Attorney-Approved Last Will and Testament Document

State-specific Last Will and Testament Forms

Last Will and Testament Form Types

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed after their death. |

| Legal Age | In most states, individuals must be at least 18 years old to create a valid will. |

| Witness Requirement | Many states require that a will be signed in the presence of at least two witnesses. |

| Revocation | A will can be revoked or changed at any time, as long as the person is of sound mind. |

| State-Specific Laws | Each state has its own laws governing wills, including how they must be executed and witnessed. |

| Executor Role | The will typically names an executor, who is responsible for carrying out the wishes of the deceased. |

| Probate Process | After death, the will usually goes through probate, a legal process to validate the will and distribute assets. |

| Intestate Succession | If someone dies without a will, their assets will be distributed according to state intestacy laws. |

| Digital Assets | Many people include instructions for digital assets, like online accounts, in their wills. |

Sample - Last Will and Testament Form

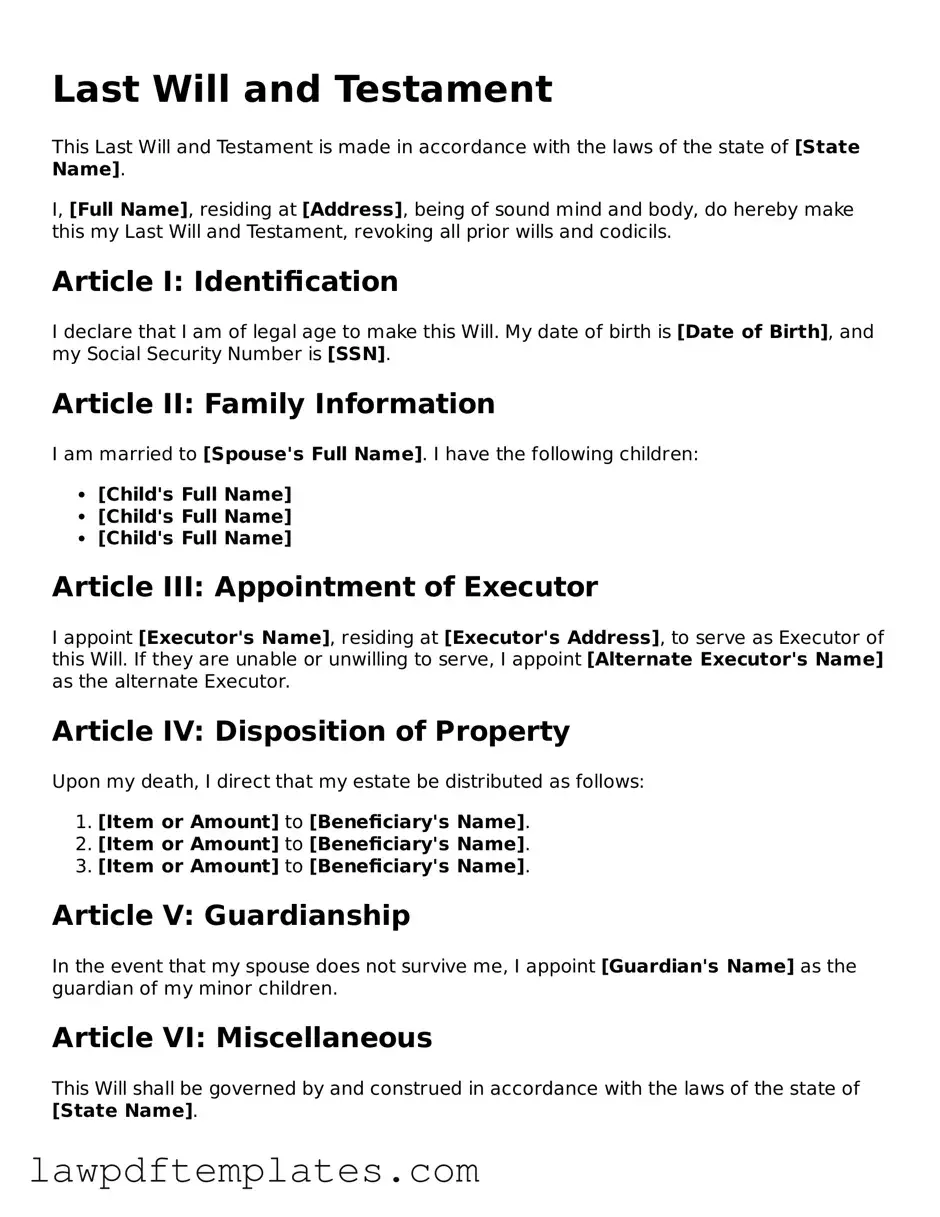

Last Will and Testament

This Last Will and Testament is made in accordance with the laws of the state of [State Name].

I, [Full Name], residing at [Address], being of sound mind and body, do hereby make this my Last Will and Testament, revoking all prior wills and codicils.

Article I: Identification

I declare that I am of legal age to make this Will. My date of birth is [Date of Birth], and my Social Security Number is [SSN].

Article II: Family Information

I am married to [Spouse's Full Name]. I have the following children:

- [Child's Full Name]

- [Child's Full Name]

- [Child's Full Name]

Article III: Appointment of Executor

I appoint [Executor's Name], residing at [Executor's Address], to serve as Executor of this Will. If they are unable or unwilling to serve, I appoint [Alternate Executor's Name] as the alternate Executor.

Article IV: Disposition of Property

Upon my death, I direct that my estate be distributed as follows:

- [Item or Amount] to [Beneficiary's Name].

- [Item or Amount] to [Beneficiary's Name].

- [Item or Amount] to [Beneficiary's Name].

Article V: Guardianship

In the event that my spouse does not survive me, I appoint [Guardian's Name] as the guardian of my minor children.

Article VI: Miscellaneous

This Will shall be governed by and construed in accordance with the laws of the state of [State Name].

In witness whereof, I have hereunto subscribed my name this [Day] day of [Month], [Year].

Signature: ________________________

[Full Name]

Witnesses

We, the undersigned witnesses, hereby attest that [Full Name] signed this Last Will and Testament in our presence.

- ________________________ [Witness #1 Name]

- ________________________ [Witness #2 Name]

Common mistakes

Creating a Last Will and Testament is an important step in ensuring your wishes are honored after you pass away. However, many people make mistakes when filling out this crucial document. One common error is not being specific enough about the distribution of assets. Vague language can lead to confusion and disputes among family members. Clearly stating who gets what can prevent misunderstandings later on.

Another frequent mistake is failing to update the will after major life events. Changes such as marriage, divorce, or the birth of a child can significantly impact your wishes. If you don’t revise your will accordingly, you may unintentionally leave out important individuals or assets.

Some people overlook the importance of having witnesses. Most states require that a will be signed in the presence of witnesses to be valid. Failing to have the proper number of witnesses can render the will invalid, leading to complications in the future.

Additionally, many individuals forget to include a residuary clause. This clause addresses any assets not specifically mentioned in the will. Without it, those assets may be distributed according to state law, rather than your wishes.

Another mistake is neglecting to name an executor. An executor is responsible for ensuring that your wishes are carried out. If you don’t name someone, the court will appoint an executor, which may not align with your preferences.

People often underestimate the importance of clear language. Using legal jargon or complex terms can create confusion. It’s best to use straightforward language that clearly conveys your intentions.

Some individuals also fail to consider tax implications. Certain bequests can have tax consequences for your heirs. Consulting with a financial advisor can help you understand these implications and plan accordingly.

Finally, many people forget to store their will in a safe yet accessible place. A will that cannot be found when needed is as good as not having one at all. Make sure to inform your loved ones about where the will is stored to avoid unnecessary stress during a difficult time.

Popular Templates:

Prenup Contract - This document sets terms for spousal support in case of separation or divorce.

USCIS Form I-864 - It does not require any fee to submit the I-864.

When you are in need of a supportive endorsement, utilizing the helpful Recommendation Letter tool can streamline the process of gathering reliable testimonials from trusted individuals. This form is structured to ensure all pertinent details are captured effectively, making it easier to present your recommendations in a professional manner.

Real Estate Termination Agreement - This document can assist in preventing potential legal issues stemming from improper cancellation.