Free Transfer-on-Death Deed Template for the State of Illinois

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | The Illinois Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Eligibility | Any individual who holds title to real estate in Illinois can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries, and they can also specify alternate beneficiaries. |

| Revocation | The deed can be revoked at any time before the owner's death by executing a new deed or a revocation document. |

| Filing Requirements | While the deed must be signed and notarized, it is also recommended to record the deed with the county recorder's office for public notice. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes during the owner's lifetime, but estate taxes may apply upon death. |

Sample - Illinois Transfer-on-Death Deed Form

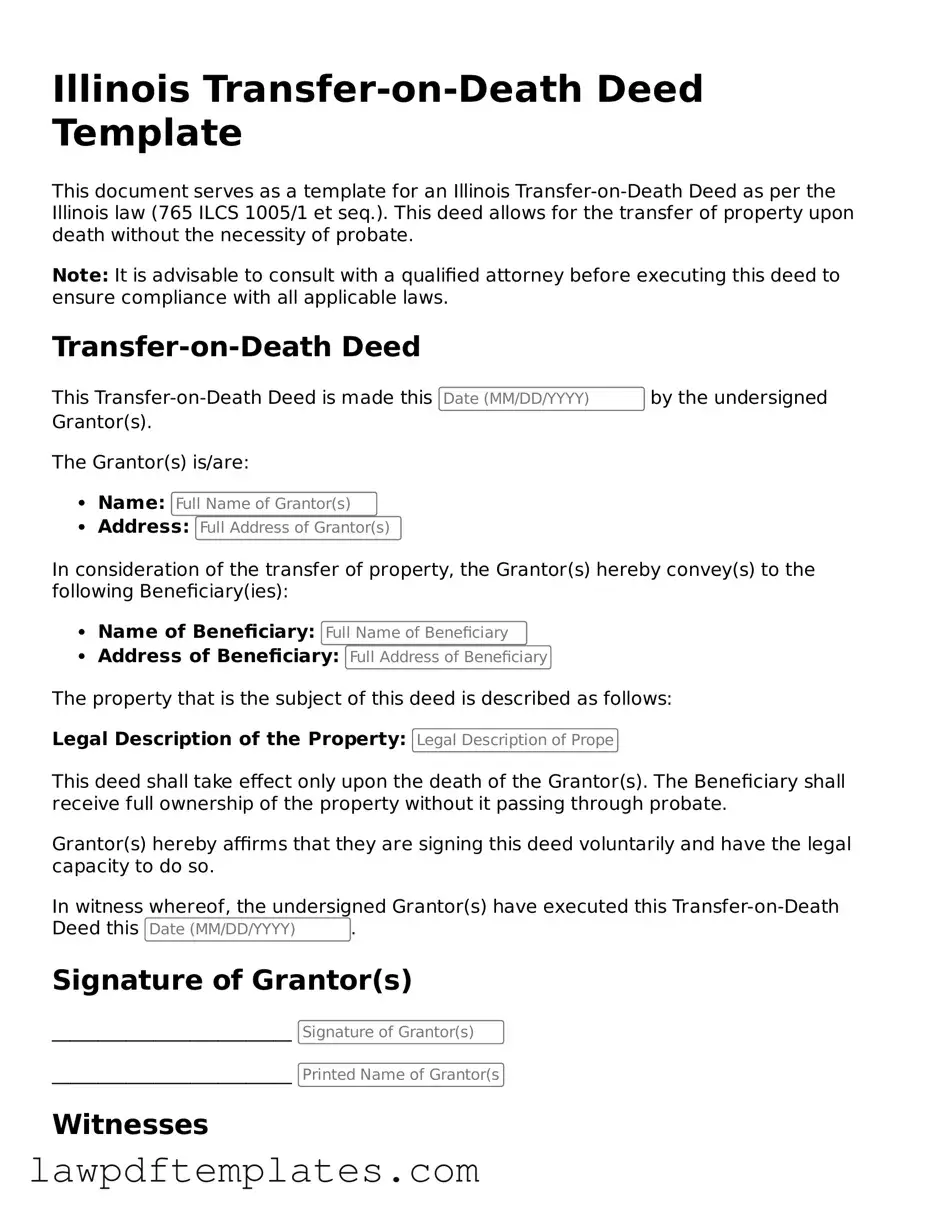

Illinois Transfer-on-Death Deed Template

This document serves as a template for an Illinois Transfer-on-Death Deed as per the Illinois law (765 ILCS 1005/1 et seq.). This deed allows for the transfer of property upon death without the necessity of probate.

Note: It is advisable to consult with a qualified attorney before executing this deed to ensure compliance with all applicable laws.

Transfer-on-Death Deed

This Transfer-on-Death Deed is made this by the undersigned Grantor(s).

The Grantor(s) is/are:

- Name:

- Address:

In consideration of the transfer of property, the Grantor(s) hereby convey(s) to the following Beneficiary(ies):

- Name of Beneficiary:

- Address of Beneficiary:

The property that is the subject of this deed is described as follows:

Legal Description of the Property:

This deed shall take effect only upon the death of the Grantor(s). The Beneficiary shall receive full ownership of the property without it passing through probate.

Grantor(s) hereby affirms that they are signing this deed voluntarily and have the legal capacity to do so.

In witness whereof, the undersigned Grantor(s) have executed this Transfer-on-Death Deed this .

Signature of Grantor(s)

__________________________

__________________________

Witnesses

We, the undersigned, hereby declare that we witnessed the execution of this Transfer-on-Death Deed by the Grantor(s).

- Witness Name:

- Signature:

- Witness Name:

- Signature:

State of Illinois

Common mistakes

Filling out the Illinois Transfer-on-Death Deed form can be a straightforward process, but there are common mistakes that individuals often make. One prevalent error is failing to provide accurate property descriptions. It is crucial to include the correct legal description of the property to avoid confusion or disputes later on. A simple oversight in this area can lead to complications in the transfer process.

Another mistake involves not properly identifying the beneficiaries. Individuals must ensure that the names of the beneficiaries are spelled correctly and that their relationship to the property owner is clearly stated. Omitting a beneficiary or listing them incorrectly can result in unintended consequences, such as disputes among heirs.

Many people neglect to sign and date the form in the presence of a notary public. The Illinois Transfer-on-Death Deed requires notarization to be valid. Without this step, the deed may not be recognized by the county recorder’s office, leading to issues when the time comes to transfer the property.

Some individuals also overlook the need to record the deed with the appropriate county office. Even if the form is completed correctly, failing to file it can render the deed ineffective. Recording the deed ensures that it is part of the public record and can be enforced when the property owner passes away.

Another common mistake is not considering the implications of transferring property upon death. People often fail to understand how this transfer can affect their estate planning or tax liabilities. It is advisable to consult with a professional to ensure that the transfer aligns with overall estate goals.

In addition, individuals may forget to review the form for completeness before submission. Missing information can delay the processing of the deed. It is essential to double-check all sections of the form to ensure that everything is filled out correctly.

Some individuals mistakenly believe that they can change beneficiaries at any time without following proper procedures. While it is possible to revoke or amend a Transfer-on-Death Deed, this must be done through a formal process. Failing to follow the correct steps can lead to confusion and disputes among potential heirs.

Another frequent oversight is not understanding the impact of jointly owned property. If property is owned jointly with right of survivorship, a Transfer-on-Death Deed may not be necessary, as the property will automatically pass to the surviving owner. Clarifying ownership types before completing the deed can prevent unnecessary complications.

Lastly, individuals sometimes underestimate the importance of keeping a copy of the completed deed in a safe place. Losing the deed can create significant challenges for beneficiaries when trying to claim the property. Keeping a record and informing beneficiaries about its location is essential for a smooth transfer process.

Discover More Transfer-on-Death Deed Templates for Specific States

California Transfer on Death Deed - This document is a simple way to plan for property transfer after your passing.

Completing the Trader Joe's application form is crucial for anyone aspiring to join this renowned grocery store chain, as it gathers vital details such as previous employment and scheduling preferences. For a comprehensive understanding of the application process, you can refer to resources like PDF Documents Hub, which can provide further assistance.

Transfer on Death Affidavit - A Transfer-on-Death Deed is revocable, allowing the owner to change beneficiaries at any time.