Free Loan Agreement Template for the State of Illinois

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The Illinois Loan Agreement form outlines the terms of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Illinois. |

| Parties Involved | It includes the lender and the borrower, both of whom must be clearly identified. |

| Loan Amount | The form specifies the total amount of money being loaned. |

| Interest Rate | The agreement outlines the interest rate applied to the loan, if any. |

| Repayment Terms | It details how and when the borrower will repay the loan. |

| Default Conditions | The form includes conditions under which the borrower would be considered in default. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties. |

| Legal Recourse | The form may outline the legal actions available to the lender in case of default. |

Sample - Illinois Loan Agreement Form

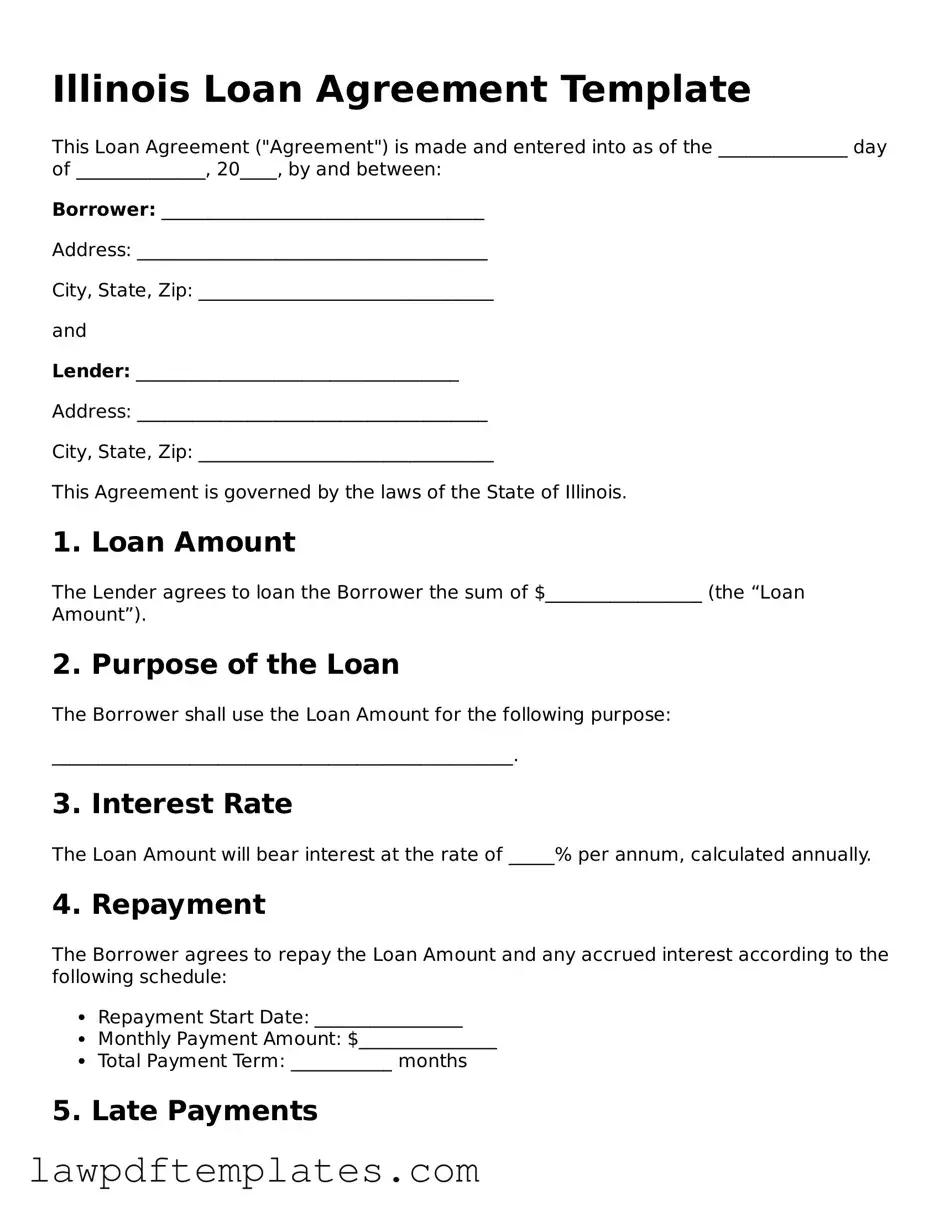

Illinois Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into as of the ______________ day of ______________, 20____, by and between:

Borrower: ___________________________________

Address: ______________________________________

City, State, Zip: ________________________________

and

Lender: ___________________________________

Address: ______________________________________

City, State, Zip: ________________________________

This Agreement is governed by the laws of the State of Illinois.

1. Loan Amount

The Lender agrees to loan the Borrower the sum of $_________________ (the “Loan Amount”).

2. Purpose of the Loan

The Borrower shall use the Loan Amount for the following purpose:

__________________________________________________.

3. Interest Rate

The Loan Amount will bear interest at the rate of _____% per annum, calculated annually.

4. Repayment

The Borrower agrees to repay the Loan Amount and any accrued interest according to the following schedule:

- Repayment Start Date: ________________

- Monthly Payment Amount: $_______________

- Total Payment Term: ___________ months

5. Late Payments

If a payment is not received within __ days after the due date, a late fee of $_______________ will be charged.

6. Default

In the event of default, the Lender may demand immediate repayment of the entire outstanding balance, including any accrued interest.

7. Governing Law

This Agreement shall be governed by and construed under the laws of the State of Illinois.

8. Signatures

By signing below, both parties agree to all terms and conditions of this Loan Agreement.

Borrower Signature: _____________________________ Date: ______________

Lender Signature: _____________________________ Date: ______________

This document serves as an important record. It is advisable to keep a copy of this Agreement for your records.

Common mistakes

Filling out the Illinois Loan Agreement form can be straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is failing to provide accurate personal information. It’s crucial to ensure that your name, address, and contact details are correct. Any discrepancies can cause delays or even lead to the rejection of the agreement.

Another mistake often seen is neglecting to read the terms and conditions thoroughly. Many individuals skim through this section, which can result in misunderstandings about interest rates, repayment schedules, and penalties for late payments. Taking the time to understand these details can prevent future disputes.

Some people also overlook the importance of including the correct loan amount. Entering an incorrect figure can affect the entire agreement. Ensure that the amount you intend to borrow matches what is specified in your application and discussions with the lender.

Additionally, failing to sign the agreement can invalidate the entire document. It’s a simple step, yet many forget to add their signature or date it properly. Without these, the loan agreement may not be legally binding.

Not providing supporting documentation is another common pitfall. Lenders often require proof of income, employment verification, or credit history. Omitting these documents can slow down the approval process or lead to denial.

Some individuals mistakenly assume that all loan agreements are the same. Each lender may have unique requirements or stipulations. It’s essential to check if there are specific clauses or sections that need special attention based on the lender's policies.

Another mistake is failing to disclose all debts and financial obligations. Transparency is key when filling out the loan agreement. Not providing a complete picture of your financial situation can lead to complications in the approval process.

People often forget to ask questions about anything they don’t understand. It’s better to seek clarification than to make assumptions. Ignoring this step can lead to signing an agreement that doesn’t align with your needs.

Lastly, many individuals neglect to keep a copy of the signed agreement. Having a personal record is essential for future reference. It can help resolve any disputes or confusion that may arise after the loan is finalized.

By avoiding these common mistakes, you can ensure a smoother experience when filling out the Illinois Loan Agreement form. Taking the time to review your information and understand the terms will lead to a better understanding of your obligations and rights as a borrower.

Discover More Loan Agreement Templates for Specific States

Promissory Note California - The agreement clarifies the loan's repayment process.

It is important to understand the legal implications of having a Power of Attorney for a Child, especially when making arrangements for the care and decision-making for your child during your absence. This document serves to protect your child's interests and facilitate necessary care in your stead.