Fillable Louisiana act of donation Template

File Details

| Fact Name | Description |

|---|---|

| Governing Law | The Louisiana Act of Donation is governed by the Louisiana Civil Code, specifically Articles 1466-1498. |

| Definition | An act of donation is a legal document that allows a person to give property to another person without expecting anything in return. |

| Types of Donations | Donations can be inter vivos (between living persons) or mortis causa (effective upon death). |

| Requirements | The act must be in writing and signed by the donor and the donee, along with two witnesses. |

| Notarization | While notarization is not mandatory, it is recommended to enhance the document's legal standing. |

| Revocation | A donor can revoke a donation under certain circumstances, such as if the donee commits a serious offense against the donor. |

| Tax Implications | Donations may have tax implications, including potential gift tax liabilities for the donor. |

| Property Types | Real estate, personal property, and rights can all be subjects of a donation. |

| Limitations | Donations cannot exceed the donor's available assets, and certain limitations apply to donations made in favor of minors. |

Sample - Louisiana act of donation Form

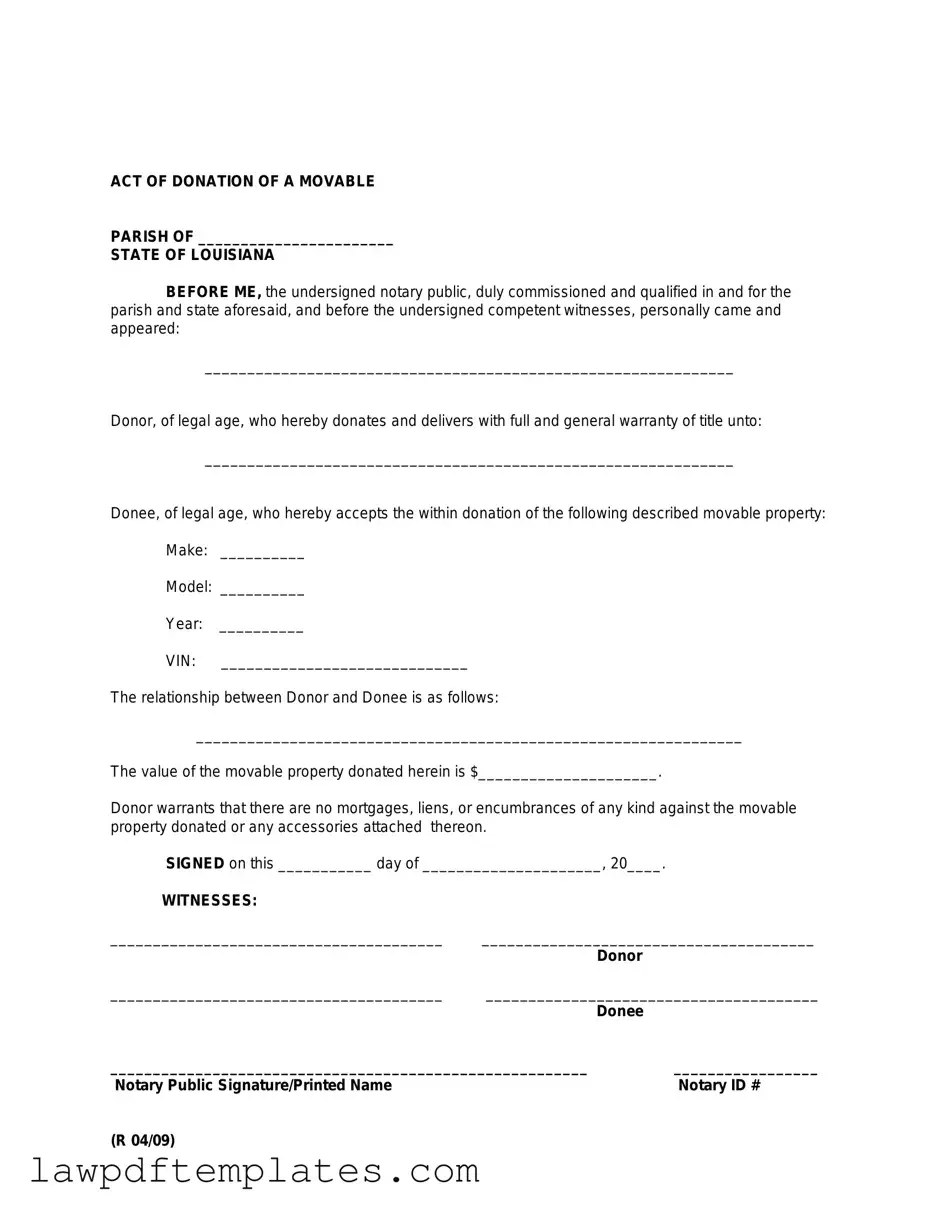

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)

Common mistakes

Filling out the Louisiana act of donation form can be a straightforward process, but many people make common mistakes that can lead to complications. One frequent error is not providing complete information. Every section of the form must be filled out accurately. Leaving out important details can delay the donation process or even invalidate the form.

Another common mistake is failing to sign the document. A signature is essential for the act of donation to be legally binding. Without it, the form holds no weight. It's also important to ensure that the signature matches the name printed on the form. Discrepancies can raise questions about the validity of the donation.

Many people overlook the importance of having witnesses. In Louisiana, the act of donation requires at least two witnesses. If the form is submitted without the necessary signatures from witnesses, it may not be considered valid. This requirement is in place to ensure that the donor's intentions are clear and supported by others.

Another mistake involves not dating the document. The date on the act of donation is crucial. It establishes when the donation was made and can affect the timing of legal rights and responsibilities. Omitting the date can lead to confusion and potential disputes later on.

People often forget to include a clear description of the property being donated. Whether it’s real estate, personal belongings, or financial assets, a precise description is necessary. Vague descriptions can create misunderstandings and may complicate the transfer process.

Some individuals mistakenly assume that the act of donation is the same as a will. While both documents deal with the transfer of property, they serve different purposes. An act of donation is immediate, while a will takes effect only after death. Understanding this difference is key to effective estate planning.

Another error is neglecting to consult with a legal expert. While the form may seem simple, the implications of a donation can be complex. Seeking advice can help ensure that all legal requirements are met and that the donor's wishes are honored.

Additionally, people sometimes fail to consider tax implications. Donations can have tax consequences, both for the donor and the recipient. It's wise to understand these implications before finalizing the donation to avoid unexpected financial burdens.

Lastly, not keeping a copy of the completed form is a common oversight. After submitting the act of donation, it’s crucial to retain a copy for personal records. This can serve as proof of the transaction and may be necessary for future reference.

Common PDF Documents

Printable Basketball Player Evaluation Form - Marks ideal defensive positions to optimize the player’s role on the team.

For those looking to secure a reliable and comprehensive document for their auto transactions, the PDF Documents Hub offers an accessible platform to obtain the Texas Vehicle Purchase Agreement, ensuring all necessary terms are clearly stated to facilitate a smooth vehicle sale process.

P45 Uk - The P45 tracks employee income and tax when moving to new employment.