Fillable Independent Contractor Pay Stub Template

File Details

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for a contractor, similar to a paycheck for employees. |

| Purpose | It serves to provide transparency in payments and helps contractors track their income for tax purposes. |

| Components | A typical pay stub includes the contractor's name, pay period, total earnings, and any deductions made. |

| Tax Implications | Independent contractors are responsible for paying their own taxes, including self-employment tax, which is reflected on the pay stub. |

| State Variations | Some states may have specific requirements for pay stubs; for example, California mandates detailed itemization of deductions. |

| Record Keeping | Contractors should keep their pay stubs for at least three years to support their income claims in case of an audit. |

| Legal Requirements | While federal law does not require pay stubs, some states, like New York, require employers to provide them to independent contractors. |

| Accessibility | Many companies now provide digital pay stubs, making it easier for contractors to access their payment information anytime. |

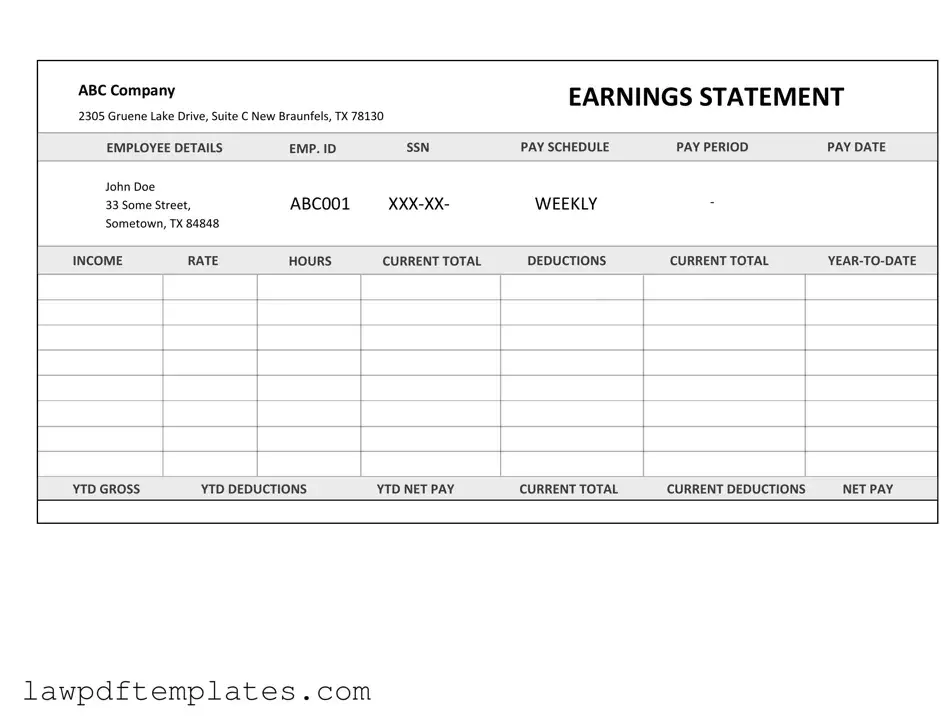

Sample - Independent Contractor Pay Stub Form

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

Common mistakes

Filling out the Independent Contractor Pay Stub form can seem straightforward, but many individuals make common mistakes that can lead to complications down the line. One of the most frequent errors is failing to include all relevant personal information. It’s essential to provide accurate details such as your name, address, and Social Security number. Omitting any of this information can delay payments and create confusion.

Another mistake is miscalculating hours worked or rates earned. This can result in underpayment or overpayment, both of which can lead to disputes. Always double-check your calculations to ensure that they reflect the actual hours and agreed-upon rates. It’s advisable to keep a record of your work hours separately to avoid any discrepancies.

Many contractors also overlook the importance of itemizing deductions. When filling out the form, it’s crucial to list any expenses that should be deducted from your gross pay. Failing to do so can inflate your taxable income and lead to unexpected tax liabilities. Keeping detailed records of your expenses will support your claims and simplify this process.

Another common error is neglecting to sign and date the form. A signature is often required to validate the document, and without it, the form may be considered incomplete. Make it a habit to review the entire form before submission to ensure all necessary fields are filled out, including your signature.

Some individuals mistakenly use outdated versions of the form. Using an old version can lead to compliance issues and may not reflect the latest regulations. Always check for the most current version of the Independent Contractor Pay Stub form before filling it out.

In addition, many contractors fail to understand the implications of misclassifying themselves. It’s vital to accurately identify your status as an independent contractor versus an employee. Misclassification can have legal consequences and impact your tax obligations. If unsure, consult a professional to clarify your status.

Another frequent mistake is not keeping copies of submitted forms. It’s important to maintain a record of all pay stubs for your personal files. This documentation can be crucial for tax purposes and for resolving any disputes that may arise later.

Some individuals do not review their pay stubs for accuracy after submission. Regularly checking your pay stubs against your records can help identify errors early. If discrepancies are found, address them immediately to avoid further complications.

Lastly, many contractors underestimate the importance of understanding their rights and responsibilities. Familiarizing yourself with the legal aspects of being an independent contractor can empower you to fill out forms correctly and protect your interests. Knowledge is key in navigating the complexities of independent contracting.

Common PDF Documents

Work Incident Report Sample - Helps track the resolution of reported safety concerns and follow-ups.

The Georgia Tractor Bill of Sale form plays a crucial role in documenting the sale and transfer of tractor ownership in Georgia. For a reliable resource to understand the intricacies of this form, you can refer to this essential guide on the complete Tractor Bill of Sale requirements.

Coat of Arms Designs - An artistic illustration blending heritage with modernity.