Free Promissory Note Template for the State of Illinois

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | An Illinois Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The Illinois Uniform Commercial Code (UCC) governs promissory notes in Illinois. |

| Essential Elements | A valid promissory note must include the principal amount, interest rate, payment terms, and signatures of the parties involved. |

| Interest Rates | Illinois law allows for the inclusion of interest rates, which must comply with state usury laws. |

| Transferability | Promissory notes in Illinois can be transferred to third parties, making them negotiable instruments. |

| Default Consequences | If the borrower defaults, the lender has the right to pursue legal action to recover the owed amount. |

| Notarization | While notarization is not required, it is recommended to enhance the document's enforceability. |

Sample - Illinois Promissory Note Form

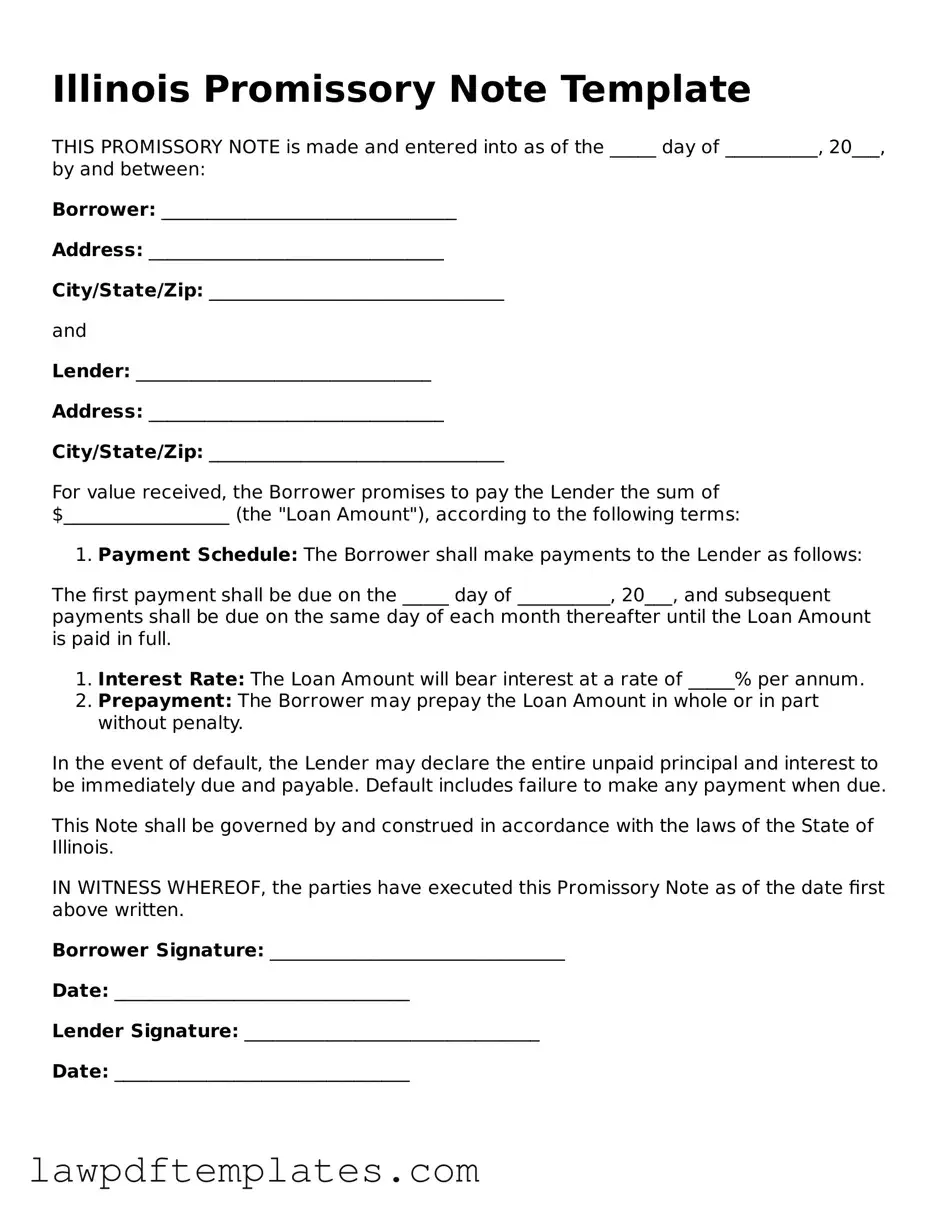

Illinois Promissory Note Template

THIS PROMISSORY NOTE is made and entered into as of the _____ day of __________, 20___, by and between:

Borrower: ________________________________

Address: ________________________________

City/State/Zip: ________________________________

and

Lender: ________________________________

Address: ________________________________

City/State/Zip: ________________________________

For value received, the Borrower promises to pay the Lender the sum of $__________________ (the "Loan Amount"), according to the following terms:

- Payment Schedule: The Borrower shall make payments to the Lender as follows:

The first payment shall be due on the _____ day of __________, 20___, and subsequent payments shall be due on the same day of each month thereafter until the Loan Amount is paid in full.

- Interest Rate: The Loan Amount will bear interest at a rate of _____% per annum.

- Prepayment: The Borrower may prepay the Loan Amount in whole or in part without penalty.

In the event of default, the Lender may declare the entire unpaid principal and interest to be immediately due and payable. Default includes failure to make any payment when due.

This Note shall be governed by and construed in accordance with the laws of the State of Illinois.

IN WITNESS WHEREOF, the parties have executed this Promissory Note as of the date first above written.

Borrower Signature: ________________________________

Date: ________________________________

Lender Signature: ________________________________

Date: ________________________________

Common mistakes

When completing the Illinois Promissory Note form, individuals often overlook important details. One common mistake is failing to include the correct names of the parties involved. It is crucial to use full legal names, as nicknames or abbreviations can lead to confusion or disputes in the future.

Another frequent error is neglecting to specify the loan amount clearly. The amount should be written both numerically and in words. For instance, writing “$1,000” and “one thousand dollars” helps prevent misunderstandings about the total owed.

People sometimes forget to outline the interest rate. This can lead to complications later on. If the interest rate is not clearly stated, it may result in disputes over how much interest is owed over the life of the loan.

Additionally, individuals may not indicate the repayment schedule. It is important to specify when payments are due and the frequency of those payments, whether monthly, quarterly, or otherwise. This clarity helps both parties understand their obligations.

Another mistake is failing to include a default clause. A default clause outlines what happens if the borrower fails to make payments. Without this, the lender may have limited options if the borrower defaults.

Many people also overlook the need for signatures. Both the borrower and the lender must sign the document for it to be legally binding. Not obtaining the necessary signatures can render the note unenforceable.

Another common oversight is not having the document notarized. While notarization is not always required, it can provide an extra layer of protection and authenticity. A notary public can verify the identities of the parties involved.

Finally, individuals may neglect to keep copies of the signed note. It is essential for both parties to retain a copy for their records. This ensures that both the lender and borrower have access to the terms of the agreement should any questions arise in the future.

Discover More Promissory Note Templates for Specific States

Promissory Note Ohio - This agreement can help the lender assess credit risk based on repayment history.

In Georgia, understanding the importance of a well-prepared legal document is crucial for one’s affairs. The power of attorney can empower your loved ones to act on your behalf. For guidance on this pivotal aspect of legal documentation, refer to our resource on the significant Power of Attorney implications.

Promissory Note Template Georgia - This document can serve as a reminder for repayment obligations for the borrower.