Attorney-Approved Loan Agreement Document

State-specific Loan Agreement Forms

Loan Agreement Form Types

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Loan Agreement is a legal document outlining the terms under which a borrower agrees to repay borrowed money to a lender. |

| Parties Involved | The agreement typically involves at least two parties: the borrower and the lender. |

| Governing Law | Loan agreements are often governed by state-specific laws, which can vary significantly. For example, in California, the governing law is the California Civil Code. |

| Interest Rates | The document specifies the interest rate applicable to the loan, which can be fixed or variable. |

| Repayment Terms | It outlines the repayment schedule, including the frequency of payments and the total duration of the loan. |

| Default Provisions | The agreement includes terms that define what constitutes a default and the consequences thereof. |

| Amendments | Any modifications to the loan agreement must be documented in writing and agreed upon by both parties. |

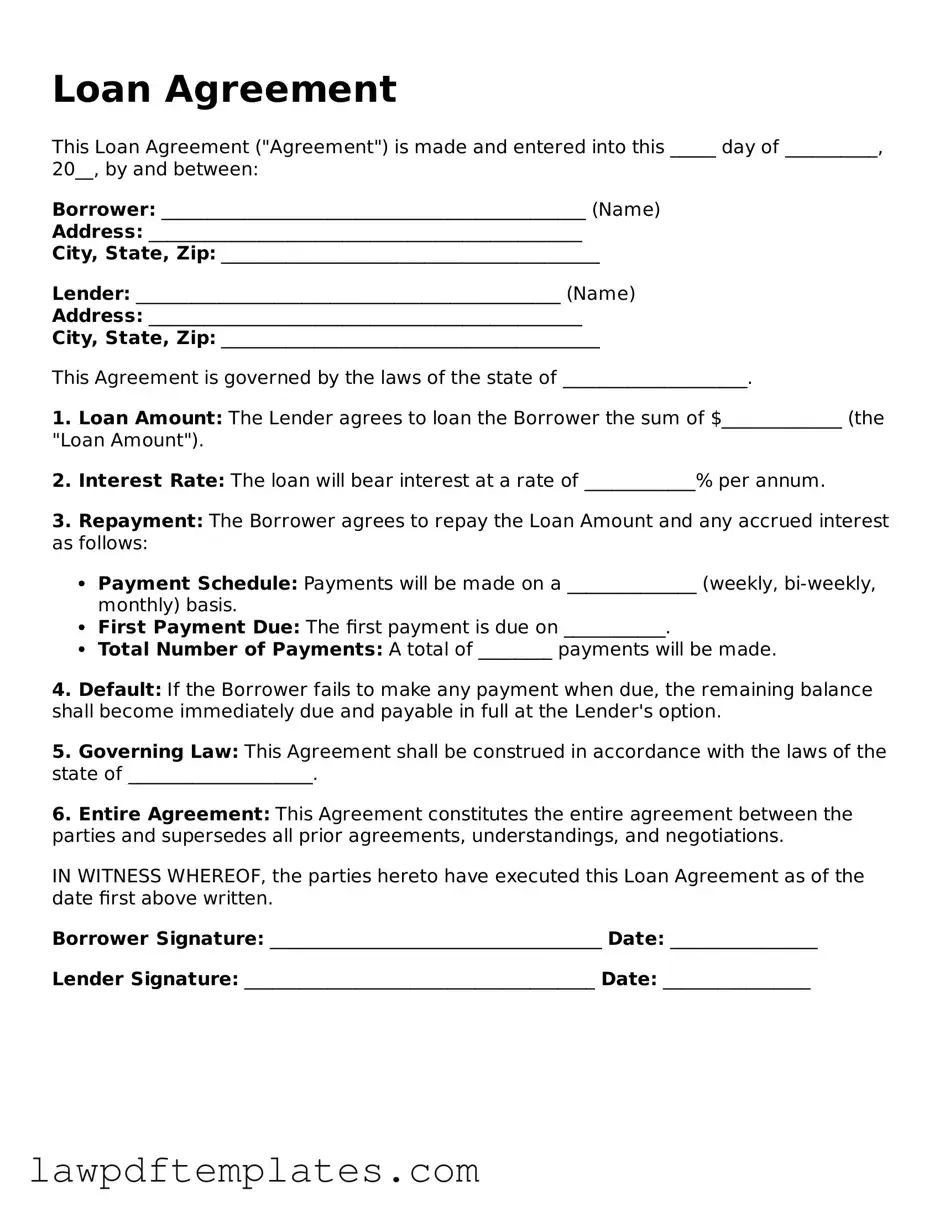

Sample - Loan Agreement Form

Loan Agreement

This Loan Agreement ("Agreement") is made and entered into this _____ day of __________, 20__, by and between:

Borrower: ______________________________________________ (Name)

Address: _______________________________________________

City, State, Zip: _________________________________________

Lender: ______________________________________________ (Name)

Address: _______________________________________________

City, State, Zip: _________________________________________

This Agreement is governed by the laws of the state of ____________________.

1. Loan Amount: The Lender agrees to loan the Borrower the sum of $_____________ (the "Loan Amount").

2. Interest Rate: The loan will bear interest at a rate of ____________% per annum.

3. Repayment: The Borrower agrees to repay the Loan Amount and any accrued interest as follows:

- Payment Schedule: Payments will be made on a ______________ (weekly, bi-weekly, monthly) basis.

- First Payment Due: The first payment is due on ___________.

- Total Number of Payments: A total of ________ payments will be made.

4. Default: If the Borrower fails to make any payment when due, the remaining balance shall become immediately due and payable in full at the Lender's option.

5. Governing Law: This Agreement shall be construed in accordance with the laws of the state of ____________________.

6. Entire Agreement: This Agreement constitutes the entire agreement between the parties and supersedes all prior agreements, understandings, and negotiations.

IN WITNESS WHEREOF, the parties hereto have executed this Loan Agreement as of the date first above written.

Borrower Signature: ____________________________________ Date: ________________

Lender Signature: ______________________________________ Date: ________________

Common mistakes

Filling out a Loan Agreement form can be a straightforward process, but many individuals make common mistakes that can lead to complications down the line. One frequent error is providing inaccurate personal information. This includes misspellings of names, incorrect Social Security numbers, or outdated addresses. Such discrepancies can delay the loan approval process and may even lead to a denial.

Another mistake often seen is failing to read the terms and conditions thoroughly. Borrowers may sign the document without fully understanding the interest rates, repayment terms, or any fees associated with the loan. This lack of understanding can result in unexpected financial burdens later on.

Many individuals overlook the importance of disclosing all sources of income. Lenders typically require a comprehensive view of a borrower’s financial situation. If someone omits income from side jobs or freelance work, it may negatively impact their loan eligibility. Transparency is key in these situations.

Inaccurate or incomplete financial information is another pitfall. Borrowers may not provide all required details regarding their assets, debts, and monthly expenses. This can lead to a misrepresentation of their financial health, causing lenders to question their reliability.

Additionally, some people fail to consider their credit history before applying. Not checking their credit report can lead to surprises during the application process. A poor credit score can affect the loan terms offered or even result in a denial.

Another common oversight is neglecting to ask questions. Borrowers often hesitate to seek clarification on any part of the form they do not understand. This lack of communication can lead to misunderstandings about the loan agreement, which may have long-term consequences.

Many individuals also make the mistake of rushing through the application process. Taking the time to carefully complete the form can prevent errors that might otherwise require corrections or additional documentation. A rushed application can lead to missed information or mistakes that could have been easily avoided.

Finally, failing to keep a copy of the completed Loan Agreement form is a mistake that can have serious implications. Having a personal record allows borrowers to refer back to the terms of the loan if any disputes arise or if they need to clarify details in the future. Keeping organized records is essential for financial management.

Popular Templates:

Car Accident Settlement Agreement Form - This release protects the other party from future claims related to the accident.

For a deeper understanding of how to use the Durable Power of Attorney effectively, you can explore the comprehensive guide available at Durable Power of Attorney documentation and requirements.

Creating a Job Application - Provide any additional information that may support your application.