Free Operating Agreement Template for the State of Massachusetts

Form Breakdown

| Fact Name | Description |

|---|---|

| Governing Law | The Massachusetts Operating Agreement is governed by the Massachusetts Limited Liability Company Act, specifically M.G.L. c. 156C. |

| Purpose | This agreement outlines the management structure and operating procedures for a limited liability company (LLC) in Massachusetts. |

| Members | All members of the LLC should be included in the operating agreement, detailing their rights and responsibilities. |

| Flexibility | The operating agreement allows for flexibility in terms of management and profit distribution among members. |

| Internal Governance | This document serves as the internal governing document for the LLC, superseding default state laws. |

| Amendments | Amendments to the operating agreement can be made, provided they follow the procedures outlined within the agreement itself. |

| Not Mandatory | While not required by law, having an operating agreement is highly recommended to prevent disputes among members. |

Sample - Massachusetts Operating Agreement Form

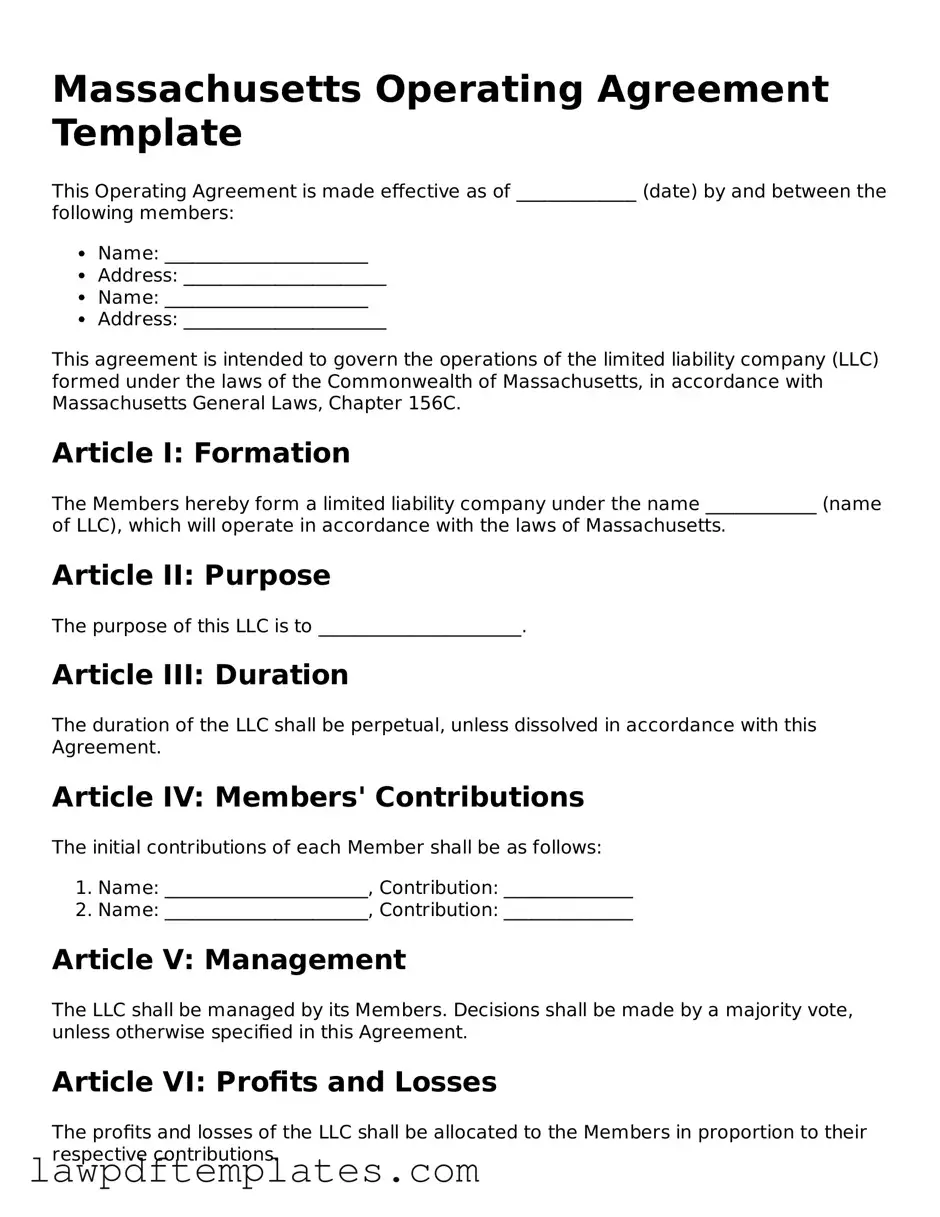

Massachusetts Operating Agreement Template

This Operating Agreement is made effective as of _____________ (date) by and between the following members:

- Name: ______________________

- Address: ______________________

- Name: ______________________

- Address: ______________________

This agreement is intended to govern the operations of the limited liability company (LLC) formed under the laws of the Commonwealth of Massachusetts, in accordance with Massachusetts General Laws, Chapter 156C.

Article I: Formation

The Members hereby form a limited liability company under the name ____________ (name of LLC), which will operate in accordance with the laws of Massachusetts.

Article II: Purpose

The purpose of this LLC is to ______________________.

Article III: Duration

The duration of the LLC shall be perpetual, unless dissolved in accordance with this Agreement.

Article IV: Members' Contributions

The initial contributions of each Member shall be as follows:

- Name: ______________________, Contribution: ______________

- Name: ______________________, Contribution: ______________

Article V: Management

The LLC shall be managed by its Members. Decisions shall be made by a majority vote, unless otherwise specified in this Agreement.

Article VI: Profits and Losses

The profits and losses of the LLC shall be allocated to the Members in proportion to their respective contributions.

Article VII: Distributions

Distributions shall be made to the Members at the times and in the amounts determined by a majority vote of the Members.

Article VIII: Miscellaneous

- This Agreement may be amended only by a written agreement signed by all Members.

- This Agreement shall be governed by the laws of the Commonwealth of Massachusetts.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the day and year first above written.

______________________

Member Signature

______________________

Member Signature

Common mistakes

When filling out the Massachusetts Operating Agreement form, individuals often make several common mistakes that can lead to complications down the line. One frequent error is failing to clearly define the roles and responsibilities of each member. This lack of clarity can result in misunderstandings and disputes among members regarding their duties and decision-making authority.

Another mistake is neglecting to include provisions for handling disputes. Without a clear process for resolving conflicts, members may find themselves in prolonged disagreements that could hinder the operation of the business. Establishing a dispute resolution mechanism, such as mediation or arbitration, is crucial for maintaining harmony within the organization.

Additionally, many people overlook the importance of specifying how profits and losses will be distributed among members. Failing to address this can lead to confusion and dissatisfaction, particularly if members have different expectations about their share of the business's financial outcomes. A well-defined distribution plan is essential for aligning member interests and ensuring fair treatment.

Lastly, some individuals mistakenly assume that the Operating Agreement is a one-time document that does not require updates. In reality, as the business evolves, so too should the agreement. Regularly reviewing and amending the Operating Agreement to reflect changes in membership, business structure, or operational procedures is vital for keeping the agreement relevant and effective.

Discover More Operating Agreement Templates for Specific States

Create an Operating Agreement - This form often includes initial capital contributions from members.

For those looking to simplify their transactions, using a Washington Bill of Sale can be beneficial, and you can easily access the necessary form through PDF Documents Hub, ensuring all aspects of the transfer are documented clearly and legally.

Llc Operating Agreement Michigan - It often includes information on how meetings will be conducted.

Operating Agreement Florida - Helps establish the procedures for handling conflicts of interest.