Free Deed in Lieu of Foreclosure Template for the State of Illinois

Form Breakdown

| Fact Name | Details |

|---|---|

| Definition | The Illinois Deed in Lieu of Foreclosure is a legal document that allows a borrower to transfer property ownership to the lender to avoid foreclosure. |

| Governing Law | This form is governed by the Illinois Compiled Statutes, specifically 735 ILCS 5/15-1401 et seq. |

| Eligibility | Homeowners must be in default on their mortgage payments and unable to reinstate the loan to qualify for this option. |

| Benefits | A deed in lieu can help borrowers avoid the lengthy foreclosure process, potentially preserving their credit score compared to a foreclosure. |

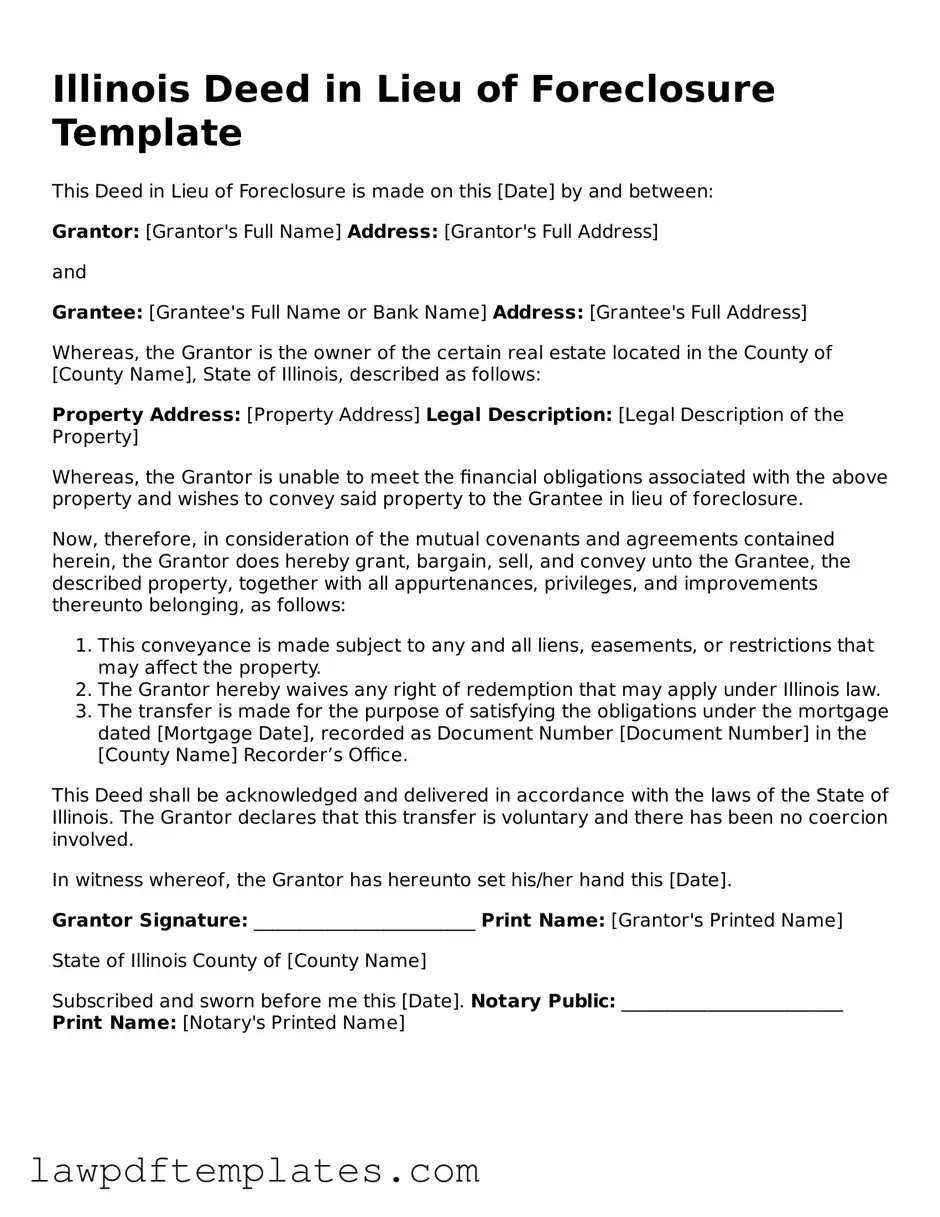

Sample - Illinois Deed in Lieu of Foreclosure Form

Illinois Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made on this [Date] by and between:

Grantor: [Grantor's Full Name] Address: [Grantor's Full Address]

and

Grantee: [Grantee's Full Name or Bank Name] Address: [Grantee's Full Address]

Whereas, the Grantor is the owner of the certain real estate located in the County of [County Name], State of Illinois, described as follows:

Property Address: [Property Address] Legal Description: [Legal Description of the Property]

Whereas, the Grantor is unable to meet the financial obligations associated with the above property and wishes to convey said property to the Grantee in lieu of foreclosure.

Now, therefore, in consideration of the mutual covenants and agreements contained herein, the Grantor does hereby grant, bargain, sell, and convey unto the Grantee, the described property, together with all appurtenances, privileges, and improvements thereunto belonging, as follows:

- This conveyance is made subject to any and all liens, easements, or restrictions that may affect the property.

- The Grantor hereby waives any right of redemption that may apply under Illinois law.

- The transfer is made for the purpose of satisfying the obligations under the mortgage dated [Mortgage Date], recorded as Document Number [Document Number] in the [County Name] Recorder’s Office.

This Deed shall be acknowledged and delivered in accordance with the laws of the State of Illinois. The Grantor declares that this transfer is voluntary and there has been no coercion involved.

In witness whereof, the Grantor has hereunto set his/her hand this [Date].

Grantor Signature: ________________________ Print Name: [Grantor's Printed Name]

State of Illinois County of [County Name]

Subscribed and sworn before me this [Date]. Notary Public: ________________________ Print Name: [Notary's Printed Name]

Common mistakes

Filling out the Illinois Deed in Lieu of Foreclosure form can be a daunting task. Many individuals overlook important details that can lead to complications. One common mistake is not providing accurate property information. It is essential to ensure that the legal description of the property matches the information on the original mortgage documents. Any discrepancies can create issues during the transfer process.

Another frequent error is failing to include all necessary signatures. The form requires signatures from all parties involved, including any co-owners. Omitting a signature can delay the process and may result in the deed being deemed invalid. It is crucial to double-check that everyone who has an interest in the property has signed the document.

People often neglect to date the form correctly. Each signature should be dated to establish the timeline of the transaction. Missing dates can lead to confusion regarding when the deed was executed, potentially complicating the foreclosure process.

Inaccurate notarization is another mistake that can arise. The form must be notarized to be legally binding. If the notary does not sign or stamp the document correctly, it may not be accepted by the lender or the county recorder's office.

Some individuals fail to communicate with their lender before submitting the deed. It is vital to notify the lender of the intent to execute a deed in lieu of foreclosure. Lack of communication can lead to misunderstandings and may prevent the lender from accepting the deed.

Another common oversight is not understanding the tax implications of a deed in lieu of foreclosure. Individuals may not realize that this type of transfer can have tax consequences. Consulting with a tax professional can provide clarity and help avoid unexpected liabilities.

Many people also overlook the importance of reviewing the deed for clarity and completeness. Any vague language or missing information can create confusion later on. Taking the time to read through the document carefully can prevent future issues.

Additionally, some individuals do not keep copies of the submitted form. It is important to retain a copy of the completed deed in lieu of foreclosure for personal records. This documentation can be useful for future reference or in case any disputes arise.

People sometimes underestimate the importance of understanding the implications of the deed in lieu of foreclosure. This option may impact credit scores and future borrowing ability. It is advisable to fully comprehend the consequences before proceeding.

Finally, individuals may rush the process. Filling out the form in haste can lead to mistakes that could have been easily avoided. Taking the time to complete the document carefully can save significant stress and complications down the line.

Discover More Deed in Lieu of Foreclosure Templates for Specific States

California Pre-foreclosure Property Transfer - This deed is a way for distressed homeowners to hand over their property voluntarily.

Deed in Lieu of Foreclosure Form - This option is worth considering for homeowners facing imminent foreclosure.

Having a properly completed Texas RV Bill of Sale is essential for ensuring a smooth transaction when selling or purchasing a recreational vehicle. This document not only verifies the ownership transfer but also protects both parties from potential disputes. For those looking to access a convenient template, you can visit PDF Documents Hub to obtain the necessary forms and make the process easier.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - It often leads to more flexible negotiation terms for pending debts and future liabilities.

Deed in Lieu Vs Foreclosure - In some circumstances, the lender may also offer assistance to the borrower as part of the agreement.