Free Last Will and Testament Template for the State of Massachusetts

Form Breakdown

| Fact Name | Details |

|---|---|

| Governing Law | The Massachusetts Last Will and Testament is governed by Massachusetts General Laws Chapter 190B. |

| Age Requirement | Individuals must be at least 18 years old to create a valid will in Massachusetts. |

| Witness Requirement | The will must be signed by at least two witnesses who are present at the same time. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the original document. |

| Holographic Wills | Massachusetts recognizes holographic wills, which are handwritten and do not require witnesses if signed by the testator. |

| Executor Appointment | The will allows the testator to appoint an executor to manage the estate after death. |

| Codicils | Changes to a will can be made through a codicil, which must also meet the same formal requirements as the original will. |

| Probate Process | After death, the will must go through the probate process to be validated and executed. |

Sample - Massachusetts Last Will and Testament Form

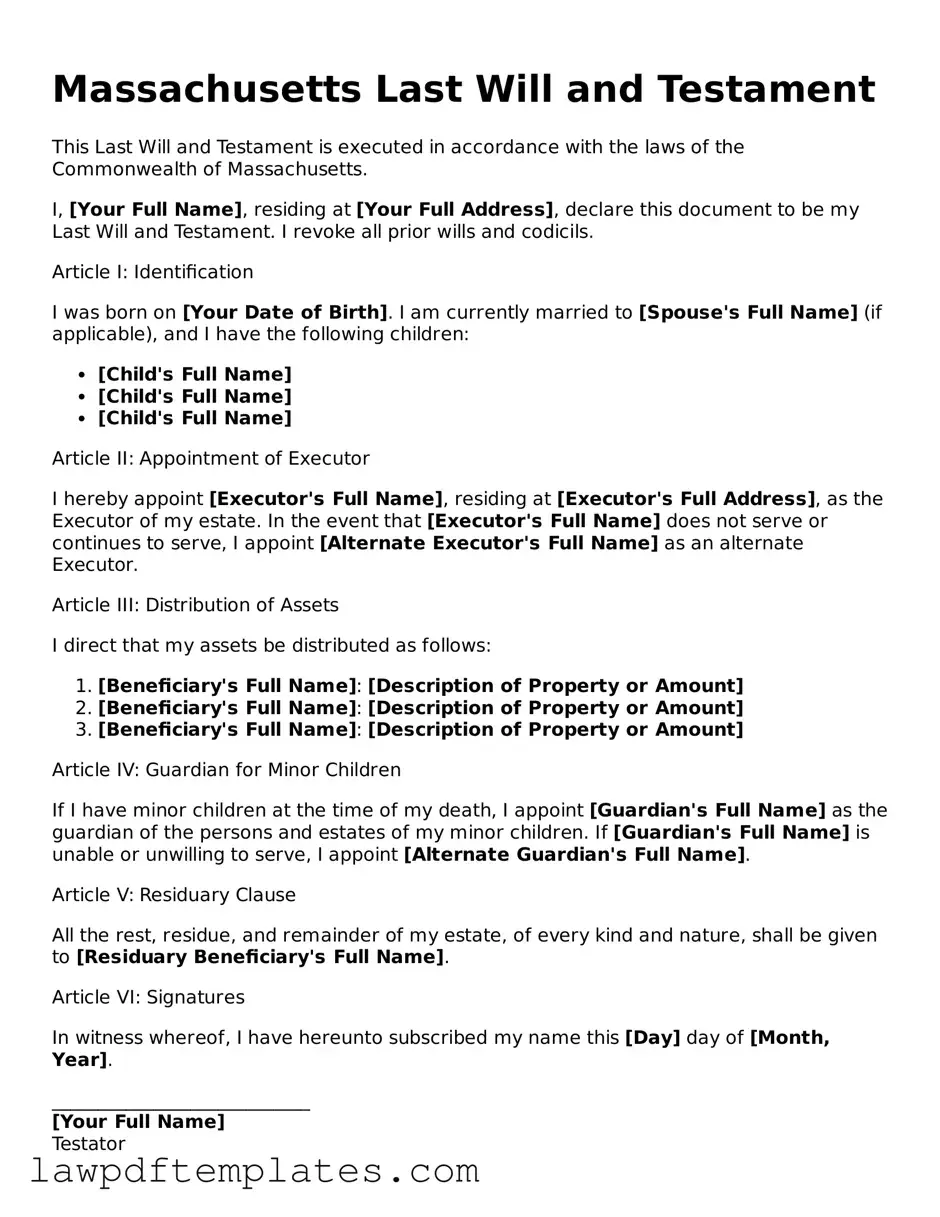

Massachusetts Last Will and Testament

This Last Will and Testament is executed in accordance with the laws of the Commonwealth of Massachusetts.

I, [Your Full Name], residing at [Your Full Address], declare this document to be my Last Will and Testament. I revoke all prior wills and codicils.

Article I: Identification

I was born on [Your Date of Birth]. I am currently married to [Spouse's Full Name] (if applicable), and I have the following children:

- [Child's Full Name]

- [Child's Full Name]

- [Child's Full Name]

Article II: Appointment of Executor

I hereby appoint [Executor's Full Name], residing at [Executor's Full Address], as the Executor of my estate. In the event that [Executor's Full Name] does not serve or continues to serve, I appoint [Alternate Executor's Full Name] as an alternate Executor.

Article III: Distribution of Assets

I direct that my assets be distributed as follows:

- [Beneficiary's Full Name]: [Description of Property or Amount]

- [Beneficiary's Full Name]: [Description of Property or Amount]

- [Beneficiary's Full Name]: [Description of Property or Amount]

Article IV: Guardian for Minor Children

If I have minor children at the time of my death, I appoint [Guardian's Full Name] as the guardian of the persons and estates of my minor children. If [Guardian's Full Name] is unable or unwilling to serve, I appoint [Alternate Guardian's Full Name].

Article V: Residuary Clause

All the rest, residue, and remainder of my estate, of every kind and nature, shall be given to [Residuary Beneficiary's Full Name].

Article VI: Signatures

In witness whereof, I have hereunto subscribed my name this [Day] day of [Month, Year].

____________________________

[Your Full Name]

Testator

Witnesses

We, the undersigned witnesses, declare that we witnessed the signing of this Last Will and Testament by the above-named Testator, who appears to be of sound mind, and at the Testator’s request, we set our hands as witnesses in the presence of the Testator. We affirm that we are not beneficiaries of this Will.

____________________________

[Witness #1 Name]

Address: [Witness #1 Address]

____________________________

[Witness #2 Name]

Address: [Witness #2 Address]

Common mistakes

Filling out a Last Will and Testament form in Massachusetts can be a straightforward process, but many individuals make critical mistakes that can lead to complications later. One common error is failing to properly identify beneficiaries. It is essential to include full names and, if possible, addresses of all beneficiaries. Without this information, disputes may arise over who is entitled to receive specific assets.

Another frequent mistake involves not signing the document correctly. In Massachusetts, a will must be signed by the testator in the presence of at least two witnesses. If the signature is missing or if the witnesses do not sign in the presence of the testator, the will may be deemed invalid. Ensuring that all parties fulfill their roles correctly is crucial for the will's enforceability.

People often overlook the importance of updating their wills. Life changes such as marriage, divorce, or the birth of a child can significantly affect how assets should be distributed. Failing to revise the will to reflect these changes can lead to unintended consequences, such as excluding a new family member or leaving assets to an ex-spouse.

Lastly, individuals sometimes neglect to consider tax implications. While Massachusetts does not have an estate tax for estates under a certain threshold, there may still be other tax considerations to keep in mind. Consulting with a financial advisor or tax professional can help ensure that the will is structured in a way that minimizes tax burdens on beneficiaries.

Discover More Last Will and Testament Templates for Specific States

Georgia Will Template - Essential for anyone looking to ensure their wishes are respected and their loved ones provided for.

Free Ohio Last Will and Testament Form Pdf - Effective upon the death of the individual who created it, known as the testator.

Template for a Will - Aids in avoiding the state's control over your estate distribution.

When preparing to complete the Trailer Bill of Sale form, it's important to ensure all information is accurately documented, and for convenience, you can access a helpful resource at PDF Documents Hub to assist with the process.

Free Will Template California - While wills can be created online, consulting with a legal expert ensures compliance with state laws.