Free Promissory Note Template for the State of Massachusetts

Form Breakdown

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Massachusetts Uniform Commercial Code (UCC) governs promissory notes in Massachusetts. |

| Parties Involved | The parties typically involved are the maker (the person who promises to pay) and the payee (the person to whom the payment is owed). |

| Interest Rate | The note may specify an interest rate. If not, Massachusetts law allows for a reasonable rate. |

| Payment Terms | Payment terms, including due date and payment method, must be clearly outlined in the note. |

| Transferability | Promissory notes are generally transferable, allowing the payee to sell or assign the note to another party. |

| Default Consequences | In case of default, the payee may pursue legal action to collect the owed amount. |

| Signature Requirement | The maker must sign the promissory note for it to be legally binding. |

| Notarization | While notarization is not required, it can provide additional legal protection for the parties involved. |

Sample - Massachusetts Promissory Note Form

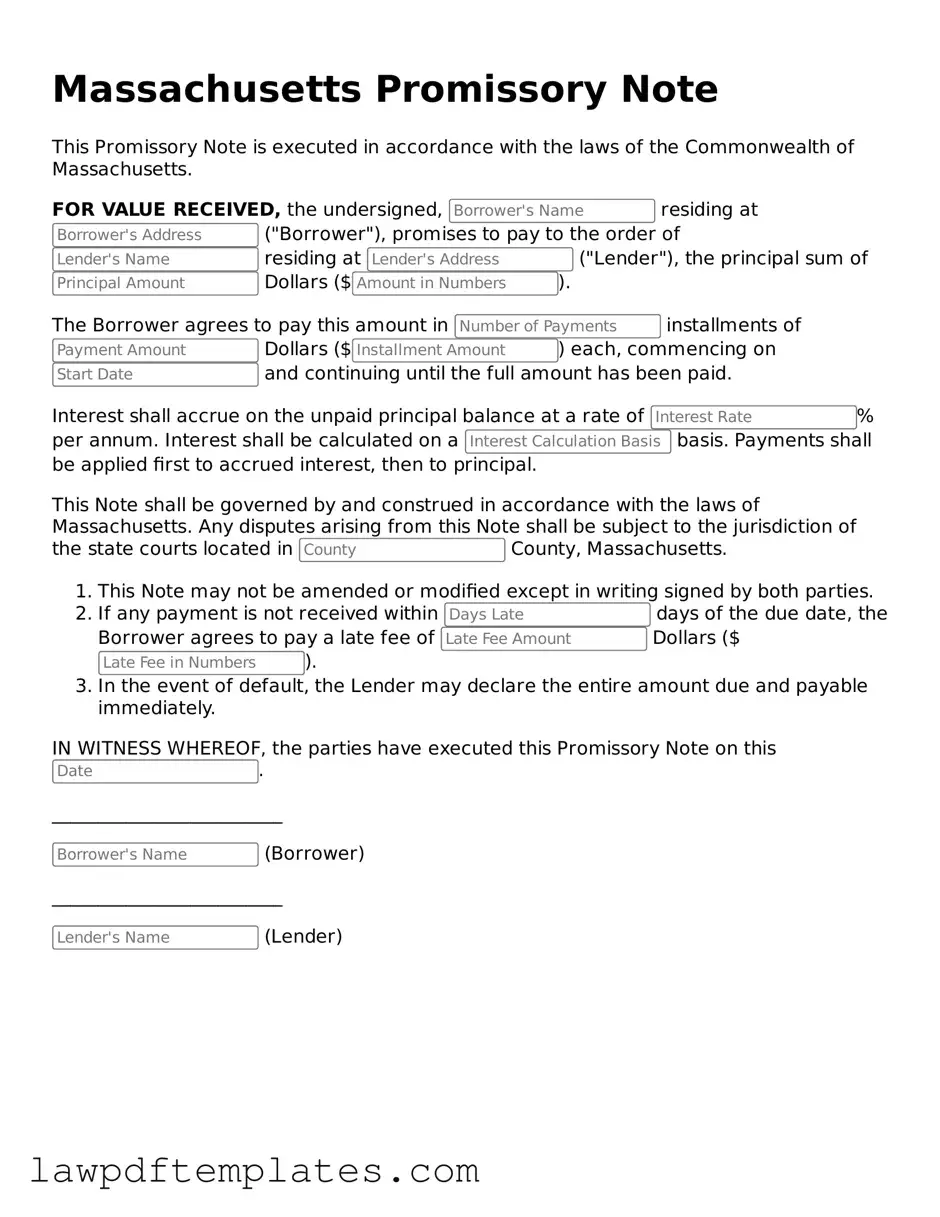

Massachusetts Promissory Note

This Promissory Note is executed in accordance with the laws of the Commonwealth of Massachusetts.

FOR VALUE RECEIVED, the undersigned, residing at ("Borrower"), promises to pay to the order of residing at ("Lender"), the principal sum of Dollars ($).

The Borrower agrees to pay this amount in installments of Dollars ($) each, commencing on and continuing until the full amount has been paid.

Interest shall accrue on the unpaid principal balance at a rate of % per annum. Interest shall be calculated on a basis. Payments shall be applied first to accrued interest, then to principal.

This Note shall be governed by and construed in accordance with the laws of Massachusetts. Any disputes arising from this Note shall be subject to the jurisdiction of the state courts located in County, Massachusetts.

- This Note may not be amended or modified except in writing signed by both parties.

- If any payment is not received within days of the due date, the Borrower agrees to pay a late fee of Dollars ($).

- In the event of default, the Lender may declare the entire amount due and payable immediately.

IN WITNESS WHEREOF, the parties have executed this Promissory Note on this .

_________________________

(Borrower)

_________________________

(Lender)

Common mistakes

Filling out the Massachusetts Promissory Note form can be straightforward, but many people make common mistakes that can lead to confusion or legal issues. One frequent error is neglecting to include all necessary information. It’s essential to provide complete details, including the names and addresses of both the borrower and the lender. Omitting even one piece of information can create complications down the line.

Another mistake often made is failing to specify the loan amount clearly. This figure should be written in both numerical and written form to avoid misunderstandings. For example, if the amount is $5,000, it should be noted as “Five Thousand Dollars ($5,000).” This redundancy helps ensure clarity.

People sometimes overlook the importance of stating the interest rate. If there is an interest charge, it should be clearly articulated. Leaving this out may lead to disputes regarding how much the borrower is expected to repay. Even if the loan is interest-free, it is wise to indicate this explicitly in the document.

Additionally, many individuals forget to include the repayment terms. This section should outline how and when payments will be made. Without clear terms, both parties may have different expectations, which can lead to conflict. It's crucial to define whether payments will be made monthly, quarterly, or in a lump sum.

Another common error involves signatures. Both the borrower and lender must sign the document for it to be legally binding. Failing to obtain both signatures can render the note invalid. It's also important to date the signatures to establish when the agreement was made.

Some people may not consider the need for witnesses or notarization. While not always required, having a witness or a notary public can provide additional security and legitimacy to the agreement. This step can be especially important in disputes.

Lastly, individuals may neglect to keep copies of the signed Promissory Note. It’s crucial for both parties to retain a copy for their records. This helps ensure that everyone has access to the same information and can refer back to the terms of the agreement if needed.

Discover More Promissory Note Templates for Specific States

Promissory Note Template Georgia - It details the responsibilities of the borrower and the rights of the lender.

Promissory Note Arizona - It can be used for personal loans, business loans, or real estate transactions.

For those looking to complete their vehicle transactions with clarity, the Texas Vehicle Purchase Agreement form is available through various online resources, including PDF Documents Hub, which provides easy access to this essential document.

Promissory Note Ohio - This document is essential for ensuring compliance with lending regulations.