Attorney-Approved Lady Bird Deed Document

State-specific Lady Bird Deed Forms

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed is a type of enhanced life estate deed that allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. |

| Governing Law | In the United States, the Lady Bird Deed is primarily governed by state law. It is recognized in states like Florida, Texas, and Michigan. |

| Retained Rights | Property owners can sell, mortgage, or change the beneficiaries without needing consent from the beneficiaries. |

| Tax Benefits | This deed can help avoid probate, which may lead to tax savings for the estate and beneficiaries. |

| Medicaid Planning | A Lady Bird Deed can be a useful tool in Medicaid planning, as it allows property to be transferred without affecting eligibility for benefits. |

| Revocability | The deed can be revoked or modified at any time by the property owner, providing flexibility in estate planning. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries, ensuring that their wishes are clearly outlined. |

| Limitations | Not all states recognize Lady Bird Deeds, so it’s essential to consult local laws before proceeding. |

| Common Usage | Often used by elderly homeowners to transfer property to children while retaining the right to live in the home for life. |

Sample - Lady Bird Deed Form

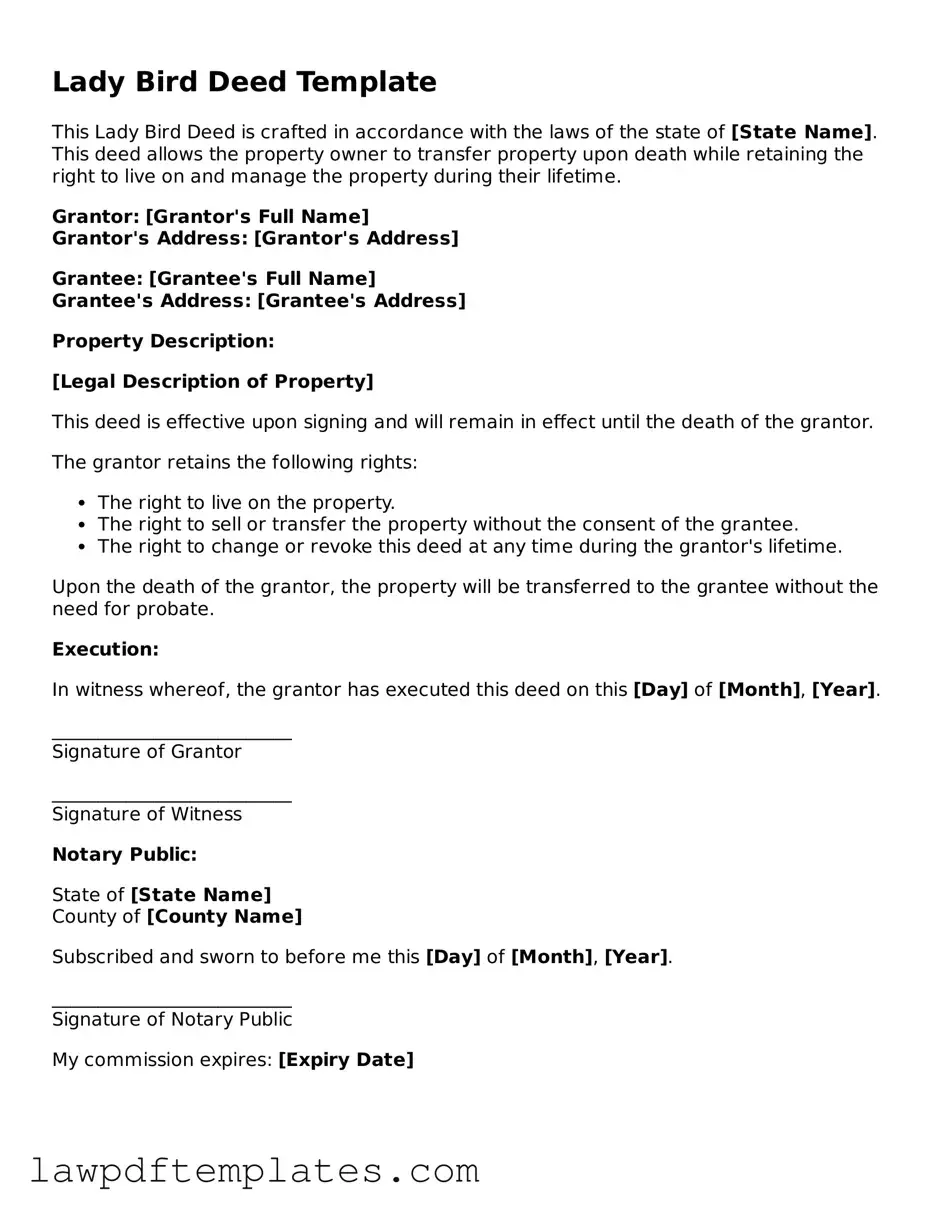

Lady Bird Deed Template

This Lady Bird Deed is crafted in accordance with the laws of the state of [State Name]. This deed allows the property owner to transfer property upon death while retaining the right to live on and manage the property during their lifetime.

Grantor: [Grantor's Full Name]

Grantor's Address: [Grantor's Address]

Grantee: [Grantee's Full Name]

Grantee's Address: [Grantee's Address]

Property Description:

[Legal Description of Property]

This deed is effective upon signing and will remain in effect until the death of the grantor.

The grantor retains the following rights:

- The right to live on the property.

- The right to sell or transfer the property without the consent of the grantee.

- The right to change or revoke this deed at any time during the grantor's lifetime.

Upon the death of the grantor, the property will be transferred to the grantee without the need for probate.

Execution:

In witness whereof, the grantor has executed this deed on this [Day] of [Month], [Year].

__________________________

Signature of Grantor

__________________________

Signature of Witness

Notary Public:

State of [State Name]

County of [County Name]

Subscribed and sworn to before me this [Day] of [Month], [Year].

__________________________

Signature of Notary Public

My commission expires: [Expiry Date]

Common mistakes

When individuals decide to use a Lady Bird Deed, they often aim to simplify the transfer of property while retaining control during their lifetime. However, there are common mistakes that can lead to complications. Understanding these pitfalls can help ensure that the deed serves its intended purpose effectively.

One frequent mistake is not clearly identifying the property being transferred. It is essential to provide a precise legal description of the property, including any relevant details like lot numbers or boundaries. Vague descriptions can lead to confusion and disputes among heirs or beneficiaries later on.

Another common error involves improperly naming the beneficiaries. People sometimes forget to include all intended beneficiaries or mistakenly list someone who should not receive the property. This oversight can create tension among family members and may result in legal challenges after the property owner passes away.

Failing to understand the implications of the Lady Bird Deed can also lead to issues. Some individuals believe that this type of deed completely avoids probate, but that is not always the case. It’s crucial to recognize that while a Lady Bird Deed can simplify the process, it may not eliminate all probate concerns, especially if other assets are involved.

Additionally, neglecting to sign the deed correctly can invalidate it. The requirements for signing can vary by state, and ensuring that the deed is executed according to local laws is vital. A deed that is not signed properly may not be recognized, leaving the property in a state of uncertainty.

People often overlook the need for proper notarization and recording of the deed. A Lady Bird Deed must be notarized to be legally binding, and it should be recorded with the appropriate county office. Failing to do so can result in the deed being challenged or disregarded, undermining the owner's intentions.

Lastly, some individuals do not consider the tax implications associated with a Lady Bird Deed. While this type of deed can provide certain benefits, it may also affect property taxes or trigger capital gains taxes upon transfer. Consulting with a tax professional can help clarify these potential consequences.

Consider Popular Types of Lady Bird Deed Documents

Quit Claim Deed Blank Form - There is no consideration required for a Quitclaim Deed, though it may be customary to state a nominal amount.

A Virginia Motor Vehicle Bill of Sale form is a legal document that records the sale and transfer of a vehicle from one party to another. This form serves as proof of ownership and includes important details about the vehicle and the transaction. For those looking to create or obtain this essential document online, check out PDF Documents Hub for easy access and resources.

Problems With Transfer on Death Deeds California - Consider discussing your plans with family members to avoid confusion later on.