Attorney-Approved Investment Letter of Intent Document

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The Investment Letter of Intent serves as a preliminary agreement outlining the terms under which an investor intends to invest in a business. |

| Non-Binding Nature | This document is generally non-binding, meaning that it expresses an intention rather than creating a legal obligation to proceed with the investment. |

| Key Components | Common components include the investment amount, valuation of the company, and any conditions that must be met before finalizing the investment. |

| Governing Law | The governing law can vary by state. For example, in California, the relevant laws include the California Corporations Code. |

| Confidentiality | Many Investment Letters of Intent include confidentiality clauses to protect sensitive information shared during negotiations. |

| Expiration Date | These letters often specify an expiration date, after which the terms may no longer be valid or negotiable. |

Sample - Investment Letter of Intent Form

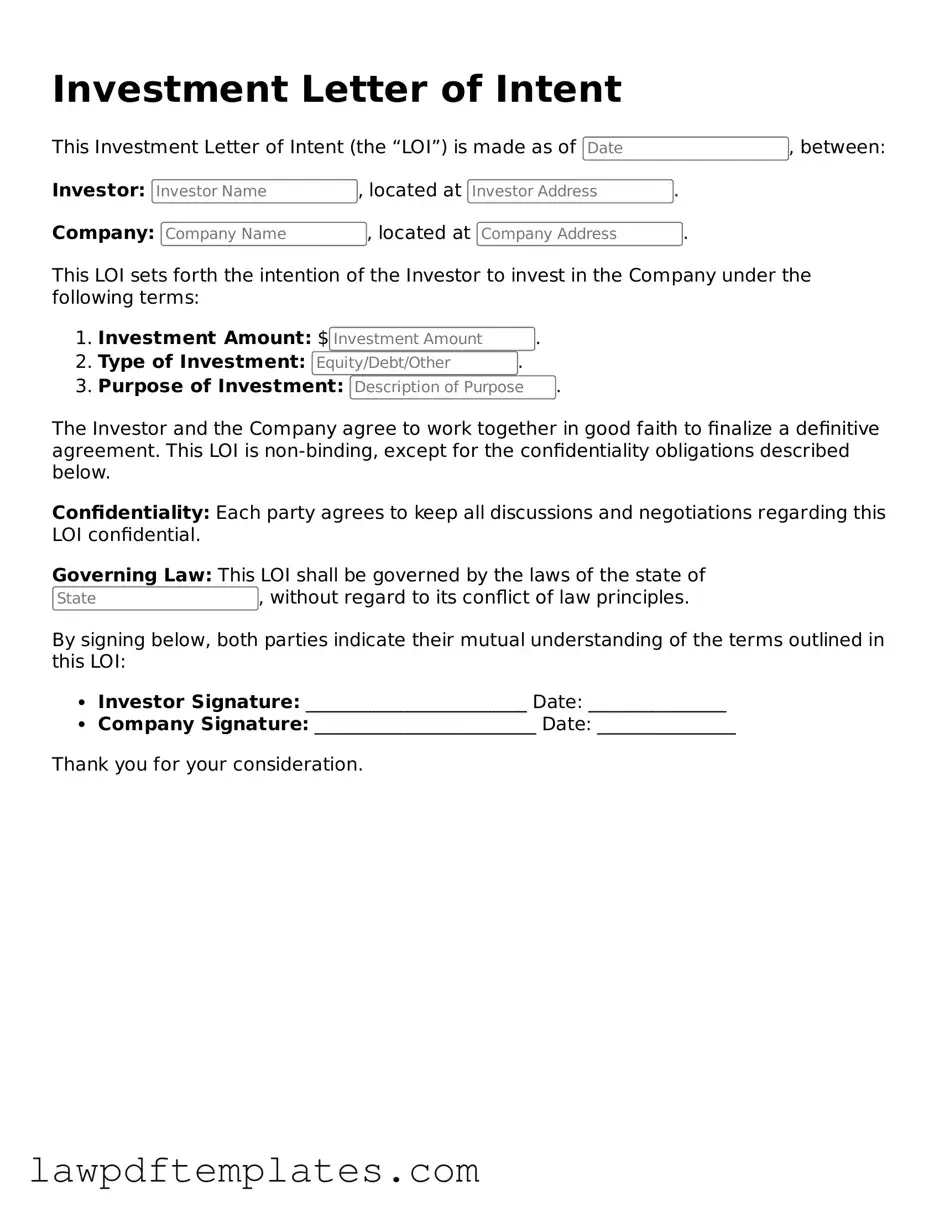

Investment Letter of Intent

This Investment Letter of Intent (the “LOI”) is made as of , between:

Investor: , located at .

Company: , located at .

This LOI sets forth the intention of the Investor to invest in the Company under the following terms:

- Investment Amount: $.

- Type of Investment: .

- Purpose of Investment: .

The Investor and the Company agree to work together in good faith to finalize a definitive agreement. This LOI is non-binding, except for the confidentiality obligations described below.

Confidentiality: Each party agrees to keep all discussions and negotiations regarding this LOI confidential.

Governing Law: This LOI shall be governed by the laws of the state of , without regard to its conflict of law principles.

By signing below, both parties indicate their mutual understanding of the terms outlined in this LOI:

- Investor Signature: ________________________ Date: _______________

- Company Signature: ________________________ Date: _______________

Thank you for your consideration.

Common mistakes

Filling out an Investment Letter of Intent (LOI) can be a crucial step in securing funding or entering into a partnership. However, many individuals make common mistakes that can lead to delays or misunderstandings. One frequent error is not providing complete information. When sections are left blank or filled out partially, it creates confusion. Investors need clear and comprehensive details to assess the proposal effectively.

Another mistake is using vague language. Clear communication is essential in legal documents. If someone uses ambiguous terms or jargon, it can lead to misinterpretation. Specificity helps to ensure that all parties understand the intent and expectations outlined in the LOI.

People often overlook the importance of reviewing the document before submission. Failing to proofread can result in typos or incorrect information. These errors can undermine the professionalism of the proposal and may even affect the credibility of the applicant.

Additionally, some individuals forget to include necessary attachments or supporting documents. An LOI may require additional information, such as financial statements or business plans. Neglecting to provide these can slow down the process or lead to rejection.

Finally, not seeking advice from a legal professional can be a significant oversight. While the LOI may seem straightforward, legal nuances can arise. Consulting with an expert can help ensure that the document meets all legal requirements and protects the interests of the parties involved.

Consider Popular Types of Investment Letter of Intent Documents

Sample Letter of Intent to Purchase - This letter can be an important step in securing financing for the purchase.

Rental Letter of Intent - A Letter of Intent to Lease Commercial Property outlines the preliminary terms for a potential lease agreement.