Fillable Gift Letter Template

File Details

| Fact Name | Description |

|---|---|

| Purpose | A Gift Letter form is used to document financial gifts given for purposes such as purchasing a home. |

| Donor Information | The form requires the donor's name, address, and relationship to the recipient. |

| Recipient Information | Details about the recipient, including their name and address, must be included. |

| Gift Amount | The specific amount of money being gifted should be clearly stated in the form. |

| No Expectation of Repayment | The donor must affirm that the gift does not need to be repaid. |

| State-Specific Requirements | Some states may have specific requirements regarding the Gift Letter form, particularly for mortgage applications. |

| Governing Laws | For example, in California, the form must comply with state gift tax laws and financial regulations. |

| Signature | Both the donor and recipient are typically required to sign the form to validate the transaction. |

| Documentation | It is advisable to keep a copy of the Gift Letter for future reference and to provide proof if needed. |

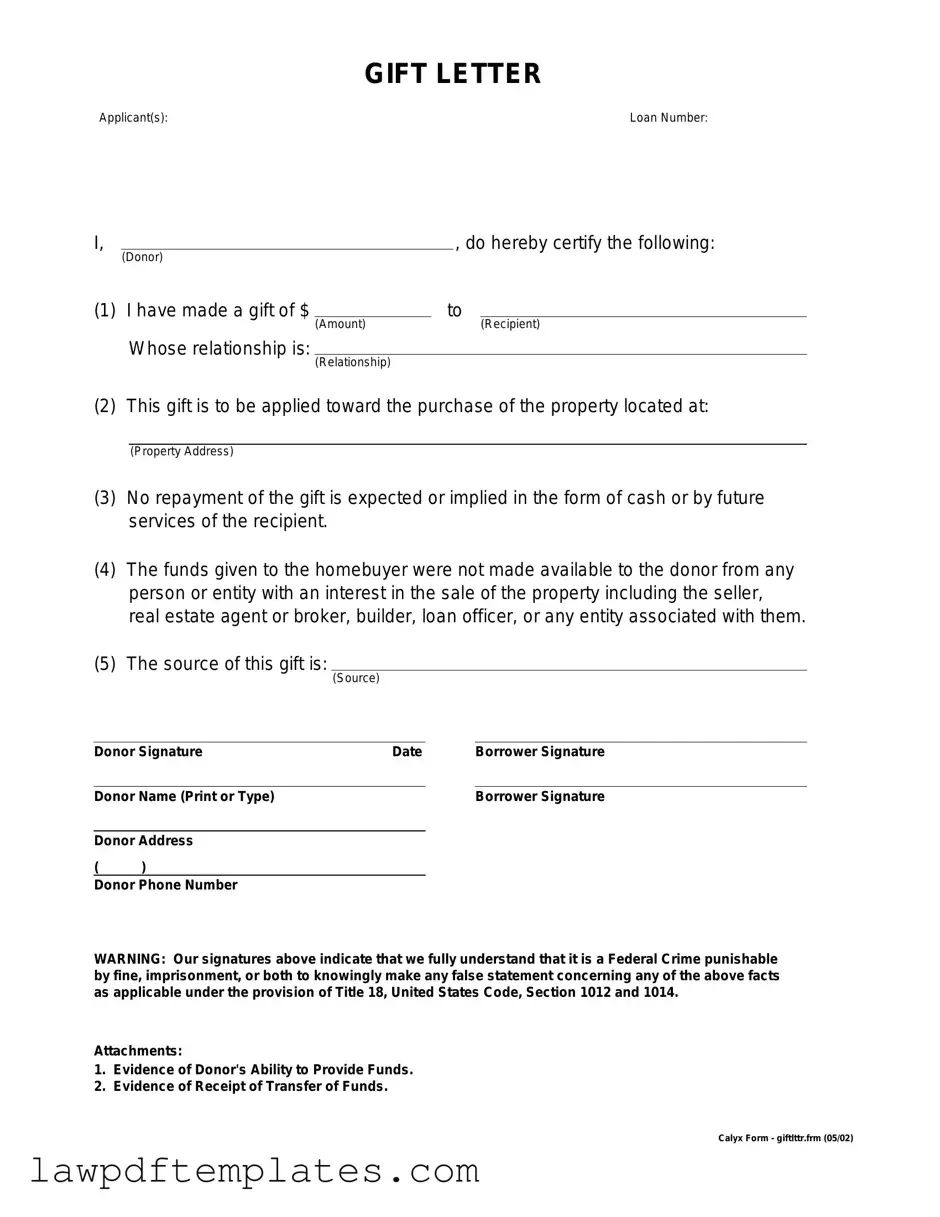

Sample - Gift Letter Form

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

Common mistakes

Filling out a Gift Letter form can seem straightforward, but many individuals make common mistakes that can lead to delays or complications in the process. One frequent error is not providing complete information about the donor. It's essential to include the donor's full name, address, and relationship to the recipient. Omitting any of these details can raise questions and potentially derail the approval process.

Another mistake often seen is failing to clearly state the amount of the gift. This figure should be explicitly mentioned in the letter. If the amount is vague or not clearly defined, it may lead to confusion or misinterpretation by financial institutions. Clarity is key to ensuring that the gift is understood as intended.

Many people also overlook the importance of the donor’s signature. The Gift Letter must be signed by the donor to validate the gift. Without this signature, the letter may not be accepted, and the entire process could be stalled. It’s crucial to ensure that the donor reviews and signs the letter before submission.

Additionally, some individuals forget to include a statement confirming that the gift does not need to be repaid. This assurance is vital for lenders to understand the nature of the funds. Without this statement, there might be concerns about the legitimacy of the gift, leading to further scrutiny.

Another common pitfall is using outdated or incorrect forms. Always ensure that the Gift Letter form being used is the most current version. Using an old form can result in non-compliance with lender requirements, causing unnecessary delays.

Moreover, people sometimes fail to provide supporting documentation. Depending on the lender, additional proof of the gift, such as bank statements or transfer records, may be required. Not including this documentation can lead to questions and potential rejection of the gift.

Lastly, neglecting to proofread the Gift Letter can result in errors that may seem minor but can have significant consequences. Simple typos or incorrect information can create doubt about the legitimacy of the gift. Taking the time to review the letter carefully can prevent these issues and ensure a smooth process.

Common PDF Documents

Panel Schedule - The Electrical Panel Schedule outlines the circuits and loads for each electrical panel.

Free Printable 5 Wishes Form - Five Wishes is an invitation to open dialogue about the wishes and values that guide health care decisions.

The importance of the FedEx Release Form cannot be overstated, as it provides a seamless delivery experience, especially when the recipient is not available. By allowing FedEx to leave packages at specified locations without a signature, customers can prevent potential delivery delays. For those looking for templates to simplify this process, Fast PDF Templates offers useful resources to assist in the proper completion and submission of this essential document.

Who Owns Geico and Progressive - Providing accurate contact details allows GEICO representatives to follow up as needed.