Fillable Intent To Lien Florida Template

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Intent to Lien Florida form serves to notify property owners that a contractor or supplier intends to file a lien against their property due to non-payment for services or materials provided. |

| Governing Law | This form is governed by Florida Statutes §713.06, which outlines the requirements for filing a lien and the necessary notice period. |

| Notice Period | According to Florida law, the notice must be served at least 45 days prior to the actual filing of the lien to ensure that the property owner is adequately informed. |

| Consequences of Non-Payment | If payment is not made within 30 days of receiving the notice, the property may be subject to a lien, which could lead to foreclosure and additional costs for the owner. |

Sample - Intent To Lien Florida Form

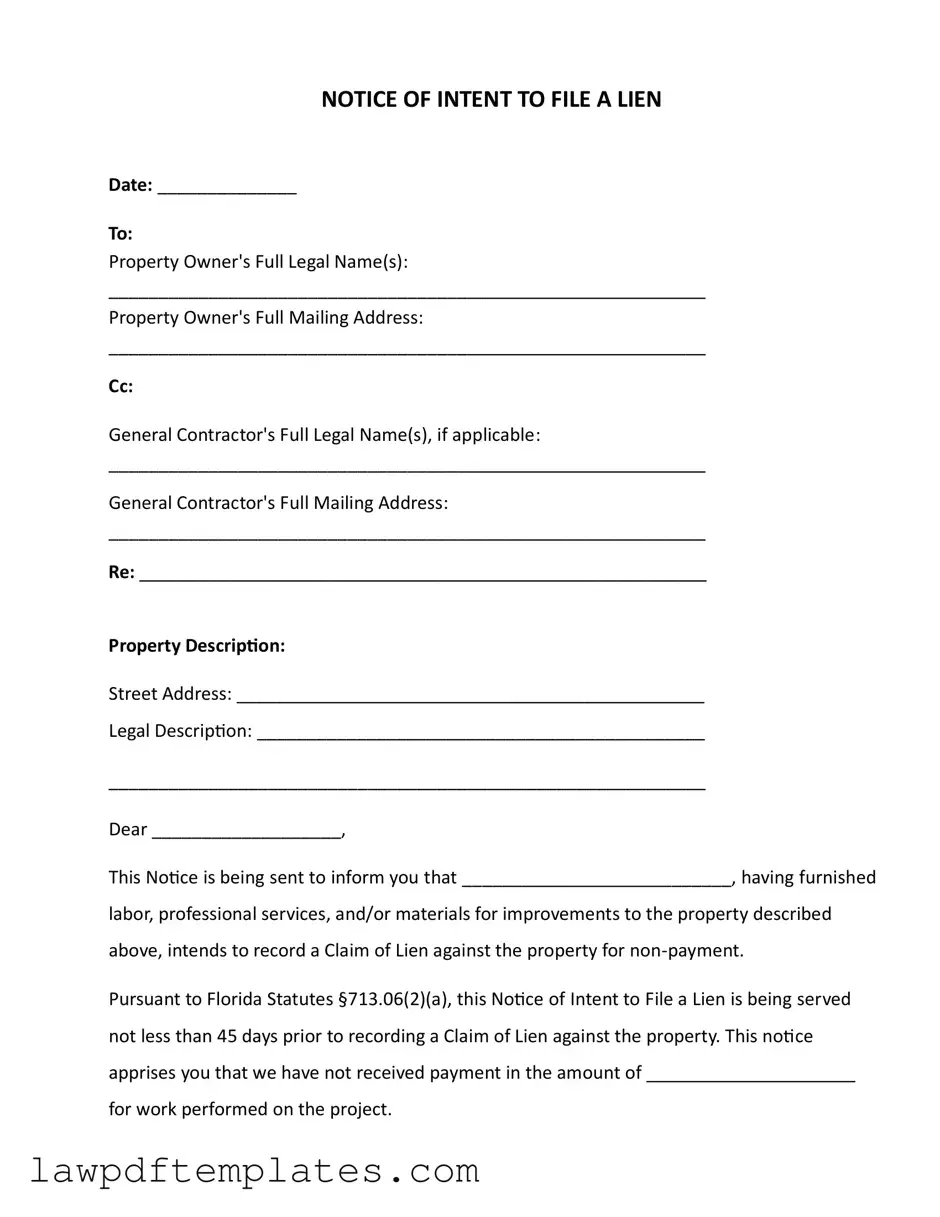

NOTICE OF INTENT TO FILE A LIEN

Date: ______________

To:

Property Owner's Full Legal Name(s):

____________________________________________________________

Property Owner's Full Mailing Address:

____________________________________________________________

Cc:

General Contractor's Full Legal Name(s), if applicable:

____________________________________________________________

General Contractor's Full Mailing Address:

____________________________________________________________

Re: _________________________________________________________

Property Description:

Street Address: _______________________________________________

Legal Description: _____________________________________________

____________________________________________________________

Dear ___________________,

This Notice is being sent to inform you that ___________________________, having furnished

labor, professional services, and/or materials for improvements to the property described above, intends to record a Claim of Lien against the property for

Pursuant to Florida Statutes §713.06(2)(a), this Notice of Intent to File a Lien is being served not less than 45 days prior to recording a Claim of Lien against the property. This notice apprises you that we have not received payment in the amount of _____________________

for work performed on the project.

As per Florida Statutes §713.06(2)(b), failure to make payment in full or provide a satisfactory response within 30 days may result in the recording of a lien on your property. If the lien is recorded, your property could be subject to foreclosure proceedings, and you could be responsible for attorney fees, court costs, and other expenses.

No waivers or releases of lien have been received that would affect the validity of this lien claim.

We would prefer to avoid this action and request your immediate attention to this matter. Please contact us at your earliest convenience to arrange payment and avoid further action.

Thank you for your prompt attention to this matter.

Sincerely,

_________________________ [Your Name]

_________________________ [Your Title]

_________________________ [Your Phone Number]

_________________________ [Your Email Address]

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the Notice of Intent to File a Lien was served on

______________ to ____________________________ at

__________________________________________ by:

□Certified Mail, Return Receipt Requested

□Registered Mail

□Hand Delivery

□Delivery by a Process Server

□Publication

____________________________ |

____________________________ |

Name |

Signature |

Common mistakes

When filling out the Intent to Lien Florida form, individuals often make several common mistakes that can lead to complications. One frequent error is failing to provide the correct legal names of the property owners. It is crucial to ensure that the names match exactly as they appear on the property deed. Any discrepancies can result in delays or even the invalidation of the lien.

Another mistake is neglecting to include a complete mailing address for the property owners. The form requires a full mailing address to ensure that the notice reaches the intended recipients. Omitting this information can lead to miscommunication and potential legal issues.

Inaccurate descriptions of the property can also pose significant problems. The form must contain both the street address and the legal description of the property. If these details are incomplete or incorrect, it could jeopardize the enforcement of the lien, as it may not be clear which property is being referenced.

Additionally, individuals sometimes forget to specify the amount owed for the work performed. This amount should be clearly stated in the notice. Without this information, the property owner may not understand the basis for the lien, which could lead to disputes and further complications.

Finally, failing to adhere to the required timelines can be detrimental. The notice must be sent at least 45 days before recording a lien, and the property owner must be given 30 days to respond. Missing these deadlines can result in the loss of the right to file the lien altogether. Timeliness is essential in these matters to protect one's interests.

Common PDF Documents

How Do I Get a Direct Deposit Form - Ensure timely payments with the reliable direct deposit option through Citibank.

When completing the transaction, it's essential to utilize the Virginia Motor Vehicle Bill of Sale form, a legal document that solidifies the sale and transfer of a vehicle. For those looking to fill out this form accurately and efficiently, you can find it at PDF Documents Hub, ensuring you have all necessary details recorded for proof of ownership.

Forms 1099 Nec - Make sure to report any discrepancies immediately to avoid penalties.

How to Get Acord Insurance Certificate - It simplifies the collection of incident information.