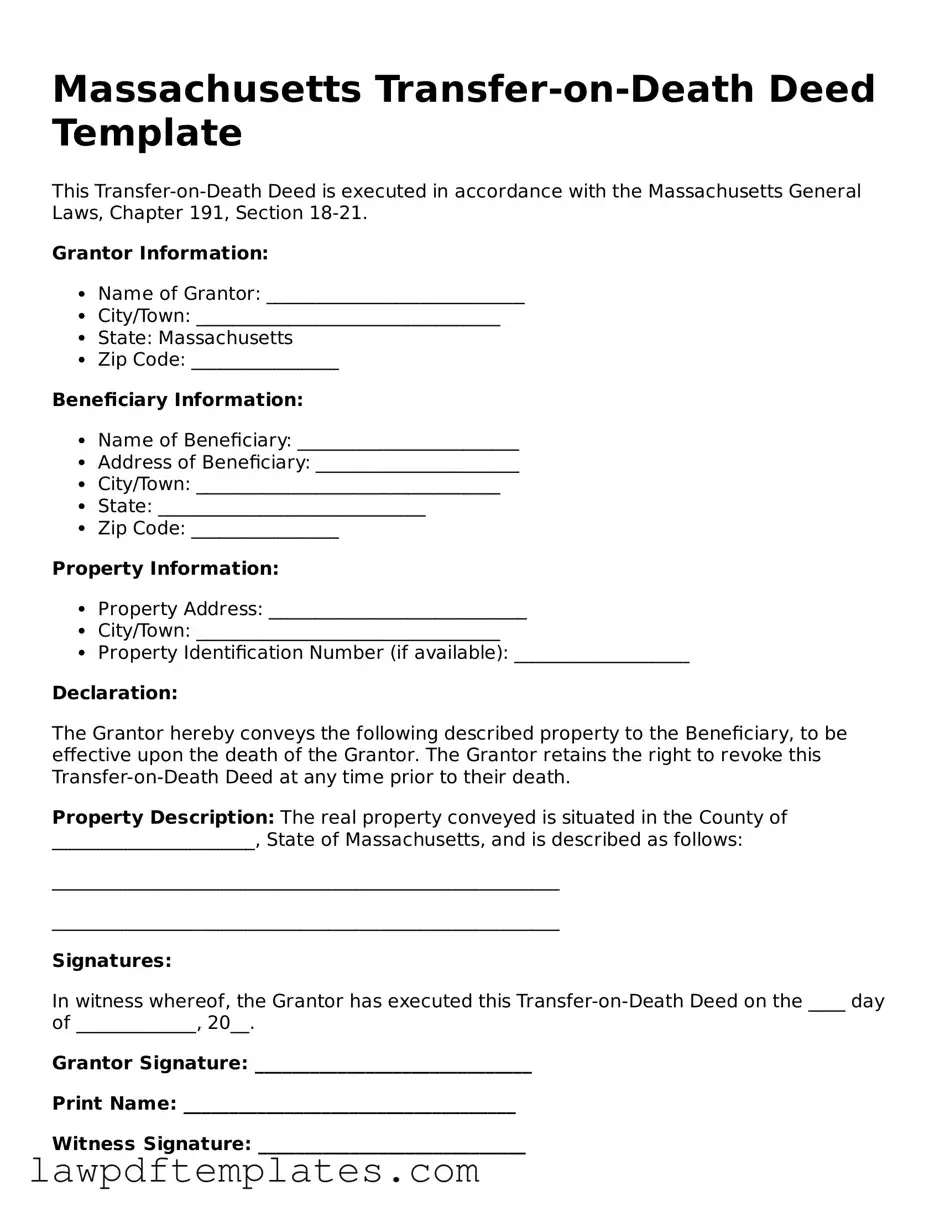

Massachusetts Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the Massachusetts General Laws, Chapter 191, Section 18-21.

Grantor Information:

- Name of Grantor: ____________________________

- City/Town: _________________________________

- State: Massachusetts

- Zip Code: ________________

Beneficiary Information:

- Name of Beneficiary: ________________________

- Address of Beneficiary: ______________________

- City/Town: _________________________________

- State: _____________________________

- Zip Code: ________________

Property Information:

- Property Address: ____________________________

- City/Town: _________________________________

- Property Identification Number (if available): ___________________

Declaration:

The Grantor hereby conveys the following described property to the Beneficiary, to be effective upon the death of the Grantor. The Grantor retains the right to revoke this Transfer-on-Death Deed at any time prior to their death.

Property Description: The real property conveyed is situated in the County of ______________________, State of Massachusetts, and is described as follows:

_______________________________________________________

_______________________________________________________

Signatures:

In witness whereof, the Grantor has executed this Transfer-on-Death Deed on the ____ day of _____________, 20__.

Grantor Signature: ______________________________

Print Name: ____________________________________

Witness Signature: _____________________________

Print Name: ____________________________________

Notary Public:

State of Massachusetts

County of ____________________________

On this ____ day of _____________, 20__, before me, a Notary Public in and for said State, personally appeared ________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that he/she executed the same for the purposes therein contained.

Witness my hand and official seal.

Notary Signature: _____________________________

My commission expires: _________________________

Common mistakes

Filling out the Massachusetts Transfer-on-Death Deed form can seem straightforward, but many people stumble along the way. One common mistake is not providing complete information about the property. Every detail counts, from the address to the legal description. Omitting even a small piece of information can lead to confusion and potential legal issues down the line.

Another frequent error is failing to properly identify the beneficiaries. It’s crucial to include full names and any relevant details, such as their relationship to the property owner. Inaccurate or vague beneficiary information can create complications when it comes time to transfer ownership.

Many individuals overlook the importance of signing the deed in front of a notary public. This step is not just a formality; it ensures that the document is legally binding. Without a proper signature and notarization, the deed may not hold up in court, leaving the intended transfer in limbo.

People often forget to record the Transfer-on-Death Deed with the local registry of deeds. Even if the form is filled out correctly, failing to record it means that the deed is not effective. Recording the deed is essential to ensure that the transfer of property occurs as intended upon the owner’s passing.

Another mistake involves not considering tax implications. While the Transfer-on-Death Deed allows for a smooth transfer of property, it’s wise to understand how it may affect estate taxes. Consulting with a tax professional can provide clarity and help avoid unexpected financial burdens.

Some individuals neglect to update the deed after significant life changes, such as marriage, divorce, or the birth of a child. If the deed does not reflect current circumstances, it may not accurately convey the owner’s wishes. Regularly reviewing and updating the deed is a smart practice.

Additionally, many people fail to communicate their plans with the beneficiaries. It’s important to have open conversations about the deed and what it means for the future. This transparency can prevent misunderstandings and ensure that everyone is on the same page.

Lastly, individuals sometimes underestimate the need for legal advice. While it’s possible to fill out the form independently, seeking guidance from a legal professional can provide peace of mind. They can help navigate the nuances of the process and ensure that everything is in order, ultimately safeguarding the owner’s wishes.

Discover More Transfer-on-Death Deed Templates for Specific States

Problems With Transfer on Death Deeds in Virginia - If the owner wishes to change beneficiaries, they can do so without altering their entire estate plan.

For individuals engaged in trailer transactions, the documentation involved is crucial, and understanding the importance of a well-prepared Trailer Bill of Sale form is vital. Utilizing a reliable resource can simplify the process; visit this page for a comprehensive overview of the necessary Trailer Bill of Sale documentation.

Todi Illinois - Property owners can name one or multiple beneficiaries, allowing for shared inheritance among family members.